1315 Via Fortuna Unit 93 Palm Desert, CA 92260

Estimated Value: $604,000 - $652,000

2

Beds

3

Baths

2,278

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 1315 Via Fortuna Unit 93, Palm Desert, CA 92260 and is currently estimated at $628,825, approximately $276 per square foot. 1315 Via Fortuna Unit 93 is a home located in Riverside County with nearby schools including James Earl Carter Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2013

Sold by

Lazar Philip R and Lazar Cheri S

Bought by

Lazar Philip R and Lazar Cheri S

Current Estimated Value

Purchase Details

Closed on

Jul 11, 2009

Sold by

Lazar Philip R and Lazar Cheri S

Bought by

Lazar Family Trust

Purchase Details

Closed on

Mar 25, 2009

Sold by

Brava Development Group Llc

Bought by

Lazar Philip R and Lazar Cheri S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$187,602

Interest Rate

4.82%

Mortgage Type

Unknown

Estimated Equity

$441,223

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lazar Philip R | -- | First American Title Company | |

| Lazar Family Trust | -- | First American Title | |

| Lazar Philip R | $410,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lazar Philip R | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,016 | $527,962 | $158,385 | $369,577 |

| 2023 | $7,016 | $507,463 | $152,236 | $355,227 |

| 2022 | $6,630 | $497,513 | $149,251 | $348,262 |

| 2021 | $5,788 | $487,759 | $146,325 | $341,434 |

| 2020 | $6,319 | $482,759 | $144,825 | $337,934 |

| 2019 | $6,203 | $473,294 | $141,986 | $331,308 |

| 2018 | $6,090 | $464,014 | $139,202 | $324,812 |

| 2017 | $5,970 | $454,917 | $136,473 | $318,444 |

| 2016 | $5,828 | $445,998 | $133,798 | $312,200 |

| 2015 | $5,845 | $439,301 | $131,790 | $307,511 |

| 2014 | $5,675 | $430,698 | $129,209 | $301,489 |

Source: Public Records

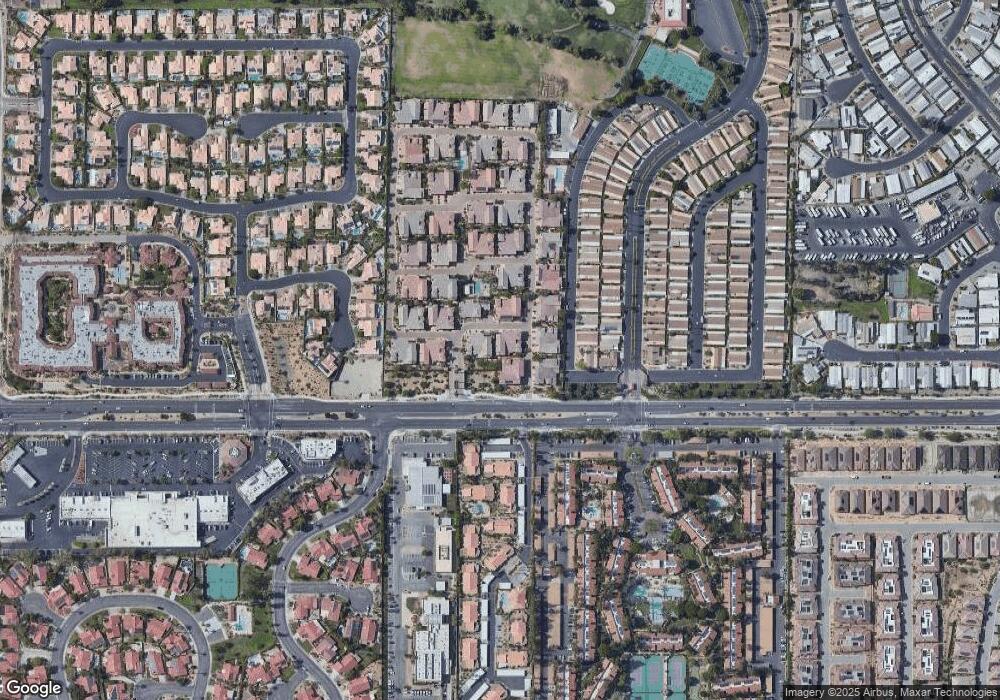

Map

Nearby Homes

- 3132 Via Giorna

- 4172 Via Mattina

- 39760 Moronga Canyon Dr

- 230 Strada Fortuna

- 39565 Ciega Creek Dr

- 4017 Via Fragante Unit 3

- 39564 Ciega Creek Dr

- 39500 Ciega Creek Dr

- 4150 Via Carrara

- 4000 Via Fragante Unit 1

- 39567 Palm Greens Pkwy

- 4018 Via Fragante Unit 2

- 3923 Via Amalfi

- 39880 Palm Greens Pkwy

- 39820 Palm Greens Pkwy

- 39475 Moronga Canyon Dr

- 2802 Via Calderia

- 40472 Periwinkle Ct

- 39405 Moronga Canyon Dr

- 4553 Via Veneto

- 1311 Via Fortuna

- 1313 Via Fortuna Unit 92

- 1305 Via Fortuna

- 6322 Via Stasera

- 1303 Via Fortuna

- 1301 Via Fortuna Unit 88

- 6324 Via Stasera

- 6326 Via Stasera

- 1054 Via Fortuna Unit 5B

- 1054 Via Fortuna

- 6373 Via Stasera

- 1052 Via Fortuna

- 1056 Via Fortuna

- 6371 Via Stasera

- 6375 Via Stasera

- 6363 Via Stasera Unit 107

- 6361 Via Stasera

- 6381 Via Stasera

- 6385 Via Stasera

- 1021 Via Fortuna