1378 Cedar Bark Ln Unit 235A Heber City, UT 84032

Timber Lakes NeighborhoodEstimated Value: $886,000 - $1,293,225

5

Beds

4

Baths

3,234

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 1378 Cedar Bark Ln Unit 235A, Heber City, UT 84032 and is currently estimated at $1,061,556, approximately $328 per square foot. 1378 Cedar Bark Ln Unit 235A is a home located in Wasatch County with nearby schools including J.R. Smith Elementary School and Wasatch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2020

Sold by

Oldham Austin and Oldham Laura

Bought by

Wallin Randall Scott and Wallin Sandra A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$510,400

Outstanding Balance

$451,064

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$610,492

Purchase Details

Closed on

Apr 22, 2020

Sold by

Oldham Laura

Bought by

Oldham Austin and Oldham Laura

Purchase Details

Closed on

Aug 12, 2014

Sold by

Oldhma Laura and Oldhma Austin

Bought by

Oldham Laura

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,290

Interest Rate

3.37%

Mortgage Type

Construction

Purchase Details

Closed on

Apr 9, 2014

Sold by

Case Bryan G

Bought by

Oldham Laura and Oldham Austin

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wallin Randall Scott | -- | First Amer Ttl Heber City | |

| Oldham Austin | -- | None Available | |

| Oldham Laura | -- | Atlas Title | |

| Oldham Laura | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wallin Randall Scott | $510,400 | |

| Previous Owner | Oldham Laura | $328,290 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,351 | $1,087,025 | $188,625 | $898,400 |

| 2024 | $9,351 | $1,102,525 | $171,125 | $931,400 |

| 2023 | $9,351 | $1,010,865 | $163,625 | $847,240 |

| 2022 | $2,720 | $530,460 | $63,500 | $466,960 |

| 2021 | $3,414 | $530,460 | $63,500 | $466,960 |

| 2020 | $3,431 | $516,960 | $50,000 | $466,960 |

| 2019 | -- | $226,200 | $0 | $0 |

| 2018 | -- | $226,200 | $0 | $0 |

| 2017 | -- | $218,583 | $0 | $0 |

| 2016 | -- | $184,673 | $0 | $0 |

| 2015 | -- | $166,271 | $27,550 | $138,721 |

| 2014 | -- | $27,555 | $27,555 | $0 |

Source: Public Records

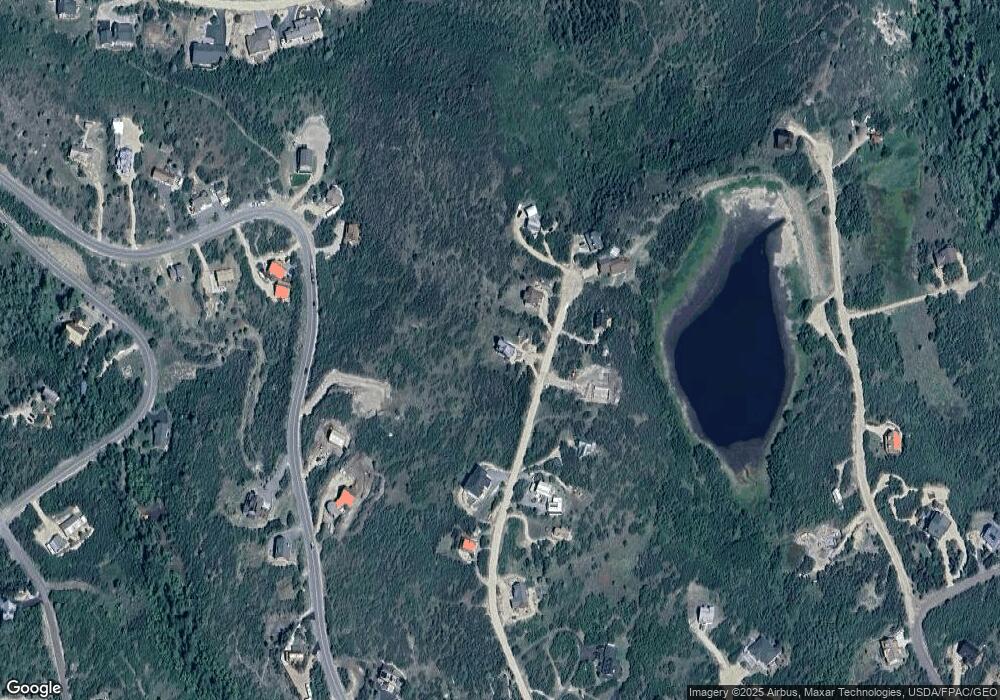

Map

Nearby Homes

- 1445 S Cedar Bark Ln

- 8510 E Lake Pines Dr Unit 264

- 8375 E Lake Pines Dr Unit 212

- 1594 Tree Top Ln Unit 825

- 1543 Ridgeline Dr

- 1543 Ridgeline Dr Unit 1224

- 1555 S Ridgeline Dr Unit 1225

- 1813 S Greenleaf Rd Unit 341

- 1810 Timber Lakes Dr

- 1810 Timber Lakes Dr Unit 832

- 9048 E Acorn Way

- 9048 E Acorn Way Unit 984

- 1795 Westview Dr Unit 1379

- 1552 Westview Dr

- 1532 S Beaver Bench Rd E Unit 1483

- 2204 Timber Lakes Dr Unit 945

- 1421 S Beaver Bench Rd Unit 1421

- 9393 Deer Creek Dr Unit 970

- 2230 Timber Lakes Dr Unit 944

- 9406 E Deer Creek Dr

- 1378 S Cedar Bark Ln E

- 1378 S Cedar Bark Ln E Unit 235

- 1442 Cedar Bark Ln Unit 233

- 1442 Cedar Bark Ln

- 1350 Cedar Bark Ln Unit 236

- 1391 S Cedar Bark Ln

- 1391 S Cedar Bark Ln Unit 241

- 1350 E Cedar Bark Ln S Unit 236

- 1350 E Cedar Bark Ln Unit 236

- 243 Cedar Bark Ln

- 240 S Cedar Bark Ln

- 1476 Cedar Bark Ln Unit 232

- 1476 Cedar Bark Ln

- 1353 Cedar Bark Ln Unit 240

- 238 Cedar Bark Ln

- 1340 Cedar Bark Ln

- 1345 Cedar Bark Ln

- 1345 Cedar Bark Ln Unit 239

- 8471 E Lake Pines Dr