13974 Francisquito Ave Unit 14 Baldwin Park, CA 91706

Estimated Value: $453,136 - $508,000

2

Beds

2

Baths

936

Sq Ft

$519/Sq Ft

Est. Value

About This Home

This home is located at 13974 Francisquito Ave Unit 14, Baldwin Park, CA 91706 and is currently estimated at $485,534, approximately $518 per square foot. 13974 Francisquito Ave Unit 14 is a home located in Los Angeles County with nearby schools including J.E. Van Wig Elementary School, Torch Middle School, and Bassett Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2002

Sold by

Fortis Carlos M

Bought by

Fortis Carlos P and Fortis Hilda I

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,500

Outstanding Balance

$34,710

Interest Rate

6.74%

Estimated Equity

$450,824

Purchase Details

Closed on

Apr 21, 2000

Sold by

Kohli Gurcharan

Bought by

Fortis Carlos M and Fortis Hilda I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,400

Interest Rate

9.5%

Purchase Details

Closed on

Aug 3, 1998

Sold by

Hud

Bought by

Kohli Gurcharan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,400

Interest Rate

9.99%

Purchase Details

Closed on

Jul 18, 1997

Sold by

Eduardo Gerardo E

Bought by

First Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fortis Carlos P | -- | American Title | |

| Fortis Carlos M | $86,000 | Commonwealth Land Title Co | |

| Kohli Gurcharan | $48,000 | First American Title Co | |

| First Mtg Corp | $119,259 | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fortis Carlos P | $82,500 | |

| Closed | Fortis Carlos M | $77,400 | |

| Previous Owner | Kohli Gurcharan | $38,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,973 | $132,154 | $27,806 | $104,348 |

| 2024 | $1,973 | $129,563 | $27,261 | $102,302 |

| 2023 | $1,915 | $127,024 | $26,727 | $100,297 |

| 2022 | $1,837 | $124,534 | $26,203 | $98,331 |

| 2021 | $1,799 | $122,093 | $25,690 | $96,403 |

| 2019 | $1,753 | $118,474 | $24,929 | $93,545 |

| 2018 | $1,688 | $116,152 | $24,441 | $91,711 |

| 2016 | $1,603 | $111,643 | $23,493 | $88,150 |

| 2015 | $1,565 | $109,967 | $23,141 | $86,826 |

| 2014 | $1,503 | $107,814 | $22,688 | $85,126 |

Source: Public Records

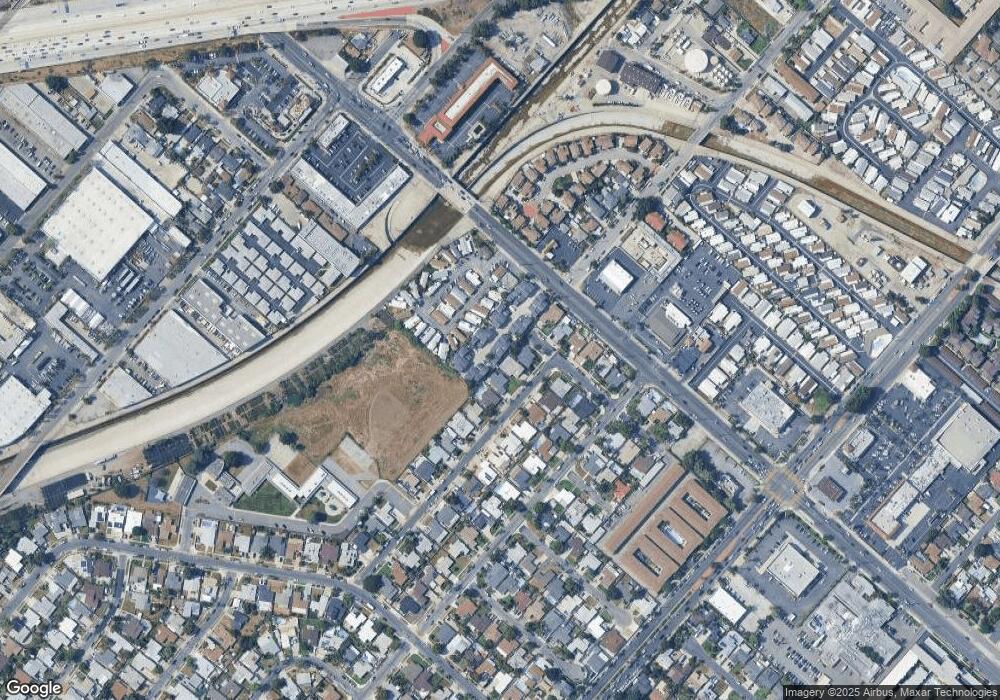

Map

Nearby Homes

- 13974 Francisquito Ave Unit 8

- 1416 Millbury Ave

- 14104 Barrydale St

- 1735 Puente Ave Unit 30

- 3060 Vineland Ave Unit 7

- 1718 Puente Ave Unit 40

- 1525 Bromley Ave

- 3314 Baldwin Park Blvd

- 1003 Le Borgne Ave

- 3004 Via Delores

- 13522 Francisquito Ave Unit C

- 13655 Foster Ave Unit 2

- 13438 Francisquito Ave

- 3355 Vineland Ave

- 14360 Merced Ave

- 1311 S Leland Ave

- 915 Stichman Ave

- 979 Willow Ave Unit 31

- 943 Willow Ave

- 3537 Maine Ave

- 13974 Francisquito Ave

- 13974 Francisquito Ave Unit 16

- 13974 Francisquito Ave Unit 15

- 13974 Francisquito Ave Unit 13

- 13974 Francisquito Ave Unit 12

- 13974 Francisquito Ave Unit 11

- 13974 Francisquito Ave Unit 4

- 13974 Francisquito Ave Unit 3

- 13974 Francisquito Ave Unit 2

- 13974 Francisquito Ave Unit 25

- 13974 Francisquito Ave Unit 24

- 13974 Francisquito Ave Unit 1

- 13974 Francisquito Ave Unit 23

- 13974 Francisquito Ave Unit 22

- 13974 Francisquito Ave Unit 21

- 13974 Francisquito Ave Unit 20

- 13974 Francisquito Ave Unit 19

- 13974 Francisquito Ave Unit 18

- 13974 Francisquito Ave

- 13974 Francisquito Ave Unit 10