Estimated Value: $719,000 - $885,000

3

Beds

2

Baths

1,432

Sq Ft

$546/Sq Ft

Est. Value

About This Home

This home is located at 13786 Sycamore Tree Ln, Poway, CA 92064 and is currently estimated at $782,152, approximately $546 per square foot. 13786 Sycamore Tree Ln is a home located in San Diego County with nearby schools including Midland Elementary, Twin Peaks Middle, and Poway High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2017

Sold by

Enyeart Robert Sanborn and Enyeart Sydelle Vogelhut

Bought by

Alfred Michael A

Current Estimated Value

Purchase Details

Closed on

Feb 28, 2014

Sold by

Enyeart Robert Sanborn and Enyeart Sydelle Vogelhut

Bought by

The Robert & Sydelle Enyeart Family Trus

Purchase Details

Closed on

Nov 19, 1998

Sold by

Va

Bought by

Enyeart Robert S and Enyeart Sydelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,229

Interest Rate

6.42%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 13, 1998

Sold by

Norwest Mtg Inc

Bought by

Va

Purchase Details

Closed on

Oct 18, 1996

Sold by

Gene Adgate

Bought by

Dasinger Donna M

Purchase Details

Closed on

Jun 15, 1989

Purchase Details

Closed on

May 29, 1987

Purchase Details

Closed on

Feb 28, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alfred Michael A | -- | None Available | |

| The Robert & Sydelle Enyeart Family Trus | -- | None Available | |

| Enyeart Robert S | $151,000 | American Title Ins Co | |

| Va | -- | Fidelity National Title Ins | |

| Norwest Mtg Inc | $114,992 | Fidelity National Title Ins | |

| Dasinger Donna M | -- | -- | |

| -- | $143,000 | -- | |

| -- | $112,000 | -- | |

| -- | $92,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Enyeart Robert S | $146,229 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,613 | $236,077 | $98,361 | $137,716 |

| 2024 | $2,613 | $231,449 | $96,433 | $135,016 |

| 2023 | $2,557 | $226,912 | $94,543 | $132,369 |

| 2022 | $2,514 | $222,464 | $92,690 | $129,774 |

| 2021 | $2,481 | $218,103 | $90,873 | $127,230 |

| 2020 | $2,448 | $215,868 | $89,942 | $125,926 |

| 2019 | $2,385 | $211,636 | $88,179 | $123,457 |

| 2018 | $2,318 | $207,487 | $86,450 | $121,037 |

| 2017 | $2,257 | $203,419 | $84,755 | $118,664 |

| 2016 | $2,210 | $199,432 | $83,094 | $116,338 |

| 2015 | $2,177 | $196,437 | $81,846 | $114,591 |

| 2014 | $2,126 | $192,590 | $80,243 | $112,347 |

Source: Public Records

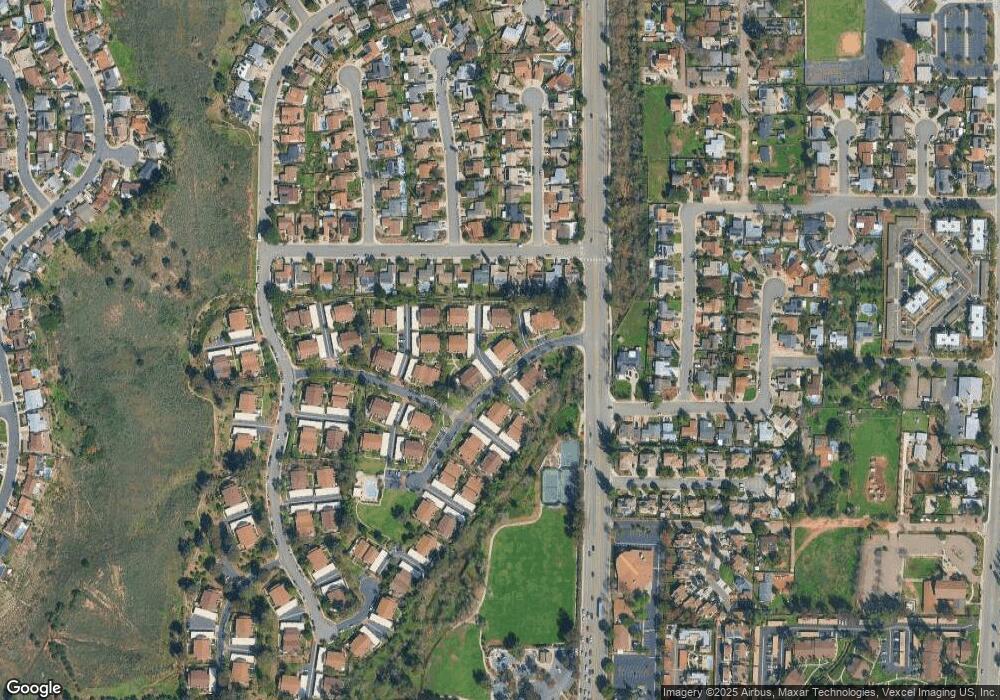

Map

Nearby Homes

- 14015 Olive Meadows Place

- 000 Carlson Ct 9 Unit 9

- 13941 Wisteria Ave Unit 53

- 13908 Hibiscus Ave Unit 40

- 13962 Magnolia Ave Unit 90

- 13056 Poway Rd

- 12939 Cree Ct

- 13643 Melissa Ln

- 1/2 Poway Rd

- 13303 Betty Lee Way

- 13085 Olympus Cir

- 12959 Creek Park Dr

- 13329 Casa Vista St Unit 98

- 14403 Gaslight Ct

- 13411 Silver Lake Dr

- 13308 Alpine Dr

- 12823 Estrella Vista St Unit 284

- 14274 Woodcreek Rd

- 13104 Corona Way Unit 324

- 13730 Holly Oak Way

- 13780 Sycamore Tree Ln

- 13782 Sycamore Tree Ln

- 13784 Sycamore Tree Ln

- 13794 Sycamore Tree Ln

- 13752 Sycamore Tree Ln

- 13776 Sycamore Tree Ln

- 13774 Sycamore Tree Ln

- 13770 Sycamore Tree Ln

- 13772 Sycamore Tree Ln

- 13768 Sycamore Tree Ln

- 13764 Sycamore Tree Ln

- 13760 Sycamore Tree Ln

- 13762 Sycamore Tree Ln

- 13730 Sycamore Tree Ln Unit 67

- 13732 Sycamore Tree Ln Unit 66

- 13758 Sycamore Tree Ln

- 13743 Sycamore Tree Ln

- 13745 Sycamore Tree Ln

- 13747 Sycamore Tree Ln

- 13741 Sycamore Tree Ln