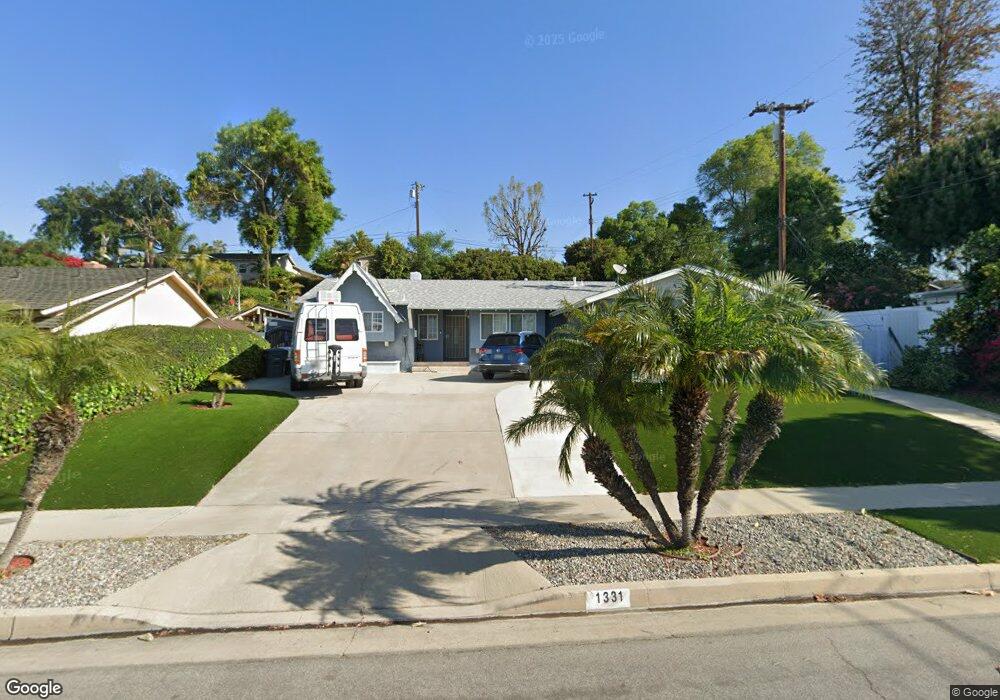

1331 E Whittier Blvd La Habra, CA 90631

Estimated Value: $912,000 - $1,365,000

5

Beds

3

Baths

2,099

Sq Ft

$526/Sq Ft

Est. Value

About This Home

This home is located at 1331 E Whittier Blvd, La Habra, CA 90631 and is currently estimated at $1,103,767, approximately $525 per square foot. 1331 E Whittier Blvd is a home located in Orange County with nearby schools including Sierra Vista Elementary School, Ladera Palma Elementary School, and Washington Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2009

Sold by

Barata Jose P and Quitan Remerlios A

Bought by

Nieves Melissa C and Peraza Maritza B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$369,600

Outstanding Balance

$240,488

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$863,279

Purchase Details

Closed on

May 13, 1998

Sold by

Cortez Gustavo A and Cortez Maria L

Bought by

Barata Jose P and Quitan Remedios A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,000

Interest Rate

7.17%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nieves Melissa C | $462,000 | Ort | |

| Barata Jose P | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nieves Melissa C | $369,600 | |

| Previous Owner | Barata Jose P | $148,000 | |

| Closed | Barata Jose P | $27,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,481 | $672,745 | $402,452 | $270,293 |

| 2024 | $7,481 | $659,554 | $394,560 | $264,994 |

| 2023 | $7,310 | $573,196 | $386,823 | $186,373 |

| 2022 | $6,448 | $561,957 | $379,238 | $182,719 |

| 2021 | $6,341 | $550,939 | $371,802 | $179,137 |

| 2020 | $6,281 | $545,290 | $367,989 | $177,301 |

| 2019 | $6,104 | $534,599 | $360,774 | $173,825 |

| 2018 | $6,000 | $524,117 | $353,700 | $170,417 |

| 2017 | $5,891 | $513,841 | $346,765 | $167,076 |

| 2016 | $5,749 | $503,766 | $339,966 | $163,800 |

| 2015 | $5,583 | $496,199 | $334,859 | $161,340 |

| 2014 | $5,416 | $486,480 | $328,300 | $158,180 |

Source: Public Records

Map

Nearby Homes

- 410 N Fonda St

- 1241 Arbolita Dr

- 1400 Eastpark Dr

- 2211 Frantz Ave

- 994 E La Habra Blvd Unit 246

- 1018 E La Habra Blvd Unit 238

- 224 S Fonda St

- 1936 Skywood St

- 1508 Mccart Ave

- Plan 4 - The Sage at The Birchwoods

- Plan 2 - The Poppy at The Birchwoods

- 308 S Valencia St

- 1318 Alta Mesa Dr

- 770 N Orange St

- 766 N Orange St

- 764 N Orange St

- 762 N Orange St

- 760 N Orange St

- 1223 El Encanto Dr

- 1663 Gatewood Ct

- 1331 E Whittier Blvd Unit 2

- 1321 E Whittier Blvd

- 811 N Fonda St

- 831 N Fonda St

- 1330 Comity Cir

- 1320 Comity Cir

- 1311 E Whittier Blvd

- 851 N Fonda St

- 1310 Comity Cir

- 1301 E Whittier Blvd

- 1341 Colfax Ct

- 741 N Fonda St

- 810 N Fonda St

- 1331 Comity Cir

- 901 N Fonda St

- 830 N Fonda St

- 740 N Colfax St

- 1300 Comity Cir

- 1331 Colfax Ct

- 850 N Fonda St