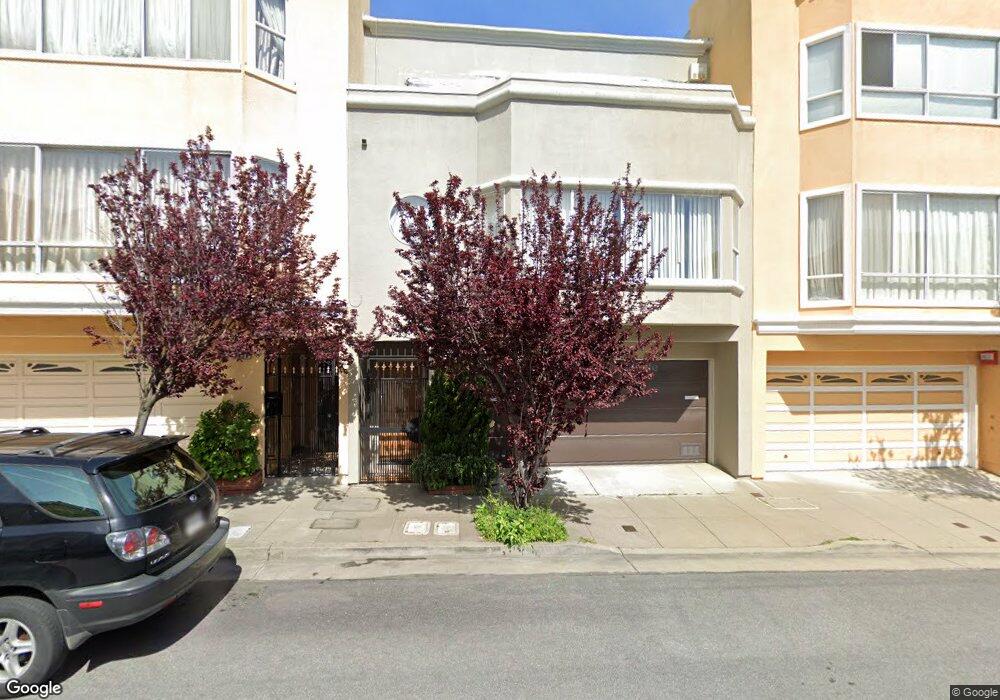

1328 Bacon St Unit 2 San Francisco, CA 94134

Portola NeighborhoodEstimated Value: $802,000 - $942,000

3

Beds

2

Baths

1,350

Sq Ft

$652/Sq Ft

Est. Value

About This Home

This home is located at 1328 Bacon St Unit 2, San Francisco, CA 94134 and is currently estimated at $880,788, approximately $652 per square foot. 1328 Bacon St Unit 2 is a home located in San Francisco County with nearby schools including Hillcrest Elementary School, King Jr. (Martin Luther) Academic Middle School, and Golden Bridges School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2023

Sold by

Corrales Eliza R

Bought by

Eliza R Corrales Revocable Trust and Corrales

Current Estimated Value

Purchase Details

Closed on

Aug 14, 2001

Sold by

Hamana Kerry Seishi

Bought by

Corrales Benjamin F and Corrales Eliza R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

7.21%

Purchase Details

Closed on

Feb 22, 2000

Sold by

San Diego Jeffery J

Bought by

Hamana Kerry Seishi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

7.75%

Purchase Details

Closed on

Feb 16, 2000

Sold by

Malabana Nida E

Bought by

Hamana Kerry Seishi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

7.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eliza R Corrales Revocable Trust | -- | None Listed On Document | |

| Corrales Benjamin F | $370,000 | Chicago Title Co | |

| Hamana Kerry Seishi | $325,000 | Fidelity National Title Co | |

| Hamana Kerry Seishi | -- | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Corrales Benjamin F | $170,000 | |

| Previous Owner | Hamana Kerry Seishi | $260,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,306 | $546,578 | $273,289 | $273,289 |

| 2024 | $6,306 | $535,862 | $267,931 | $267,931 |

| 2023 | $6,216 | $525,356 | $262,678 | $262,678 |

| 2022 | $6,105 | $515,056 | $257,528 | $257,528 |

| 2021 | $5,999 | $504,958 | $252,479 | $252,479 |

| 2020 | $6,017 | $499,782 | $249,891 | $249,891 |

| 2019 | $5,811 | $489,984 | $244,992 | $244,992 |

| 2018 | $5,616 | $480,378 | $240,189 | $240,189 |

| 2017 | $5,550 | $470,960 | $235,480 | $235,480 |

| 2016 | $5,714 | $461,726 | $230,863 | $230,863 |

| 2015 | $5,641 | $454,792 | $227,396 | $227,396 |

| 2014 | $5,492 | $445,884 | $222,942 | $222,942 |

Source: Public Records

Map

Nearby Homes

- 1636 Bacon St

- 180 Princeton St

- 120 Princeton St

- 366 Harvard St

- 920 Felton St

- 50 University St

- 280 Madison St

- 1029 Silver Ave

- 38 Colby St

- 46 Dartmouth St

- 25 Gambier St

- 1162 Bowdoin St

- 548 Burrows St

- 71 Gladstone Dr

- 406 Goettingen St

- 301 Maynard St

- 1316 Bowdoin St

- 132 Bache St

- 886 Moultrie St

- 881 Moultrie St

- 1328 Bacon St Unit 1

- 1338 Bacon St

- 1318 Bacon St

- 1348 Bacon St Unit 2

- 1348 Bacon St Unit 1

- 1368 Bacon St

- 1378 Bacon St Unit 2

- 1244 Bacon St

- 1303 Bacon St

- 1323 Bacon St

- 1333 Bacon St

- 408 Amherst St

- 1343 Bacon St

- 1398 Bacon St Unit 2

- 1398 Bacon St Unit 1

- 1238 Bacon St

- 1363 Bacon St

- 412 Amherst St

- 1406 Bacon St

- 1406 Bacon St