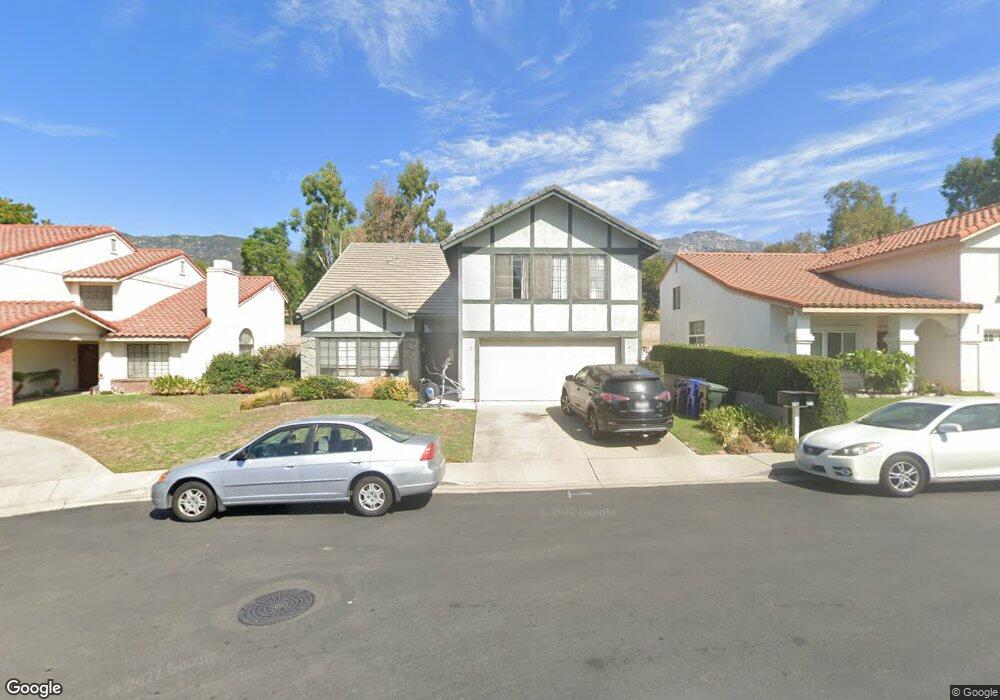

1351 Ajuga St Upland, CA 91784

Estimated Value: $960,624 - $996,000

4

Beds

3

Baths

2,918

Sq Ft

$337/Sq Ft

Est. Value

About This Home

This home is located at 1351 Ajuga St, Upland, CA 91784 and is currently estimated at $982,656, approximately $336 per square foot. 1351 Ajuga St is a home located in San Bernardino County with nearby schools including Pepper Tree Elementary, Pioneer Junior High School, and Upland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2018

Sold by

Wasef Eman

Bought by

Wasef Eman George and The Eman George Trust

Current Estimated Value

Purchase Details

Closed on

Dec 11, 2018

Sold by

Wasef Medhat K and Wasef Eman

Bought by

Wasef Eman

Purchase Details

Closed on

Oct 10, 2000

Sold by

Rashidi Ali

Bought by

Wasef Medhat K and Wasef Eman

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

7.86%

Purchase Details

Closed on

Aug 18, 1993

Sold by

Mcmullen Walter John and Mcmullen Susan M

Bought by

Rashidi Ali

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

7.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wasef Eman George | -- | None Available | |

| Wasef Eman | -- | None Available | |

| Wasef Medhat K | $270,000 | First American Title Ins Co | |

| Rashidi Ali | $228,000 | Fidelity National Title Insu |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wasef Medhat K | $150,000 | |

| Previous Owner | Rashidi Ali | $171,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,572 | $406,851 | $142,399 | $264,452 |

| 2024 | $4,427 | $398,874 | $139,607 | $259,267 |

| 2023 | $4,360 | $391,053 | $136,870 | $254,183 |

| 2022 | $4,266 | $383,385 | $134,186 | $249,199 |

| 2021 | $4,261 | $375,868 | $131,555 | $244,313 |

| 2020 | $4,145 | $372,014 | $130,206 | $241,808 |

| 2019 | $4,131 | $364,720 | $127,653 | $237,067 |

| 2018 | $4,032 | $357,569 | $125,150 | $232,419 |

| 2017 | $3,916 | $350,558 | $122,696 | $227,862 |

| 2016 | $3,711 | $343,684 | $120,290 | $223,394 |

| 2015 | $3,626 | $338,521 | $118,483 | $220,038 |

| 2014 | $3,533 | $331,890 | $116,162 | $215,728 |

Source: Public Records

Map

Nearby Homes

- 1279 Moss St

- 2252 Verbena Ave

- 2183 Paris Cir

- 2257 Poppy Ave

- 1435 Lookout Ct

- 2166 Malati Cir

- 2326 Fairfield Way

- 2360 N Mountain Ave

- 1435 Highpoint St

- 1257 Citrus St

- 1393 Sunrise Cir S

- 1328 Sunrise Cir S

- 1214 Miller Ct

- 2415 Park Blvd

- 937 Emerson St

- 2489 Burt St

- 2521 Electric Ave

- 1098 W 25th St

- 2335 N San Antonio Ave

- 2337 N San Antonio Ave

- 1345 Ajuga St

- 2265 Lobelia Ave

- 1339 Ajuga St

- 2257 Lobelia Ave

- 2253 Lobelia Ave

- 2264 Ajuga Ave

- 2260 Ajuga Ave

- 2256 Ajuga Ave

- 2249 Lobelia Ave

- 2252 Ajuga Ave

- 2245 Lobelia Ave

- 2265 Jasmine Ave

- 2261 Jasmine Ave

- 2246 Ajuga Ave

- 1390 Daylily St

- 2255 Jasmine Ave

- 2253 Jasmine Ave

- 2239 Lobelia Ave

- 1344 Zinnia St

- 1352 Zinnia St

Your Personal Tour Guide

Ask me questions while you tour the home.