13452 Falcon Pointe Dr Orlando, FL 32837

Estimated Value: $543,653 - $596,000

4

Beds

3

Baths

2,280

Sq Ft

$255/Sq Ft

Est. Value

About This Home

This home is located at 13452 Falcon Pointe Dr, Orlando, FL 32837 and is currently estimated at $580,663, approximately $254 per square foot. 13452 Falcon Pointe Dr is a home located in Orange County with nearby schools including Endeavor Elementary School, Hunters Creek Middle School, and Freedom High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2003

Sold by

Xayavong Vonsack and Xayavong Daomonh

Bought by

Millar Norman G and Millar Sonia

Current Estimated Value

Purchase Details

Closed on

Jul 26, 2000

Sold by

Bettendorf Victoria and Horstemeyer Phyllis L

Bought by

Xayavong Vongsack and Xayavong Daomonh

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,600

Interest Rate

8.23%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 7, 1995

Sold by

Srepel Tanya and Morin Charles

Bought by

Bettendorf Victoria and Horstemeyer Phyllis L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,850

Interest Rate

8.21%

Purchase Details

Closed on

Jul 29, 1993

Sold by

Davis Homes Fl Inc

Bought by

Srepel Tanya

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,500

Interest Rate

7.34%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Millar Norman G | $245,300 | First United Title | |

| Xayavong Vongsack | $222,000 | -- | |

| Bettendorf Victoria | $180,000 | -- | |

| Srepel Tanya | $189,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bettendorf Victoria | $177,600 | |

| Previous Owner | Bettendorf Victoria | $24,000 | |

| Previous Owner | Bettendorf Victoria | $158,850 | |

| Previous Owner | Srepel Tanya | $151,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,162 | $217,529 | -- | -- |

| 2024 | $2,936 | $217,529 | -- | -- |

| 2023 | $2,936 | $205,241 | $0 | $0 |

| 2022 | $2,807 | $199,263 | $0 | $0 |

| 2021 | $2,757 | $193,459 | $0 | $0 |

| 2020 | $2,625 | $190,788 | $0 | $0 |

| 2019 | $2,694 | $186,499 | $0 | $0 |

| 2018 | $2,658 | $183,022 | $0 | $0 |

| 2017 | $2,606 | $277,666 | $60,000 | $217,666 |

| 2016 | $2,578 | $272,310 | $60,000 | $212,310 |

| 2015 | $2,621 | $257,401 | $60,000 | $197,401 |

| 2014 | $2,670 | $219,831 | $55,000 | $164,831 |

Source: Public Records

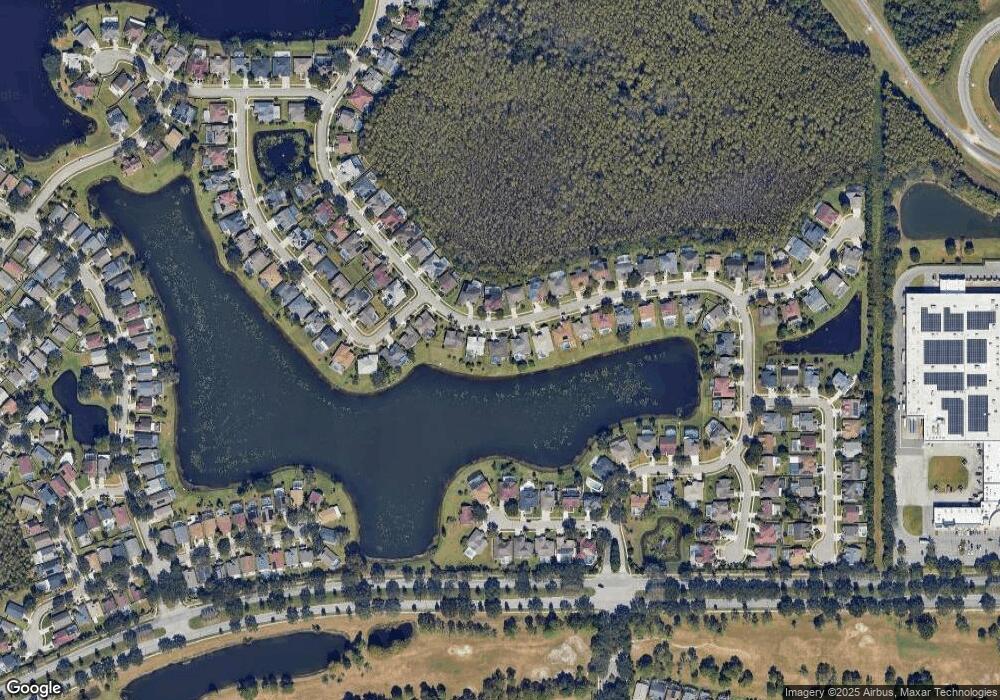

Map

Nearby Homes

- 2547 Raccoon Run Ln

- 13521 Mallard Cove Blvd

- 13525 Mallard Cove Blvd

- 13821 Boros St

- 13953 Fairway Island Dr Unit 621

- 13941 Fairway Island Dr Unit 733

- 13500 Turtle Marsh Loop Unit 825

- 13584 Turtle Marsh Loop Unit 121

- 13584 Turtle Marsh Loop Unit 132

- 14013 Fairway Island Dr Unit 434

- 13512 Turtle Marsh Loop Unit 720

- 13512 Turtle Marsh Loop Unit 729

- 14025 Fairway Island Dr Unit 318

- 13524 Turtle Marsh Loop Unit 621

- 2213 Oldfield Dr

- 2815 Crane Trace Cir

- 13929 Fairway Island Dr Unit 825

- 14037 Fairway Island Dr Unit 224

- 13839 Fairway Island Dr Unit 1116

- 13839 Fairway Island Dr Unit 1122

- 13458 Falcon Pointe Dr

- 13446 Falcon Pointe Dr

- 13464 Falcon Pointe Dr

- 13453 Falcon Pointe Dr

- 13440 Falcon Pointe Dr

- 13459 Falcon Pointe Dr

- 13441 Falcon Pointe Dr

- 13470 Falcon Pointe Dr

- 13465 Falcon Pointe Dr

- 2500 Raccoon Run Ln

- 13435 Falcon Pointe Dr

- 13476 Falcon Pointe Dr

- 2506 Raccoon Run Ln

- 13482 Falcon Pointe Dr

- 13429 Falcon Pointe Dr

- 13477 Falcon Pointe Dr

- 13428 Falcon Pointe Dr

- 13483 Falcon Pointe Dr

- 13423 Falcon Pointe Dr

- 13488 Falcon Pointe Dr