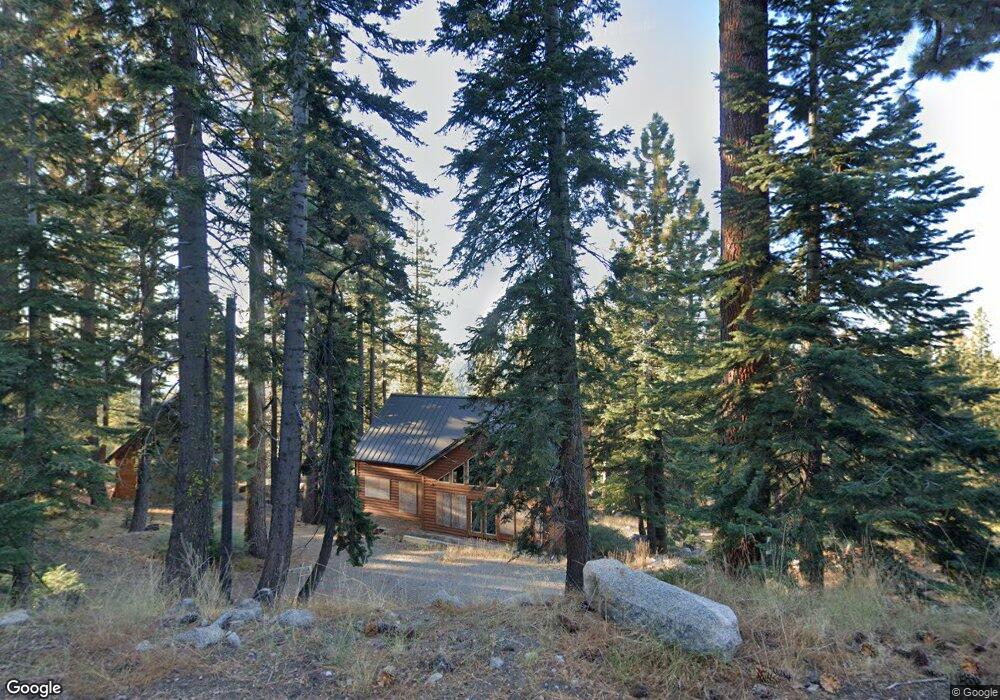

1361 Summit View Rd Unit 69 Arnold, CA 95223

Estimated Value: $427,000 - $457,000

2

Beds

2

Baths

1,740

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 1361 Summit View Rd Unit 69, Arnold, CA 95223 and is currently estimated at $448,755, approximately $257 per square foot. 1361 Summit View Rd Unit 69 is a home located in Calaveras County with nearby schools including Bret Harte Union High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2009

Sold by

Imb Reo Llc

Bought by

Sidhu Ranjit S and Lam Yin See

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$135,548

Interest Rate

5.2%

Mortgage Type

New Conventional

Estimated Equity

$313,207

Purchase Details

Closed on

May 29, 2009

Sold by

Ellis Jason

Bought by

Onewest Bank Fsb

Purchase Details

Closed on

Dec 28, 2005

Sold by

Ellis Jason and Ellis Jeremy

Bought by

Ellis Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$305,500

Interest Rate

3.25%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Apr 25, 2005

Sold by

Compton Laura Jill and Rymple Ronald A

Bought by

Ellis Jason and Ellis Jeremy

Purchase Details

Closed on

Apr 30, 2001

Sold by

Greene Leonard E and Greene Pamela K

Bought by

Compton Laura Jill and Rymple Ronald A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sidhu Ranjit S | $260,000 | Commerce Title Company | |

| Imb Reo Llc | -- | Commerce Title Company | |

| Onewest Bank Fsb | $227,220 | None Available | |

| Ellis Jason | -- | Alliance Title Company | |

| Ellis Jason | $75,500 | First American Title Company | |

| Compton Laura Jill | $17,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sidhu Ranjit S | $208,000 | |

| Previous Owner | Ellis Jason | $305,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,164 | $335,598 | $103,260 | $232,338 |

| 2023 | $4,046 | $322,568 | $99,251 | $223,317 |

| 2022 | $3,843 | $316,244 | $97,305 | $218,939 |

| 2021 | $3,824 | $310,045 | $95,398 | $214,647 |

| 2020 | $3,780 | $306,867 | $94,420 | $212,447 |

| 2019 | $3,735 | $300,851 | $92,569 | $208,282 |

| 2018 | $3,513 | $294,953 | $90,754 | $204,199 |

| 2017 | $3,423 | $289,171 | $88,975 | $200,196 |

| 2016 | $3,412 | $283,502 | $87,231 | $196,271 |

| 2015 | -- | $279,244 | $85,921 | $193,323 |

| 2014 | -- | $273,775 | $84,238 | $189,537 |

Source: Public Records

Map

Nearby Homes

- 1752 N Skyline Dr

- 20 Big Meadow Dr

- 179 Kitch Trail

- 0 Kitch Trail Unit 202501304

- 0 Kitch Trail Unit 202501305

- 282 Little Buck Rd

- 34 Silver Tip Dr

- 175 Silver Tip Dr

- 2 Blue Rock Trail

- 1 Blue Rock Trail

- 51 Liberty Rd

- 3134 Muriettas Roost

- 1934 Almaden Dr

- 54 Liberty Rd

- 0 Prather Meadow Rd Unit 225152963

- 39 Liberty Rd

- 60 Liberty Rd

- 550 Cabbage Patch Log Rd

- 1526 Seminole

- 74 Bear Valley Rd

- 1361 Summit View Rd

- 1361-69 Summit View Dr

- 1351 Summit View

- 1371 Summit View

- 930 Ponderosa Way

- 1356 Summit View Rd

- 1368 Summit View

- 952 Ponderosa Way

- 1312 Summit View Rd

- 1307 1307 Skyline Dr

- 1290 Summit View Rd

- 1267 Summit View

- 1283 Skyline Dr

- 970 Ponderosa Way

- 859 Ponderosa Way

- 1053 Ponderosa Way

- 842 Ponderosa Way

- 990 Ponderosa Way

- 1251 Summit View

- 1294 Skyline Dr