13972 Hala Way Unit 40 Garden Grove, CA 92843

Estimated Value: $514,000 - $725,000

2

Beds

2

Baths

994

Sq Ft

$633/Sq Ft

Est. Value

About This Home

This home is located at 13972 Hala Way Unit 40, Garden Grove, CA 92843 and is currently estimated at $629,307, approximately $633 per square foot. 13972 Hala Way Unit 40 is a home located in Orange County with nearby schools including Woodbury Elementary School, James Irvine Intermediate School, and Bolsa Grande High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 14, 2003

Sold by

Bengali Mohammad R

Bought by

Reyes Vicente and Reyes Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,230

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 29, 1998

Sold by

Bengali Nancy L

Bought by

Bengali Mohammad R

Purchase Details

Closed on

Sep 14, 1998

Sold by

Franze Charles M and Franze Jodi

Bought by

Bengali Mohammad R

Purchase Details

Closed on

Oct 6, 1997

Sold by

Franze Charles M

Bought by

Franze Charles M and Franze Jodi

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reyes Vicente | $277,000 | Fidelity National Title | |

| Bengali Mohammad R | -- | Fidelity National Title Ins | |

| Bengali Mohammad R | $107,000 | Fidelity National Title Ins | |

| Franze Charles M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Reyes Vicente | $274,230 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,942 | $393,823 | $273,032 | $120,791 |

| 2024 | $4,942 | $386,101 | $267,678 | $118,423 |

| 2023 | $4,850 | $378,531 | $262,430 | $116,101 |

| 2022 | $4,740 | $371,109 | $257,284 | $113,825 |

| 2021 | $4,673 | $363,833 | $252,239 | $111,594 |

| 2020 | $4,617 | $360,103 | $249,653 | $110,450 |

| 2019 | $4,554 | $353,043 | $244,758 | $108,285 |

| 2018 | $4,442 | $346,121 | $239,959 | $106,162 |

| 2017 | $4,395 | $339,335 | $235,254 | $104,081 |

| 2016 | $3,748 | $296,000 | $204,032 | $91,968 |

| 2015 | $3,750 | $296,000 | $204,032 | $91,968 |

| 2014 | $3,471 | $273,775 | $181,807 | $91,968 |

Source: Public Records

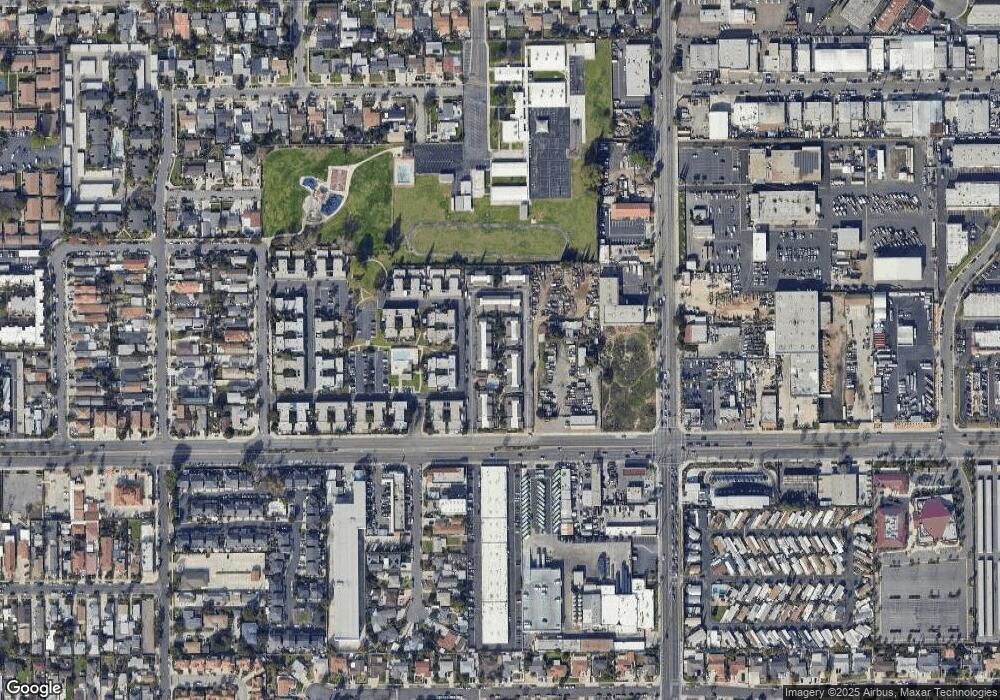

Map

Nearby Homes

- 11321 Parkgreen Ln Unit 102

- 1609 N Parsons Place

- 1114 N Gates St

- 13322 Euclid St

- 13611 Glenhaven Dr

- 526 W Tribella Ct

- 1314 N Bewley St

- 10886 Lotus Dr

- 4201 W 5th St Unit 314

- 3625 W 11th St

- 14356 Taft St

- 14151 Lake St

- 4248 W 5th St

- 3929 W 5th St Unit 16

- 5317 Silver Dr

- 13312 Michael Rainford Cir

- 4832 W 5th St Unit B

- 3932 W 5th St Unit 202

- 230 Green Dr

- 3424 W Washington Ave Unit 228

- 13956 Hala Way Unit 37

- 13966 Hala Way

- 13952 Hala Way Unit 36

- 13952 Hala Way

- 13955 Nadia Way Unit 4

- 13971 Nadia Way Unit 1

- 13965 Nadia Way Unit 2

- 13965 Nadia Way

- 13951 Nadia Way Unit 5

- 13961 Nadia Way Unit 3

- 13941 Nadia Way Unit 7

- 13932 Hala Way

- 13945 Nadia Way

- 13911 Nadia Way Unit 12

- 13935 Nadia Way Unit 8

- 13926 Hala Way Unit 34

- 13931 Nadia Way Unit 9

- 13912 Hala Way Unit 31

- 13922 Hala Way