Estimated Value: $1,551,000 - $1,683,000

4

Beds

3

Baths

2,393

Sq Ft

$667/Sq Ft

Est. Value

About This Home

This home is located at 133 Seabry St, Eagle, CO 81631 and is currently estimated at $1,595,652, approximately $666 per square foot. 133 Seabry St is a home located in Eagle County with nearby schools including Brush Creek Elementary School, Eagle Valley Middle School, and Eagle Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2015

Sold by

Peel David M and Peel Kimberly S

Bought by

Hiatt Katherine A and Hiatt Stefan C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,000

Outstanding Balance

$364,699

Interest Rate

3.85%

Mortgage Type

New Conventional

Estimated Equity

$1,230,953

Purchase Details

Closed on

Feb 13, 2006

Sold by

Sleepy Hollow At Eagle Ranch Llc

Bought by

Peel David M and Peel Kimberly S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

6.1%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 9, 2005

Sold by

Lfi Llc

Bought by

Sleepy Hollow At Eagle Ranch Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hiatt Katherine A | $669,000 | Land Title Guarantee Company | |

| Peel David M | $647,799 | Land Title Guarantee Company | |

| Sleepy Hollow At Eagle Ranch Llc | -- | Land Title Guarantee Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hiatt Katherine A | $464,000 | |

| Previous Owner | Peel David M | $250,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,261 | $85,080 | $15,280 | $69,800 |

| 2023 | $6,261 | $85,080 | $15,280 | $69,800 |

| 2022 | $5,313 | $58,000 | $10,020 | $47,980 |

| 2021 | $5,469 | $59,670 | $10,310 | $49,360 |

| 2020 | $4,771 | $50,280 | $9,210 | $41,070 |

| 2019 | $4,763 | $50,280 | $9,210 | $41,070 |

| 2018 | $4,765 | $48,240 | $8,060 | $40,180 |

| 2017 | $4,744 | $48,240 | $8,060 | $40,180 |

| 2016 | $4,268 | $42,160 | $6,350 | $35,810 |

| 2015 | -- | $42,160 | $6,350 | $35,810 |

| 2014 | -- | $32,600 | $3,900 | $28,700 |

Source: Public Records

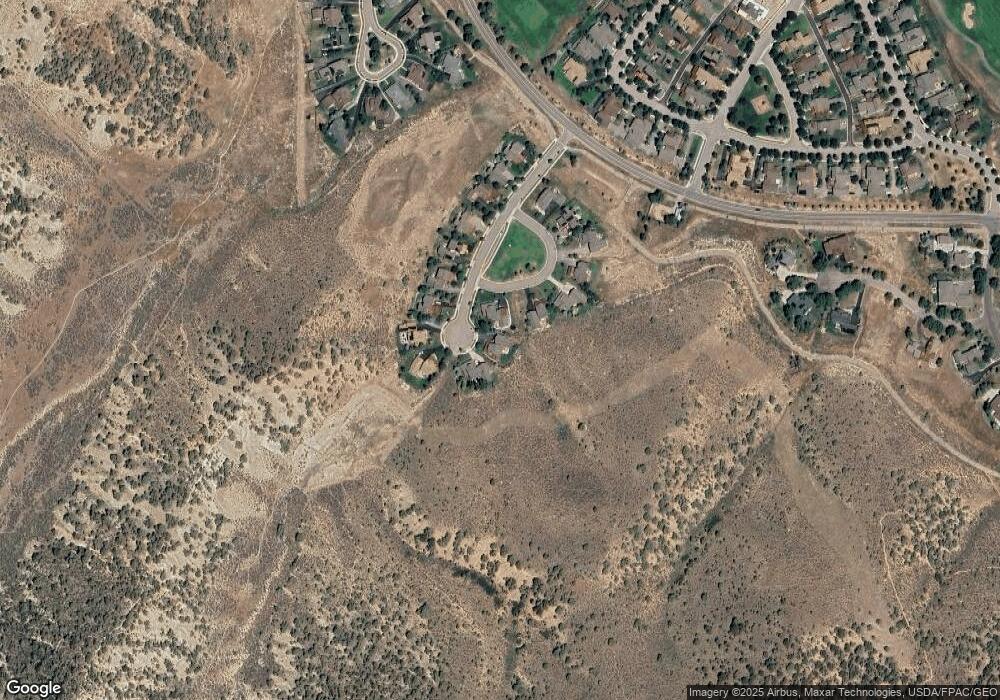

Map

Nearby Homes

- 49 Double Hitch

- 207 Aidan Rd

- 111 Double Hitch

- 51 Silver Spur

- 248 Lime Park Dr

- 277 Lime Park Dr

- 53 Sawmill Cir

- 13 Sawmill Cir

- 33 Bunkhouse Place

- 80 Freestone Rd Unit B201

- 89 Robins Egg

- 74 Soleil Cir

- 259 Harrier Cir

- 422 Harrier Cir

- 748 Hernage Creek Rd

- 270 Founders Ave

- 264 Founders Ave

- 510 Brush Creek Terrace Unit G3

- 116 Thresher Ct

- 596 Fourth of July Rd