1380 Pegan Common Livermore, CA 94550

Estimated Value: $1,628,000 - $1,907,000

5

Beds

3

Baths

2,495

Sq Ft

$689/Sq Ft

Est. Value

About This Home

This home is located at 1380 Pegan Common, Livermore, CA 94550 and is currently estimated at $1,718,044, approximately $688 per square foot. 1380 Pegan Common is a home located in Alameda County with nearby schools including Jackson Avenue Elementary School, East Avenue Middle School, and Livermore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2000

Sold by

Grant J Brian and Grant Sharon M

Bought by

Grant J Brian and Grant Sharon

Current Estimated Value

Purchase Details

Closed on

Mar 11, 1999

Sold by

Reynolds Timothy and Reynolds Cheri Pagett

Bought by

Grant J Brian and Grant Sharon M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.73%

Purchase Details

Closed on

Aug 6, 1997

Sold by

Pegan Dusan M and Pegan Janet M

Bought by

Reynolds Timothy and Reynolds Cheri Pagett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,600

Interest Rate

7.61%

Mortgage Type

Construction

Purchase Details

Closed on

Oct 7, 1994

Sold by

Pegan Dusan M and Pegan Janet M

Bought by

Pegan Dusan M and Pegan Janet M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grant J Brian | -- | -- | |

| Grant J Brian | $445,000 | Old Republic Title Company | |

| Reynolds Timothy | $108,000 | Golden California Title Co | |

| Pegan Dusan M | $13,500 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Grant J Brian | $240,000 | |

| Previous Owner | Reynolds Timothy | $273,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,830 | $690,590 | $209,277 | $488,313 |

| 2024 | $8,830 | $676,915 | $205,174 | $478,741 |

| 2023 | $8,698 | $670,507 | $201,152 | $469,355 |

| 2022 | $8,573 | $650,362 | $197,208 | $460,154 |

| 2021 | $7,656 | $637,474 | $193,342 | $451,132 |

| 2020 | $8,154 | $637,867 | $191,360 | $446,507 |

| 2019 | $8,188 | $625,362 | $187,608 | $437,754 |

| 2018 | $8,014 | $613,102 | $183,930 | $429,172 |

| 2017 | $7,809 | $601,083 | $180,325 | $420,758 |

| 2016 | $7,522 | $589,300 | $176,790 | $412,510 |

| 2015 | $7,058 | $580,448 | $174,134 | $406,314 |

| 2014 | $6,934 | $569,078 | $170,723 | $398,355 |

Source: Public Records

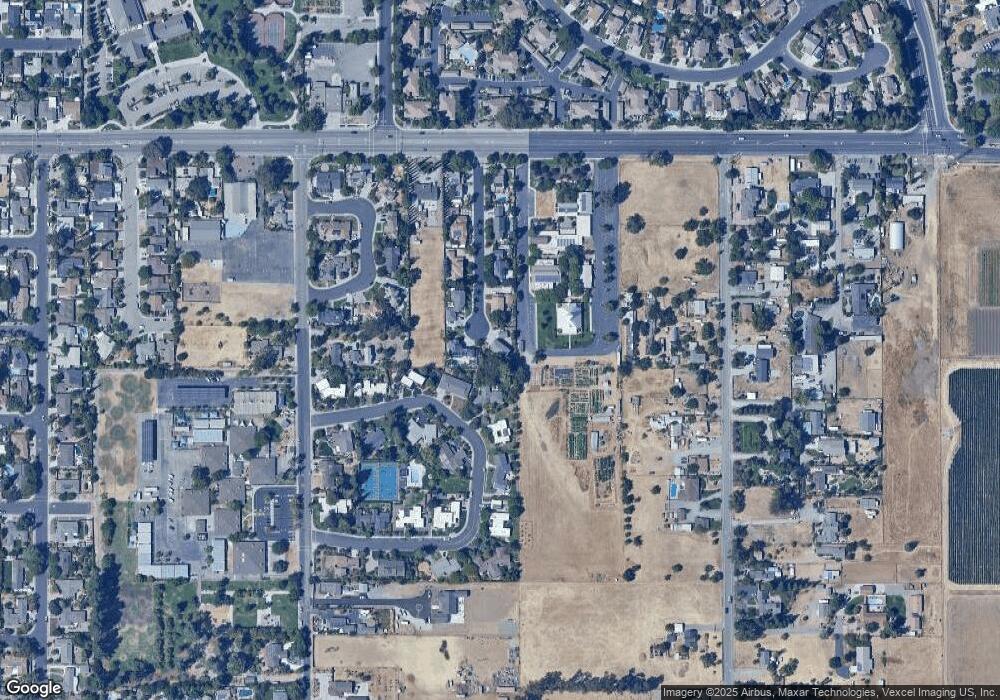

Map

Nearby Homes

- 1368 Pegan Common

- 736 Adams Ave

- 5157 Diane Ln

- 476 Beverly St

- 5477 Stockton Loop

- 368 Beverly St

- 4382 Colgate Way

- 2089 Staghorn Way

- 5311 Charlotte Way

- 766 Joyce St

- 838 Hazel St

- 3965 Purdue Way

- 473 Andrea Cir

- 3959 Purdue Way

- 3902 Dartmouth Way

- 4674 Kimberley Common

- 5410 Betty Cir

- 3857 Pestana Way

- 202 Sonia Way

- 505 Joyce St

- 1395 Pegan Common

- 4628 Almond Cir

- 1373 Pegan Common

- 4616 Almond Cir

- 4634 Almond Cir

- 1346 Pegan Common

- 1357 Pegan Common

- 4614 Almond Cir

- 1264 Blossom Cir

- 4623 Almond Cir

- 4627 Almond Cir

- 1324 Pegan Common

- 1339 Pegan Common

- 4642 Almond Cir

- 1276 Blossom Cir

- 4608 Almond Cir

- 1250 Blossom Cir

- 4609 Almond Cir

- 1479 Buena Vista Ave

- 1362 Almond Ave