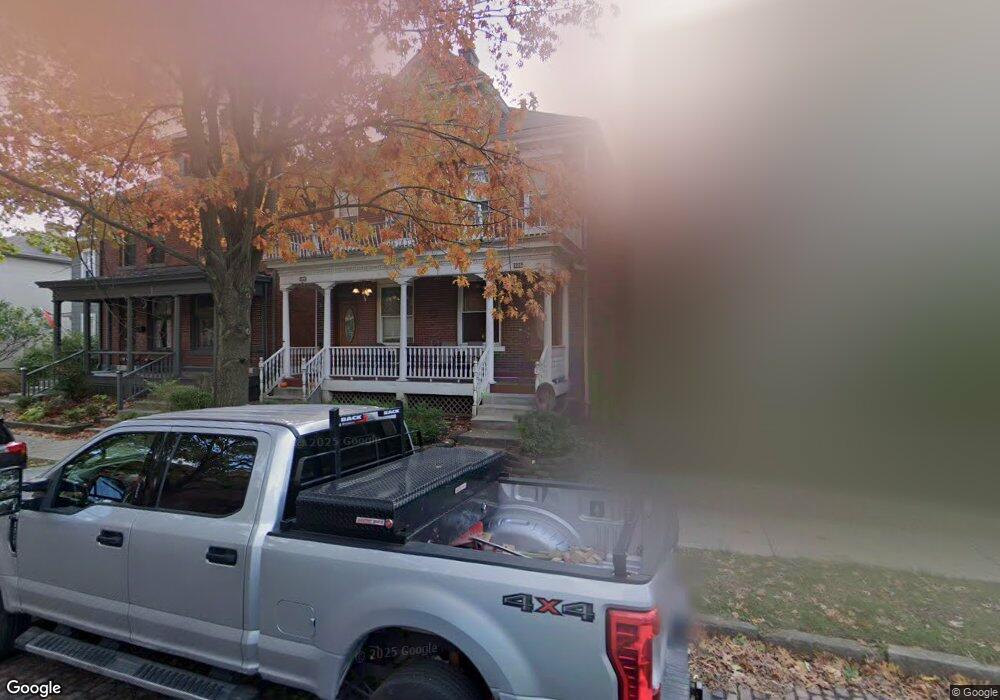

135 E Mithoff St Unit 137 Columbus, OH 43206

Merion Village NeighborhoodEstimated Value: $375,000 - $765,000

6

Beds

2

Baths

2,244

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 135 E Mithoff St Unit 137, Columbus, OH 43206 and is currently estimated at $589,721, approximately $262 per square foot. 135 E Mithoff St Unit 137 is a home located in Franklin County with nearby schools including Siebert Elementary School, South High School, and South Columbus Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2009

Sold by

Newman Daniel and Newman Jennifer Nicole

Bought by

Mithoff Investments Llc

Current Estimated Value

Purchase Details

Closed on

Jan 28, 2005

Sold by

Velio Mithoff Deshler Llc

Bought by

Newman Daniel J and Talis Mark Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 30, 1998

Sold by

Trout Robert E

Bought by

Velio Gezim Jim

Purchase Details

Closed on

Oct 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mithoff Investments Llc | -- | None Available | |

| Newman Daniel J | $300,000 | Amerititle | |

| Velio Gezim Jim | $64,500 | Amerititle | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Newman Daniel J | $240,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,610 | $166,050 | $46,240 | $119,810 |

| 2024 | $7,610 | $166,050 | $46,240 | $119,810 |

| 2023 | $7,515 | $166,040 | $46,235 | $119,805 |

| 2022 | $6,267 | $117,920 | $42,460 | $75,460 |

| 2021 | $6,278 | $117,920 | $42,460 | $75,460 |

| 2020 | $6,287 | $117,920 | $42,460 | $75,460 |

| 2019 | $5,668 | $91,150 | $42,460 | $48,690 |

| 2018 | $5,009 | $91,150 | $42,460 | $48,690 |

| 2017 | $5,667 | $91,150 | $42,460 | $48,690 |

| 2016 | $4,789 | $70,490 | $23,310 | $47,180 |

| 2015 | $4,360 | $70,490 | $23,310 | $47,180 |

| 2014 | $4,371 | $70,490 | $23,310 | $47,180 |

| 2013 | $1,959 | $64,050 | $21,175 | $42,875 |

Source: Public Records

Map

Nearby Homes

- 154-156 E Gates St

- 164 Frebis Ave

- 165 Frebis Ave

- 6 Hanford St Unit 6

- 242 Thurman Ave

- 1264 S High St

- 1366 S 4th St

- 1389 S 6th St

- 1357 City Park Ave Unit 359

- 320 E Mithoff St

- 1361 City Park Ave

- 327 E Mithoff St

- 10 - 20 E Deshler Ave

- 37 Stewart Ave

- 1036 S Front St

- 1452 S 4th St

- 348-350 E Moler St

- 272 E Jenkins Ave

- 395 E Deshler Ave

- 184 Reinhard Ave

- 131 E Mithoff St

- 139 E Mithoff St Unit 141

- 139 E Mithoff St Unit 41

- 141 E Mithoff St

- 155 E Mithoff St

- 129 E Mithoff St

- 159 E Mithoff St

- 123 E Mithoff St

- 1188 S 4th St Unit 190

- 1188 S 4th St Unit Near Schiller Park

- 161 E Mithoff St

- 124 E Gates St

- 132 E Gates St Unit 134

- 136 E Gates St Unit 138

- 136 E Mithoff St

- 142 E Gates St Unit 144

- 142 E Gates St Unit 44

- 115 E Mithoff St Unit 115

- 113 E Mithoff St Unit 113

- 120 E Gates St Unit 122