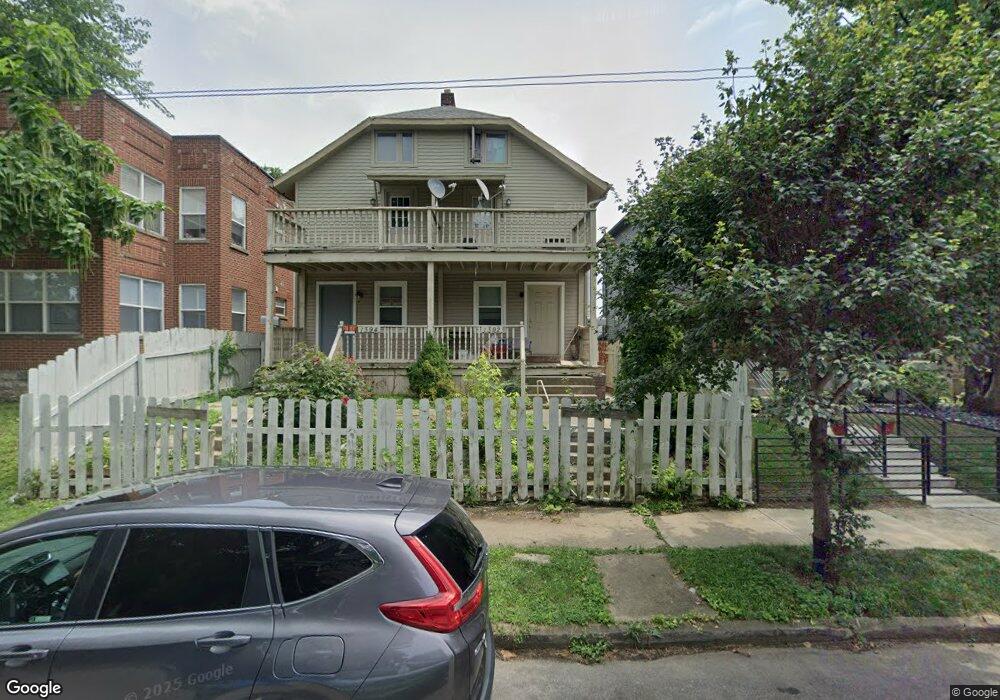

1392 Hamlet St Unit 2 Columbus, OH 43201

Weinland Park NeighborhoodEstimated Value: $379,549 - $475,000

5

Beds

2

Baths

2,464

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 1392 Hamlet St Unit 2, Columbus, OH 43201 and is currently estimated at $426,637, approximately $173 per square foot. 1392 Hamlet St Unit 2 is a home located in Franklin County with nearby schools including Weinland Park Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2015

Sold by

Federal National Mortgage Association

Bought by

Lin Chin Yuan

Current Estimated Value

Purchase Details

Closed on

Sep 28, 2015

Sold by

Wasil Malou and Wasil Malou Cyril

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Aug 14, 2015

Sold by

Wasil Malou and Pnc Bank Na

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jan 26, 2001

Bought by

Wasil Craig

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,400

Interest Rate

7.43%

Purchase Details

Closed on

Jun 21, 2000

Sold by

Marlowe Michael and Marlowe Lisa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,150

Interest Rate

8.19%

Purchase Details

Closed on

Feb 17, 1995

Sold by

Est John T Bradley

Bought by

Michael Marlowe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lin Chin Yuan | -- | Attorney | |

| Federal National Mortgage Association | $96,505 | Attorney | |

| Federal National Mortgage Association | $54,000 | None Available | |

| Wasil Craig | $66,000 | Chicago Title | |

| -- | $65,000 | -- | |

| Michael Marlowe | $13,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wasil Craig | $59,400 | |

| Previous Owner | Mcnamee Ann | $57,150 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,966 | $108,360 | $36,750 | $71,610 |

| 2024 | $4,966 | $108,360 | $36,750 | $71,610 |

| 2023 | $4,904 | $108,360 | $36,750 | $71,610 |

| 2022 | $3,899 | $73,370 | $8,300 | $65,070 |

| 2021 | $3,906 | $73,370 | $8,300 | $65,070 |

| 2020 | $3,912 | $73,370 | $8,300 | $65,070 |

| 2019 | $3,508 | $56,420 | $6,370 | $50,050 |

| 2018 | $1,729 | $56,420 | $6,370 | $50,050 |

| 2017 | $3,464 | $56,420 | $6,370 | $50,050 |

| 2016 | $3,274 | $48,060 | $5,640 | $42,420 |

| 2015 | $2,973 | $48,060 | $5,640 | $42,420 |

| 2014 | $2,980 | $48,060 | $5,640 | $42,420 |

| 2013 | $1,433 | $43,680 | $5,110 | $38,570 |

Source: Public Records

Map

Nearby Homes

- 1342 Hamlet St Unit 344

- 1336 N 5th St Unit 338

- 1440-1442 Hamlet St

- 1411 N 5th St

- 1376 N 6th St

- 1291 N Grant Ave

- 1239 Cromartie Ln

- 1222 N Grant Ave Unit H

- 1158 Summit St

- 1187 Cromartie Ln

- 1152 Summit St

- 249 E Greenwood Ave

- 138 E Greenwood Ave

- 1276 N High St Unit 402

- 156 E 4th Ave

- 1151 Summit St

- 1149 Summit St

- 289 E Greenwood Ave

- 1136 Summit St

- 288 E 4th Ave

- 1392 Hamlet St Unit 394

- 1386 Hamlet St Unit 388

- 219 E 8th Ave

- 231 E 8th Ave

- 1400 Hamlet St Unit 101

- 1400 Hamlet St

- 1382-1384 Hamlet St

- 1382 Hamlet St Unit 384

- 1378 Hamlet St Unit 380

- 1378 Hamlet St Unit 1380

- 1378-1380 Hamlet St

- 1376 Hamlet St

- 1383 N 4th St Unit 385

- 1387 N 4th St Unit 389

- 1393 Hamlet St

- 1383-1385 N 4th St

- 1414 Hamlet St

- 1389 Hamlet St

- 1370 Hamlet St

- 1373 N 4th St Unit 375

Your Personal Tour Guide

Ask me questions while you tour the home.