13805 Cedar Rd Unit 8203 Cleveland, OH 44118

Estimated Value: $55,000 - $65,136

1

Bed

1

Bath

799

Sq Ft

$75/Sq Ft

Est. Value

About This Home

This home is located at 13805 Cedar Rd Unit 8203, Cleveland, OH 44118 and is currently estimated at $60,284, approximately $75 per square foot. 13805 Cedar Rd Unit 8203 is a home located in Cuyahoga County with nearby schools including Gearity Professional Development School, Monticello Middle School, and Cleveland Heights High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2000

Sold by

Estate Of Jack Stone

Bought by

Stone Bernard and Stone Melvin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Outstanding Balance

$7,351

Interest Rate

8.03%

Estimated Equity

$52,933

Purchase Details

Closed on

Sep 24, 2000

Sold by

Stone Bernard

Bought by

Ziechmann Karin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Outstanding Balance

$7,351

Interest Rate

8.03%

Estimated Equity

$52,933

Purchase Details

Closed on

Sep 19, 2000

Sold by

Stone Melvin

Bought by

Ziechmann Karin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Outstanding Balance

$7,351

Interest Rate

8.03%

Estimated Equity

$52,933

Purchase Details

Closed on

Jan 30, 1979

Sold by

Kirshbaum Lawrence and Kirshbaum Dale

Bought by

Stone Jack

Purchase Details

Closed on

Jan 1, 1975

Bought by

Kirshbaum Lawrence and Kirshbaum Dale

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stone Bernard | -- | -- | |

| Ziechmann Karin | $30,000 | -- | |

| Ziechmann Karin | -- | -- | |

| Stone Jack | $27,900 | -- | |

| Kirshbaum Lawrence | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ziechmann Karin | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,009 | $18,165 | $1,820 | $16,345 |

| 2023 | $283 | $9,590 | $1,050 | $8,540 |

| 2022 | $329 | $9,590 | $1,050 | $8,540 |

| 2021 | $328 | $9,590 | $1,050 | $8,540 |

| 2020 | $236 | $7,000 | $770 | $6,230 |

| 2019 | $236 | $20,000 | $2,200 | $17,800 |

| 2018 | $229 | $7,000 | $770 | $6,230 |

| 2017 | $236 | $6,620 | $670 | $5,950 |

| 2016 | $236 | $6,620 | $670 | $5,950 |

| 2015 | $236 | $6,620 | $670 | $5,950 |

| 2014 | $236 | $7,360 | $740 | $6,620 |

Source: Public Records

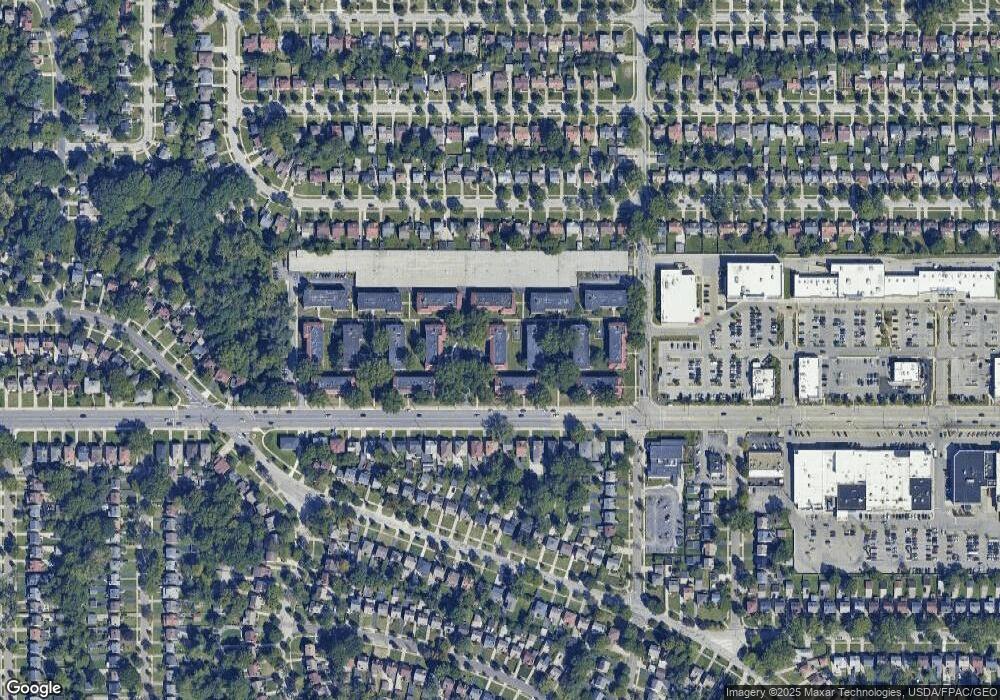

Map

Nearby Homes

- 13805 Cedar Rd Unit 203

- 13801 Cedar Rd Unit 102

- 3841 Washington Blvd

- 13765 Cedar Rd Unit 303C

- 3797 Bushnell Rd

- 3781 Bushnell Rd

- 3874 Washington Blvd

- 13726 Cedar Rd

- 2223 Fenwick Rd

- 2187 Barrington Rd

- 2244 Edgerton Rd

- 2192 Barrington Rd

- 13677 Cedar Rd

- 2216 Barrington Rd

- 3778 E Antisdale Rd

- 2227 Cranston Rd

- 3958 Bushnell Rd

- 2203 Brockway Rd

- 3733 E Antisdale Rd

- 13629 Cedar Rd

- 13805 Cedar Rd Unit 201

- 13805 Cedar Rd Unit 101

- 13805 Cedar Rd Unit 202

- 13805 Cedar Rd Unit 102

- 13805 Cedar Rd Unit 206

- 13805 Cedar Rd Unit 304

- 13805 Cedar Rd Unit 8201

- 13805 Cedar Rd Unit 305

- 13805 Cedar Rd Unit 205

- 13805 Cedar Rd Unit 303

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd

- 13805 Cedar Rd Unit 306

- 13805 Cedar Rd Unit 106

- 13805 Cedar Rd Unit 103