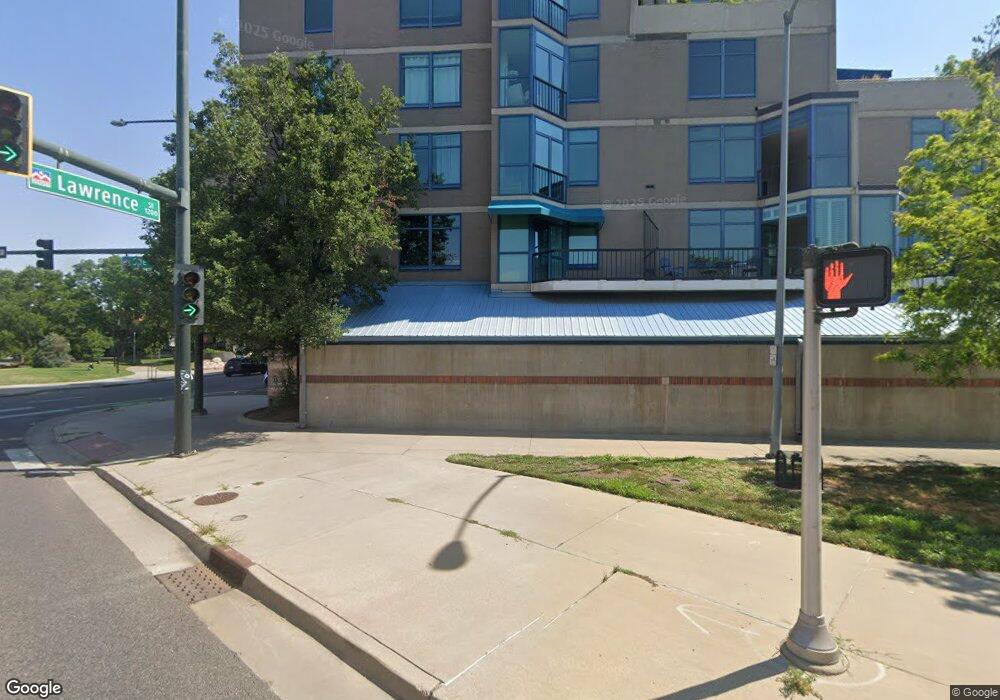

1350 Lawrence St Unit 9D Denver, CO 80204

Central Business District NeighborhoodEstimated Value: $547,000 - $681,000

1

Bed

2

Baths

1,279

Sq Ft

$484/Sq Ft

Est. Value

About This Home

This home is located at 1350 Lawrence St Unit 9D, Denver, CO 80204 and is currently estimated at $619,076, approximately $484 per square foot. 1350 Lawrence St Unit 9D is a home located in Denver County with nearby schools including Greenlee Elementary School, Kepner Beacon Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 26, 2018

Sold by

Obermeier Thomas and Obermeier Christine Poe

Bought by

Szymanski Deborah T and Mcquaid Sean D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$338,252

Interest Rate

3.93%

Mortgage Type

New Conventional

Estimated Equity

$280,824

Purchase Details

Closed on

Aug 26, 2002

Sold by

Z T & T Llc

Bought by

Obermeier Thomas and Obermeier Christine Poe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,600

Interest Rate

6.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 7, 2002

Sold by

Todd Slack Margaret

Bought by

Z T & T Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,878

Interest Rate

7.12%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Szymanski Deborah T | $500,000 | First Integrity Title | |

| Obermeier Thomas | -- | Stewart Title | |

| Z T & T Llc | $335,500 | Land Title | |

| Todd Jordon Frederick | -- | Land Title | |

| Todd Slack Margaret | -- | Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Szymanski Deborah T | $400,000 | |

| Previous Owner | Obermeier Thomas | $183,600 | |

| Previous Owner | Z T & T Llc | $372,878 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,370 | $42,550 | $7,340 | $35,210 |

| 2023 | $3,297 | $42,550 | $7,340 | $35,210 |

| 2022 | $3,313 | $41,660 | $11,440 | $30,220 |

| 2021 | $3,198 | $42,860 | $11,770 | $31,090 |

| 2020 | $3,050 | $41,110 | $10,930 | $30,180 |

| 2019 | $2,513 | $34,850 | $10,930 | $23,920 |

| 2018 | $1,957 | $32,500 | $10,160 | $22,340 |

| 2017 | $1,951 | $32,500 | $10,160 | $22,340 |

| 2016 | $2,445 | $37,940 | $9,361 | $28,579 |

| 2015 | $2,342 | $37,940 | $9,361 | $28,579 |

| 2014 | $1,713 | $28,590 | $6,018 | $22,572 |

Source: Public Records

Map

Nearby Homes

- 1350 Lawrence St Unit 2F

- 1133 14th St Unit 2620

- 1133 14th St Unit 4050

- 1133 14th St Unit 2330

- 1133 14th St Unit 2820

- 1133 14th St Unit 3700

- 1133 14th St Unit 2110

- 1133 14th St Unit 4150

- 1133 14th St Unit 2000

- 1133 14th St Unit 1820

- 1133 14th St Unit 3320

- 1133 14th St Unit 2300

- 1020 15th St Unit 31L

- 1020 15th St Unit 3D

- 1020 15th St Unit 27K

- 1020 15th St Unit 30K

- 1020 15th St Unit 27B

- 1020 15th St Unit 22A

- 1020 15th St Unit 214

- 1020 15th St Unit 17C

- 1350 Lawrence St Unit 4B

- 1350 Lawrence St Unit PHA

- 1350 Lawrence St

- 1350 Lawrence St

- 1350 Lawrence St

- 1350 Lawrence St Unit 2I

- 1350 Lawrence St Unit 2H

- 1350 Lawrence St Unit 2G

- 1350 Lawrence St Unit E

- 1350 Lawrence St

- 1350 Lawrence St Unit 3E

- 1350 Lawrence St Unit 2E

- 1350 Lawrence St Unit 6D

- 1350 Lawrence St

- 1350 Lawrence St Unit 4D

- 1350 Lawrence St Unit 3D

- 1350 Lawrence St Unit 2D

- 1350 Lawrence St Unit C

- 1350 Lawrence St Unit 9C

- 1350 Lawrence St Unit 8C