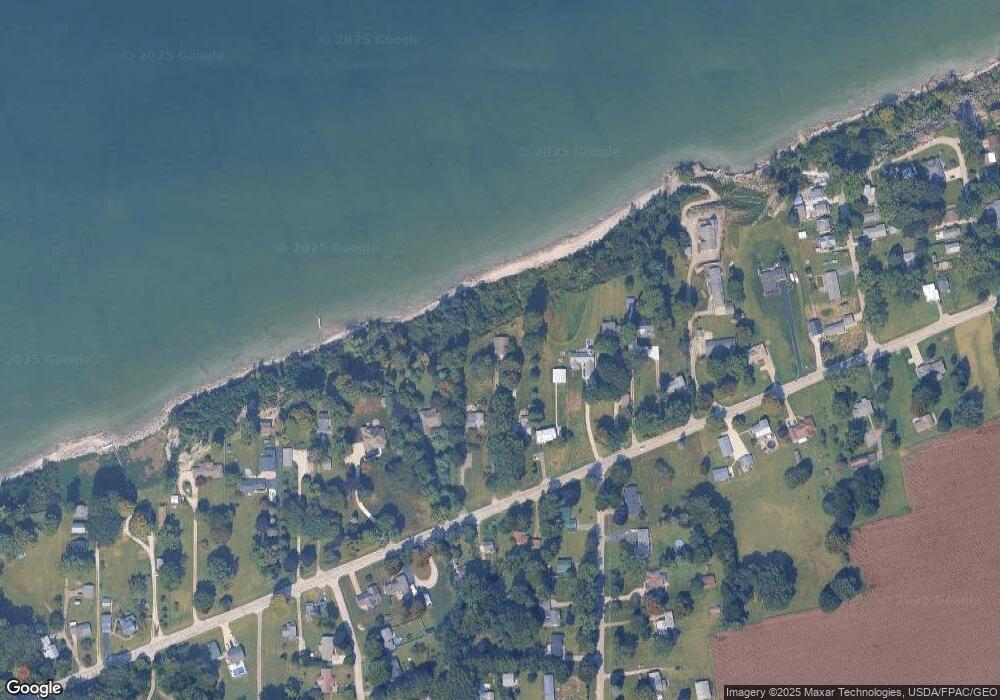

1380 Lake Rd Conneaut, OH 44030

Kingsville NeighborhoodEstimated Value: $316,000 - $355,000

3

Beds

2

Baths

1,949

Sq Ft

$171/Sq Ft

Est. Value

About This Home

This home is located at 1380 Lake Rd, Conneaut, OH 44030 and is currently estimated at $333,830, approximately $171 per square foot. 1380 Lake Rd is a home located in Ashtabula County with nearby schools including Lakeshore Primary Elementary School, Gateway Elementary School, and Conneaut Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2002

Sold by

Montgomery Carole A

Bought by

Chordas Ronald K and Chordas Carlette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,500

Outstanding Balance

$54,777

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$279,053

Purchase Details

Closed on

Dec 13, 1996

Sold by

Vig Bart F

Bought by

Montgomery Carole A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,500

Interest Rate

7.63%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chordas Ronald K | $139,500 | -- | |

| Montgomery Carole A | $126,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chordas Ronald K | $128,500 | |

| Previous Owner | Montgomery Carole A | $94,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,593 | $90,130 | $37,450 | $52,680 |

| 2023 | $4,174 | $90,130 | $37,450 | $52,680 |

| 2022 | $4,033 | $76,690 | $28,810 | $47,880 |

| 2021 | $4,104 | $76,690 | $28,810 | $47,880 |

| 2020 | $4,101 | $76,690 | $28,810 | $47,880 |

| 2019 | $4,673 | $85,860 | $30,280 | $55,580 |

| 2018 | $4,455 | $85,860 | $30,280 | $55,580 |

| 2017 | $4,447 | $85,860 | $30,280 | $55,580 |

| 2016 | $3,404 | $71,440 | $25,200 | $46,240 |

| 2015 | $3,438 | $71,440 | $25,200 | $46,240 |

| 2014 | $3,028 | $71,440 | $25,200 | $46,240 |

| 2013 | $2,540 | $61,640 | $22,510 | $39,130 |

Source: Public Records

Map

Nearby Homes

- 139 Salisbury Rd

- 1300 Lake Rd

- 106 Margor Dr

- 1185 Lake Rd

- 2663 Lake Rd

- 40 Oakland Blvd

- 320 W Main Rd

- 1145 Lake Rd

- 202 W Main Rd Unit Lot 150

- 210 W Main Rd

- 1036 Golfview Dr

- 220 Daniels Ave

- 3988 Lake Rd

- 4377 E Center St

- 247 Whitney St

- 919 Lincoln Dr

- 681 Madison St

- 0 Creek Rd Unit 5146859

- 4040 E Center St

- 7410 Fieldstone Ave