13315 Cross Pointe Dr West Palm Beach, FL 33418

Eastpointe NeighborhoodEstimated Value: $519,000 - $594,000

3

Beds

2

Baths

1,769

Sq Ft

$307/Sq Ft

Est. Value

About This Home

This home is located at 13315 Cross Pointe Dr, West Palm Beach, FL 33418 and is currently estimated at $542,632, approximately $306 per square foot. 13315 Cross Pointe Dr is a home located in Palm Beach County with nearby schools including Marsh Pointe Elementary School, William T. Dwyer High School, and Watson B. Duncan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2023

Sold by

Kass Linda R

Bought by

Linda Kass Revocable Trust

Current Estimated Value

Purchase Details

Closed on

May 17, 2023

Sold by

Kass Linda R

Bought by

Linda Kass Revocable Trust

Purchase Details

Closed on

Aug 28, 2020

Sold by

Rao Radha Krishna Babji and Rao Vaibhavi Babji

Bought by

Kass Linda R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 31, 2017

Sold by

Schwartz Hannah B

Bought by

Rao Radha Krishna Babji and Rao Vaibhavi Babji

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

4.16%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 26, 2005

Sold by

Schwartz Hannah B and Schwartz Hanah B

Bought by

Schwartz Hannah B and Schwartz William I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Linda Kass Revocable Trust | -- | None Listed On Document | |

| Linda Kass Revocable Trust | -- | None Listed On Document | |

| Linda Kass Revocable Trust | -- | None Listed On Document | |

| Kass Linda R | $340,000 | Attorney | |

| Rao Radha Krishna Babji | $205,000 | Clear Title Svcs Inc | |

| Schwartz Hannah B | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kass Linda R | $272,000 | |

| Previous Owner | Rao Radha Krishna Babji | $164,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,637 | $301,805 | -- | -- |

| 2023 | $5,450 | $293,015 | $0 | $0 |

| 2022 | $5,326 | $284,481 | $0 | $0 |

| 2021 | $5,257 | $276,195 | $0 | $276,195 |

| 2020 | $4,522 | $196,195 | $0 | $196,195 |

| 2019 | $4,589 | $195,315 | $0 | $195,315 |

| 2018 | $4,415 | $195,315 | $0 | $195,315 |

| 2017 | $3,954 | $170,315 | $0 | $0 |

| 2016 | $2,032 | $102,370 | $0 | $0 |

| 2015 | $2,046 | $101,658 | $0 | $0 |

| 2014 | $1,949 | $100,851 | $0 | $0 |

Source: Public Records

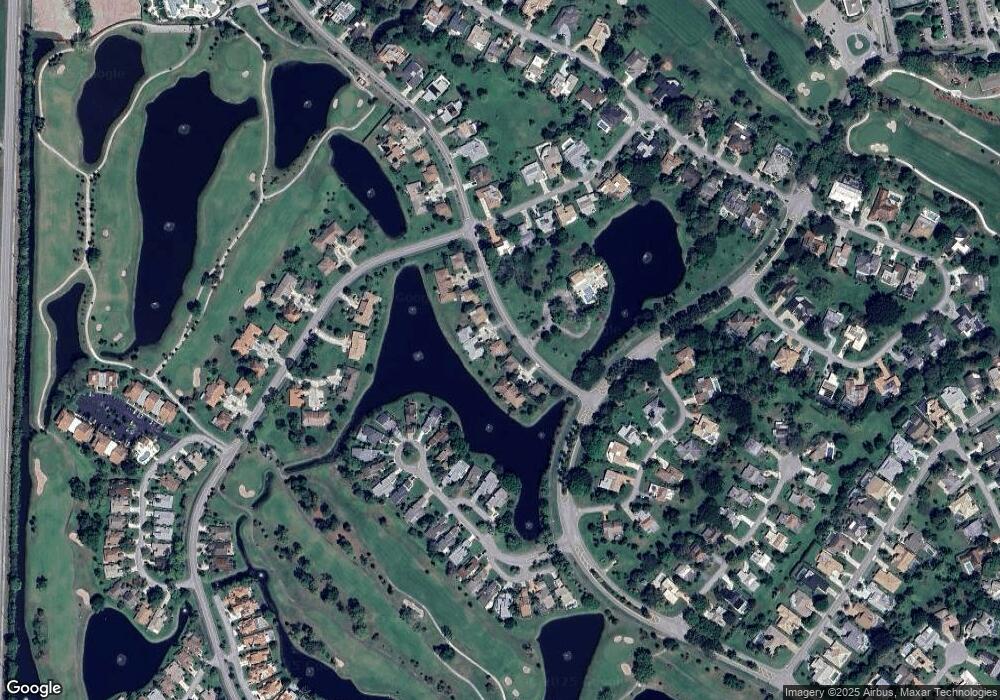

Map

Nearby Homes

- 13335 Crosspointe Dr

- 13335 Cross Pointe Dr

- 13334 Saffron Cir

- 13257 Touchstone Place

- 6378 Eastpointe Pines St

- 13403 Touchstone Place Unit A102

- 13403 Touchstone Place Unit A202

- 6501 Eastpointe Pines St

- 13258 Touchstone Place

- 13210 Touchstone Place

- 6689 Eastpointe Pines St

- 13692 Crosspointe Dr

- 6319 Brandon St

- 13250 Camero Way

- 13765 Dalrada Ave Unit Brixton 10

- 13783 Dalrada Ave Unit Whitestone 007

- 13813 Dalrada Ave Unit Coral 002

- 13808 Dalrada Ave Unit Scarlett

- 13807 Ave Unit 3 Brixton

- 13681 Dalrada Ave Unit Coral 34

- 13315 Crosspointe Dr

- 13305 Crosspointe Dr

- 13325 Cross Pointe Dr

- 13325 Crosspointe Dr

- 13295 Crosspointe Dr

- 13345 Cross Pointe Dr

- 13345 Crosspointe Dr

- 13285 Crosspointe Dr

- 13275 Crosspointe Dr

- 13355 Crosspointe Dr

- 13365 Crosspointe Dr

- 13375 Crosspointe Dr

- 13385 Crosspointe Dr

- 6703 S Pine Ct

- 13488 Touchstone Place

- 6709 S Pine Ct

- 6697 S Pine Ct

- 13496 Touchstone Place

- 6691 S Pine Ct

- 6715 S Pine Ct