1315 Glen Oaks Dr West Des Moines, IA 50266

Estimated Value: $727,000 - $823,000

1

Bed

3

Baths

3,096

Sq Ft

$253/Sq Ft

Est. Value

About This Home

This home is located at 1315 Glen Oaks Dr, West Des Moines, IA 50266 and is currently estimated at $783,815, approximately $253 per square foot. 1315 Glen Oaks Dr is a home with nearby schools including Westridge Elementary School, Valley Southwoods Freshman High School, and Indian Hills Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2025

Sold by

Ten Braak D Richard

Bought by

D Richard Ten Braak Revocable Trust and Ten Braak

Current Estimated Value

Purchase Details

Closed on

Apr 10, 2013

Sold by

Elliott Eugene G and Elliott Dalena M

Bought by

Stanley Kent Harlan Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$416,000

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 16, 2006

Sold by

Glen Oaks Country Club Inc

Bought by

Braak D Richard Ten

Purchase Details

Closed on

Sep 29, 2005

Sold by

Baker Bernard John and Baker Bernard J

Bought by

Baker Bernard J and Bernard J Baker Iii Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| D Richard Ten Braak Revocable Trust | -- | None Listed On Document | |

| D Richard Ten Braak Revocable Trust | -- | None Listed On Document | |

| Stanley Kent Harlan Trust | $52,000 | None Available | |

| Braak D Richard Ten | $39,500 | Itc | |

| Baker Bernard J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stanley Kent Harlan Trust | $416,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,212 | $780,900 | $71,700 | $709,200 |

| 2023 | $12,434 | $780,900 | $71,700 | $709,200 |

| 2022 | $12,286 | $652,800 | $63,100 | $589,700 |

| 2021 | $12,306 | $652,800 | $63,100 | $589,700 |

| 2020 | $12,116 | $622,200 | $63,800 | $558,400 |

| 2019 | $11,510 | $622,200 | $63,800 | $558,400 |

| 2018 | $11,534 | $570,400 | $62,400 | $508,000 |

| 2017 | $11,308 | $570,400 | $62,400 | $508,000 |

| 2016 | $11,058 | $543,500 | $63,800 | $479,700 |

| 2015 | $11,058 | $543,500 | $63,800 | $479,700 |

| 2014 | $11,182 | $534,700 | $68,800 | $465,900 |

Source: Public Records

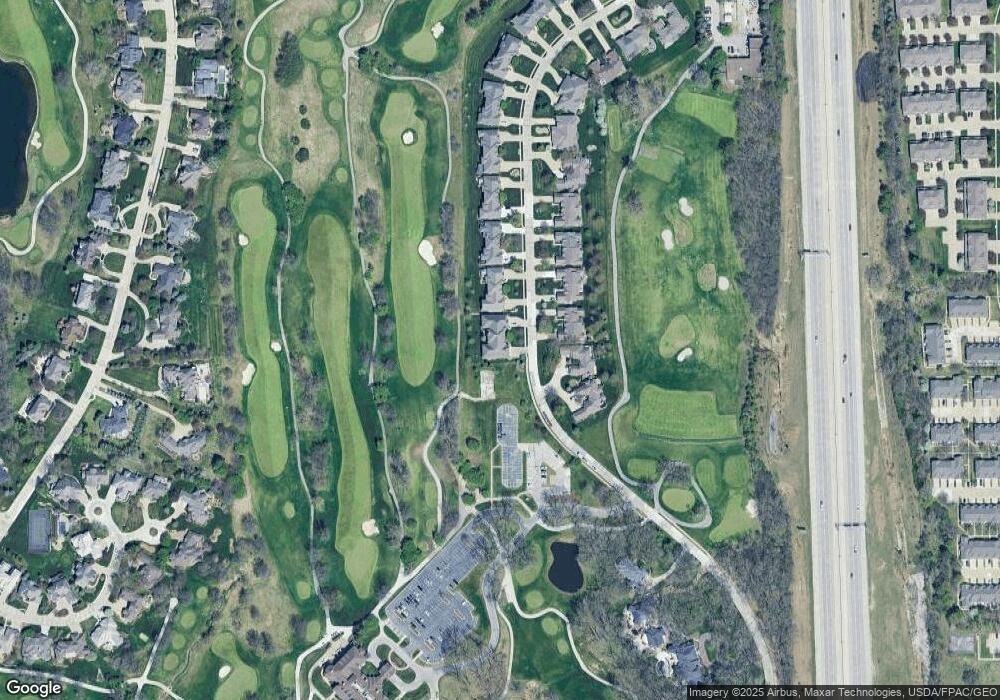

Map

Nearby Homes

- 1259 Glen Oaks Dr

- 5535 Glen Oaks Point

- 1069 Glen Oaks Dr

- 5769 Gallery Ct

- 1051 Glen Oaks Dr

- 1117 S 52nd St Unit 1707

- 1145 S 52nd St Unit 1502

- 5754 Gallery Ct

- 5583 Beechwood Terrace

- 1104 S 51st St

- Balsam Plan at The Pines at Glen Oaks

- Hemlock Plan at The Pines at Glen Oaks

- Juniper Plan at The Pines at Glen Oaks

- 1205 Tulip Tree Ln

- 4 S My Way

- 5 S My Way

- 33 S My Way

- 1 S My Way

- 3 S My Way

- 858 Burr Oaks Dr

- 1303 Glen Oaks Dr

- 1283 Glen Oaks Dr

- 1267 Glen Oaks Dr

- 1324 Glen Oaks Dr

- 1336 Glen Oaks Dr

- 1312 Glen Oaks Dr

- 1300 Glen Oaks Dr

- 1348 Glen Oaks Dr

- 1274 Glen Oaks Dr

- 1360 Glen Oaks Dr

- 1243 Glen Oaks Dr

- 1262 Glen Oaks Dr

- 1250 Glen Oaks Dr

- 1227 Glen Oaks Dr

- 1238 Glen Oaks Dr

- 1211 Glen Oaks Dr

- 1226 Glen Oaks Dr

- 1203 Glen Oaks Dr

- 1202 Glen Oaks Dr

- 1181 Glen Oaks Dr