138 Indigo Ct Magnolia, TX 77355

Clear Creek Forest NeighborhoodEstimated Value: $530,000 - $560,408

--

Bed

1

Bath

1,724

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 138 Indigo Ct, Magnolia, TX 77355 and is currently estimated at $540,803, approximately $313 per square foot. 138 Indigo Ct is a home located in Montgomery County with nearby schools including J.L. Lyon Elementary School, Magnolia Sixth Grade Campus, and Magnolia Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2016

Sold by

W & L Investments Llc

Bought by

Jampco Ventures Llc-Series D

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2009

Sold by

Lopez Cristobal and Lopez Ameri

Bought by

W & L Investments Llc

Purchase Details

Closed on

May 18, 2006

Sold by

Banco Popular North America

Bought by

Lopez Cristobal and Lopez Ameri

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 2, 2005

Sold by

Font Michel

Bought by

Banco Popular North America

Purchase Details

Closed on

Dec 9, 2002

Sold by

Trejos Leandros and Trejos Amalia

Bought by

Sanchez Abel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jampco Ventures Llc-Series D | -- | None Available | |

| W & L Investments Llc | -- | Stewart Title Houston Div | |

| Lopez Cristobal | -- | First American Title | |

| Banco Popular North America | $51,000 | -- | |

| Sanchez Abel | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lopez Cristobal | $36,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,441 | $510,000 | $213,202 | $296,798 |

| 2024 | $7,420 | $470,000 | $213,202 | $256,798 |

| 2023 | $7,420 | $470,000 | $213,200 | $256,800 |

| 2022 | $7,411 | $420,000 | $192,730 | $227,270 |

| 2021 | $6,116 | $329,030 | $137,350 | $191,680 |

| 2020 | $6,618 | $327,000 | $137,350 | $189,650 |

| 2019 | $6,424 | $319,000 | $137,350 | $181,650 |

| 2018 | $5,746 | $271,830 | $0 | $0 |

| 2017 | $5,665 | $267,170 | $81,720 | $185,450 |

| 2016 | $5,691 | $268,380 | $81,720 | $186,660 |

| 2015 | $4,027 | $230,000 | $81,720 | $148,280 |

| 2014 | $4,027 | $187,770 | $46,630 | $141,140 |

Source: Public Records

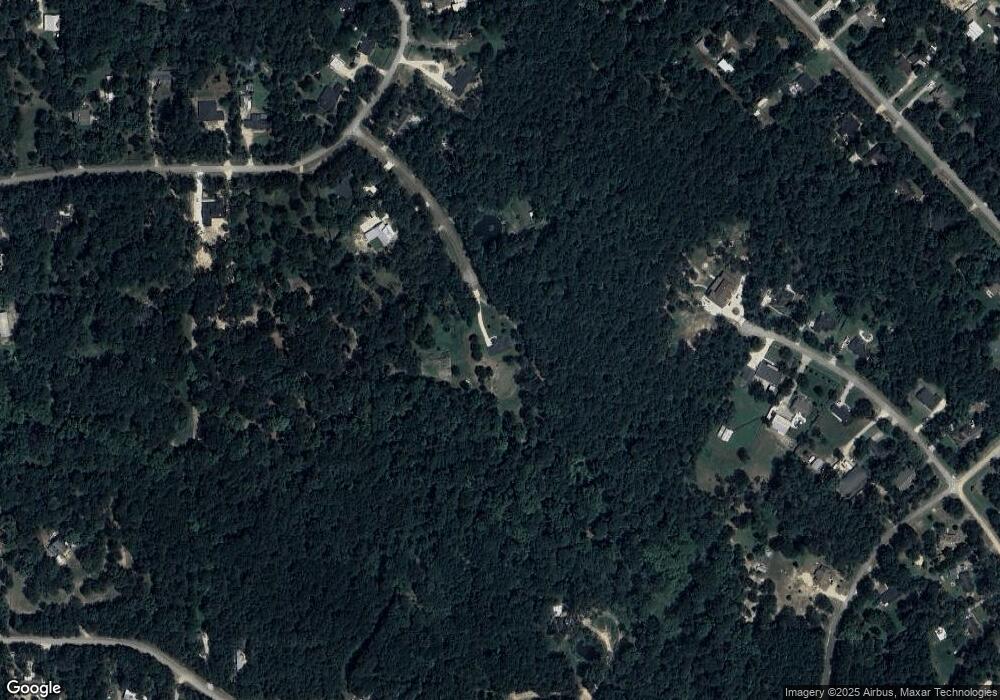

Map

Nearby Homes

- 289 Pelican St

- 24445 Pipestem Dr

- 0 Baneberry

- 451 Pelican St

- 30003 Desert Willow Ct

- 23016 Glenwood Blvd

- 22710 Meadowsweet Dr

- 30311 N Holly Oaks Cir

- 22806 Lantana Dr

- 23215 Nichols Sawmill Rd

- 22403 Meadowsweet Dr

- 25103 Lake Park Ct

- 30103 Thousand Oaks Ct

- 23615 Roberts Cemetery Rd

- 22922 Blackgum Dr

- 22920 Blackgum Dr

- 22219 Rainfern Dr

- 23602 Kings Forest Rd

- 25402 Holly Oaks Ct

- TBD Clear Creek Cir

- LOT 9 Indigo Ct

- Lot 32 Indigo Ct

- 124 Indigo Ct Ct

- 124 Indigo Ct

- 121 Indigo Ct

- 00 Sundew Ct

- 106 Indigo Ct

- 226 Sundew Ct

- Lot 25 Pelican St

- Lot 27 Pelican St

- Lot 29 Pelican St

- Lot 31 Indigo Ct

- Lot 30 Pelican St

- 23 Pelican

- 24 Pelican

- 10000 Bentley Dr

- 0 Bob Link

- Lot 26 Pelican St

- Lot 28 Pelican St

- 0 Pelican Rd