Estimated Value: $447,000 - $480,000

3

Beds

3

Baths

1,982

Sq Ft

$235/Sq Ft

Est. Value

About This Home

This home is located at 139 Ropango Way, Hemet, CA 92545 and is currently estimated at $466,092, approximately $235 per square foot. 139 Ropango Way is a home located in Riverside County with nearby schools including Cawston Elementary School, Rancho Viejo Middle School, and Tahquitz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 23, 2023

Sold by

Torres Gloria Cruz

Bought by

2023 Gloria Cruz Torres Separate Property Fam and Torres

Current Estimated Value

Purchase Details

Closed on

Oct 3, 2023

Sold by

Perez Armando

Bought by

Torres Gloria Cruz

Purchase Details

Closed on

Mar 24, 2008

Sold by

Residential Funding Co Llc

Bought by

Perez Armando and Torres Gloria Cruz

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 15, 2007

Sold by

Ramirez Prince Bruno and Ramirez Blanca Rosa

Bought by

Residential Funding Co Llc and Wilshire Credit Corp

Purchase Details

Closed on

Aug 7, 2003

Sold by

Kb Home Coastal Inc

Bought by

Ramirez Prince Bruno and Ramirez Blanca Rosa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,109

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2023 Gloria Cruz Torres Separate Property Fam | -- | None Listed On Document | |

| Torres Gloria Cruz | -- | None Listed On Document | |

| Perez Armando | $200,000 | Multiple | |

| Residential Funding Co Llc | $292,500 | None Available | |

| Ramirez Prince Bruno | $234,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Perez Armando | $184,000 | |

| Previous Owner | Ramirez Prince Bruno | $199,109 | |

| Closed | Ramirez Prince Bruno | $35,137 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,023 | $262,685 | $91,936 | $170,749 |

| 2023 | $4,023 | $252,486 | $88,367 | $164,119 |

| 2022 | $3,918 | $247,536 | $86,635 | $160,901 |

| 2021 | $3,855 | $242,684 | $84,937 | $157,747 |

| 2020 | $3,807 | $240,197 | $84,067 | $156,130 |

| 2019 | $3,730 | $235,488 | $82,419 | $153,069 |

| 2018 | $3,628 | $230,871 | $80,804 | $150,067 |

| 2017 | $3,643 | $226,345 | $79,220 | $147,125 |

| 2016 | $3,598 | $221,908 | $77,667 | $144,241 |

| 2015 | $3,558 | $218,576 | $76,501 | $142,075 |

| 2014 | $3,061 | $184,000 | $64,000 | $120,000 |

Source: Public Records

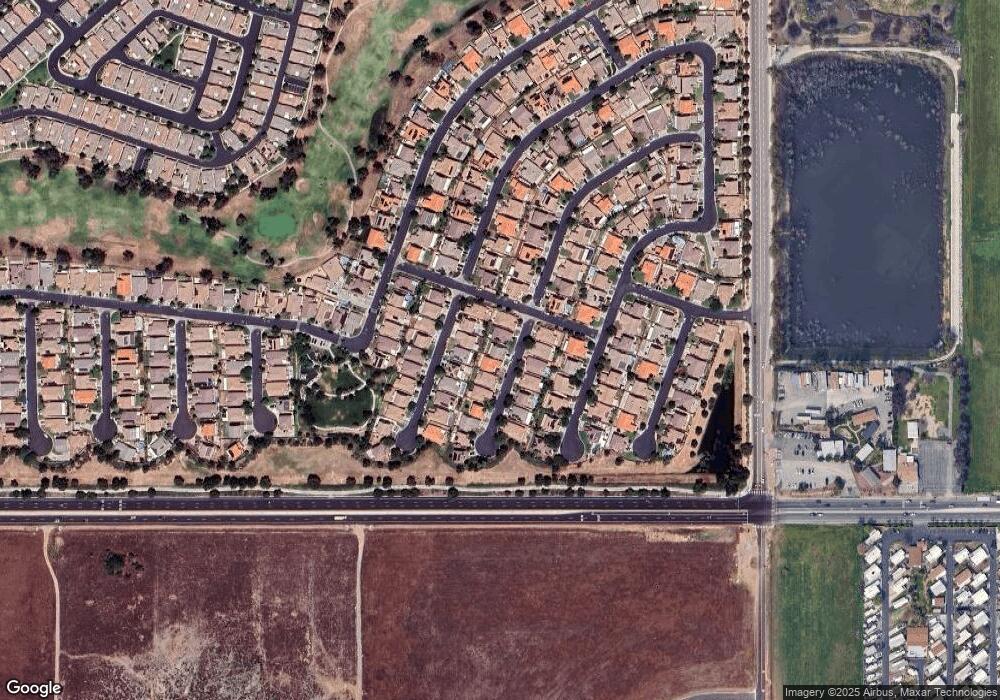

Map

Nearby Homes

- 32302 California 74

- 2 California Ave

- 245 Glenview Ln

- 270 Cog Hill Ln

- 35099 W Florida Ave Unit B6

- 8160 Doral Ln

- 8197 Doral Ln

- 8295 Carnoustie Ave

- 1903 Breachy Way

- 215 Firestone Ln

- 7969 Mickelson Way

- 248 Four Seasons Blvd

- 241 Carner Ln

- 8251 Triplett Ln

- 230 Eagle Ln

- 8070 Mickelson Way

- 0 California Ave Unit SW25254173

- 257 Stricker Ln

- 233 Eagle Ln

- 7791 Armour Dr

- 137 Ropango Way

- 145 Ropango Way

- 131 Ropango Way

- 142 La Amistad Way

- 147 Ropango Way

- 144 La Amistad Way

- 136 La Amistad Way

- 140 Ropango Way

- 150 La Amistad Way

- 134 La Amistad Way

- 142 Ropango Way

- 129 Ropango Way

- 134 Ropango Way

- 132 Ropango Way

- 130 La Amistad Way

- 123 Ropango Way

- 151 Ropango Way

- 124 Ropango Way

- 160 La Amistad Way

- 128 La Amistad Way