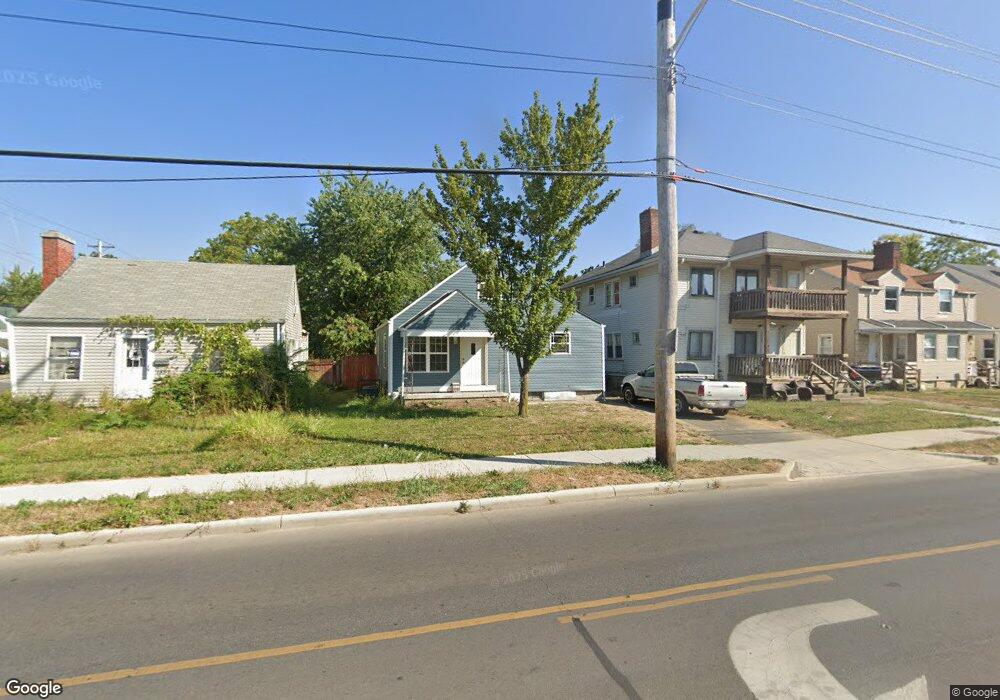

1336 E Hudson St Columbus, OH 43211

North Linden NeighborhoodEstimated Value: $115,000 - $153,000

3

Beds

1

Bath

1,043

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 1336 E Hudson St, Columbus, OH 43211 and is currently estimated at $132,535, approximately $127 per square foot. 1336 E Hudson St is a home located in Franklin County with nearby schools including Linden-Mckinley Stem School On Arcadia, North Columbus Preparatory Academy, and Midnimo Cross Cultural Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2023

Sold by

Baker Barry D

Bought by

Morin Marco A

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2006

Sold by

Storts Stephen M and Storts Pamela A

Bought by

Sharp Brian L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,000

Interest Rate

6.39%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 18, 2006

Sold by

Storts Pamela A

Bought by

Storts Stephen M

Purchase Details

Closed on

Dec 20, 2005

Sold by

Taris Edward L and Joseph E Taris Living Trust

Bought by

Storts Pamela A

Purchase Details

Closed on

Sep 18, 2002

Sold by

Gamma Holding & Trading Company

Bought by

Taris Joseph E and The Joseph E Taris Living Trus

Purchase Details

Closed on

Mar 25, 1987

Bought by

Gamma Holding & Trading

Purchase Details

Closed on

Jan 1, 1987

Purchase Details

Closed on

Jul 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morin Marco A | $57,200 | Allodial Title | |

| Sharp Brian L | $58,000 | None Available | |

| Storts Stephen M | -- | Independent | |

| Storts Pamela A | -- | Principle T | |

| Taris Joseph E | -- | -- | |

| Gamma Holding & Trading | -- | -- | |

| -- | $28,000 | -- | |

| -- | $30,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sharp Brian L | $58,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,099 | $45,300 | $10,470 | $34,830 |

| 2024 | $3,099 | $45,300 | $10,470 | $34,830 |

| 2023 | $3,836 | $45,300 | $10,470 | $34,830 |

| 2022 | $2,234 | $20,730 | $5,080 | $15,650 |

| 2021 | $1,077 | $20,730 | $5,080 | $15,650 |

| 2020 | $1,120 | $20,730 | $5,080 | $15,650 |

| 2019 | $1,032 | $17,010 | $4,410 | $12,600 |

| 2018 | $973 | $17,010 | $4,410 | $12,600 |

| 2017 | $1,020 | $17,010 | $4,410 | $12,600 |

| 2016 | $1,009 | $15,230 | $3,120 | $12,110 |

| 2015 | $916 | $15,230 | $3,120 | $12,110 |

| 2014 | $918 | $15,230 | $3,120 | $12,110 |

| 2013 | $533 | $17,920 | $3,675 | $14,245 |

Source: Public Records

Map

Nearby Homes

- 1362 Clinton St

- 2260 Homestead Dr

- 1435 Kohr Place

- 2316 Ontario St

- 1430 Kenmore Rd

- 2225 Medina Ave

- 2204 Medina Ave

- 1481 Kohr Place

- 1509 Loretta Ave

- 1450 Briarwood Ave

- 1457 Cordell Ave

- 2210 Gerbert Rd

- 2157 Cleveland Ave Unit 2153

- 2163 Cleveland Ave Unit 2161

- 1544 Briarwood Ave

- 0 E Maynard Ave

- 2305 Cleveland Ave

- 1411 Genessee Ave

- 2126 Cleveland Ave

- 1545 Arlington Ave

- 1340 E Hudson St Unit 342

- 1332 E Hudson St

- 1342 E Hudson St

- 1346 E Hudson St Unit 348

- 1352 E Hudson St Unit 354

- 1429 Medina Ave

- 1343 Loretta Ave

- 1320 E Hudson St

- 1349 Loretta Ave

- 1337 Loretta Ave

- 1358 E Hudson St

- 1353 Loretta Ave

- 695 E Hudson St

- 1359 Loretta Ave

- 1329 E Hudson St

- 1341 E Hudson St

- 1325 Loretta Ave

- 1364 E Hudson St

- 1345 E Hudson St

- 1310 E Hudson St

Your Personal Tour Guide

Ask me questions while you tour the home.