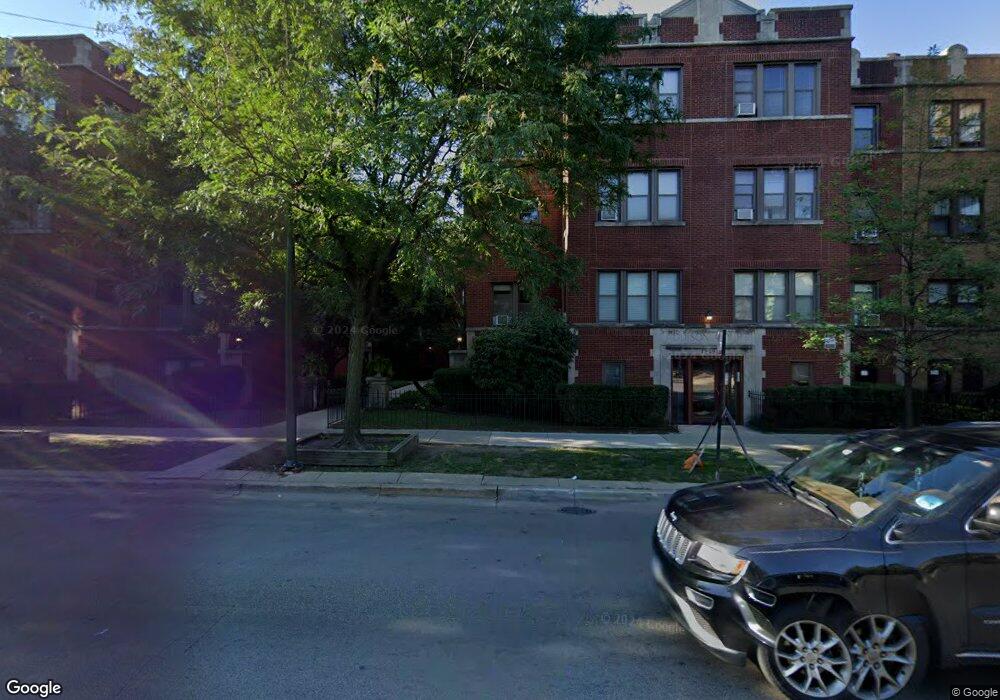

1325 W Addison St Unit 13253A Chicago, IL 60613

Lakeview NeighborhoodEstimated Value: $313,000 - $392,000

--

Bed

--

Bath

--

Sq Ft

0.37

Acres

About This Home

This home is located at 1325 W Addison St Unit 13253A, Chicago, IL 60613 and is currently estimated at $346,847. 1325 W Addison St Unit 13253A is a home located in Cook County with nearby schools including Blaine Elementary School, Lake View High School, and Saint Andrew School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2019

Sold by

Nardo Carlos E and Nardo Yolanda

Bought by

Elm Operations Llc

Current Estimated Value

Purchase Details

Closed on

May 29, 2003

Sold by

Chartier Jill

Bought by

Nardo Carlos E and Nardo Yolanda

Purchase Details

Closed on

May 11, 2001

Sold by

Vaughan Dawn Marie

Bought by

Chartier Jill

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,800

Interest Rate

7.22%

Mortgage Type

Balloon

Purchase Details

Closed on

Oct 27, 1998

Sold by

Lambrecht Amy

Bought by

Vaughan Dawn Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,000

Interest Rate

6.37%

Purchase Details

Closed on

Sep 30, 1993

Sold by

Huneryager Steven S and Huneryager Dinna L

Bought by

Lambrecht Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,000

Interest Rate

7.15%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Elm Operations Llc | $223,500 | Greater Illinois Title | |

| Nardo Carlos E | $224,000 | Stewart Title | |

| Chartier Jill | $156,000 | -- | |

| Vaughan Dawn Marie | $120,000 | -- | |

| Lambrecht Amy | $58,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Chartier Jill | $124,800 | |

| Previous Owner | Vaughan Dawn Marie | $114,000 | |

| Previous Owner | Lambrecht Amy | $78,000 | |

| Closed | Chartier Jill | $11,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,726 | $18,171 | $7,534 | $10,637 |

| 2023 | $4,113 | $17,660 | $6,075 | $11,585 |

| 2022 | $4,113 | $20,000 | $6,075 | $13,925 |

| 2021 | $4,022 | $19,999 | $6,075 | $13,924 |

| 2020 | $3,291 | $14,775 | $2,592 | $12,183 |

| 2019 | $3,233 | $16,094 | $2,592 | $13,502 |

| 2018 | $3,179 | $16,094 | $2,592 | $13,502 |

| 2017 | $3,499 | $16,255 | $2,268 | $13,987 |

| 2016 | $3,256 | $16,255 | $2,268 | $13,987 |

| 2015 | $2,979 | $16,255 | $2,268 | $13,987 |

| 2014 | $3,582 | $19,306 | $1,852 | $17,454 |

| 2013 | $3,511 | $19,306 | $1,852 | $17,454 |

Source: Public Records

Map

Nearby Homes

- 3539 N Southport Ave Unit 2N

- 3509 N Janssen Ave

- 3708 N Southport Ave Unit 3

- 3639 N Greenview Ave

- 1134 W Addison St

- 3719 N Magnolia Ave

- 1142 W Cornelia Ave Unit 3

- 1519 W Addison St

- 1123 W Addison St

- 3527 N Bosworth Ave

- 1327 W Roscoe St Unit 2

- 3507 N Bosworth Ave

- 3732 N Janssen Ave Unit A

- 1440 W Roscoe St Unit 2

- 1140 W Newport Ave Unit H

- 3760 N Wayne Ave

- 1145 W Newport Ave Unit U

- 3735 N Greenview Ave

- 3644 N Bosworth Ave

- 1447 W Roscoe St Unit PH

- 1325 W Addison St Unit 3A

- 1329 W Addison St Unit 1B

- 1329 W Addison St Unit 1329C

- 1325 W Addison St Unit 13252A

- 1319 W Addison St Unit 13191B

- 1319 W Addison St Unit 13192B

- 1319 W Addison St Unit 13193A

- 1329 W Addison St Unit 13291A

- 1319 W Addison St Unit 13193B

- 1319 W Addison St Unit 1319C

- 1329 W Addison St Unit 13292B

- 1319 W Addison St Unit 13192A

- 1329 W Addison St Unit 13293A

- 1325 W Addison St Unit 13251B

- 1325 W Addison St Unit 13253B

- 1329 W Addison St Unit 13292A

- 1329 W Addison St Unit 13293B

- 1325 W Addison St Unit 13251A

- 1319 W Addison St Unit 13191A

- 1325 W Addison St Unit 13252B