139 Eagle Ln Tazewell, TN 37879

Estimated Value: $172,033 - $256,000

--

Bed

1

Bath

1,344

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 139 Eagle Ln, Tazewell, TN 37879 and is currently estimated at $227,008, approximately $168 per square foot. 139 Eagle Ln is a home located in Claiborne County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2002

Sold by

Claiborne County Habitat H

Bought by

Bolden Melissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,230

Outstanding Balance

$19,634

Interest Rate

6.21%

Estimated Equity

$207,374

Purchase Details

Closed on

Aug 19, 2002

Bought by

Bolden Melissa % Claiborne County Habitat Hum

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,230

Interest Rate

6.21%

Purchase Details

Closed on

Dec 19, 1994

Bought by

Claiborne County Habitat For Humanity Inc

Purchase Details

Closed on

Jun 7, 1993

Bought by

England Arnold D and England Opal

Purchase Details

Closed on

Jan 1, 1977

Bought by

England Builders & Dev Co Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bolden Melissa | $67,000 | -- | |

| Bolden Melissa % Claiborne County Habitat Hum | $67,000 | -- | |

| Claiborne County Habitat For Humanity Inc | $63,000 | -- | |

| England Arnold D | $65,000 | -- | |

| England Builders & Dev Co Inc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | England Builders & Dev Co Inc | $46,230 | |

| Previous Owner | England Builders & Dev Co Inc | $46,230 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $726 | $31,025 | $3,900 | $27,125 |

| 2023 | $726 | $31,025 | $3,900 | $27,125 |

| 2022 | $621 | $31,025 | $3,900 | $27,125 |

| 2021 | $606 | $23,525 | $3,450 | $20,075 |

| 2020 | $606 | $23,525 | $3,450 | $20,075 |

| 2019 | $606 | $23,525 | $3,450 | $20,075 |

| 2018 | $606 | $23,525 | $3,450 | $20,075 |

| 2017 | $606 | $23,525 | $3,450 | $20,075 |

| 2016 | $619 | $24,000 | $3,450 | $20,550 |

| 2015 | $595 | $24,000 | $3,450 | $20,550 |

| 2014 | $595 | $23,993 | $0 | $0 |

Source: Public Records

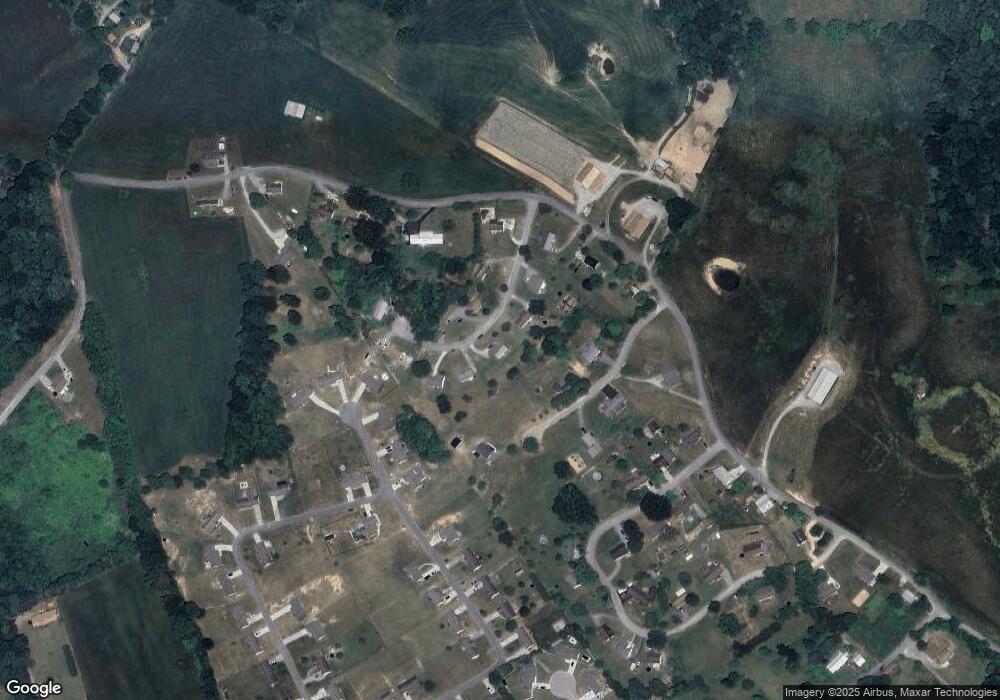

Map

Nearby Homes

- 166 Altina Cir

- 1161 Essary Rd

- 116 Magnolia Ln

- 135 Milo Cir

- 649 Baldwin Hill Rd

- 175 Norris Dr

- 844 Jim Pressnell Rd

- 865 Shade Pressnell Rd

- 485 Norris Dr

- 136 Cardwell Dr

- 728 Essary Rd

- 282 Jay Dr

- 181 Gloria Dr

- 1258 Dogwood Rd

- 0 Highway 25 Hwy E Unit 1313870

- 721 Fan St

- 1828 Cherokee Cir

- 1719 Boone Cir

- 122 Opal St

- 153 Creed Way