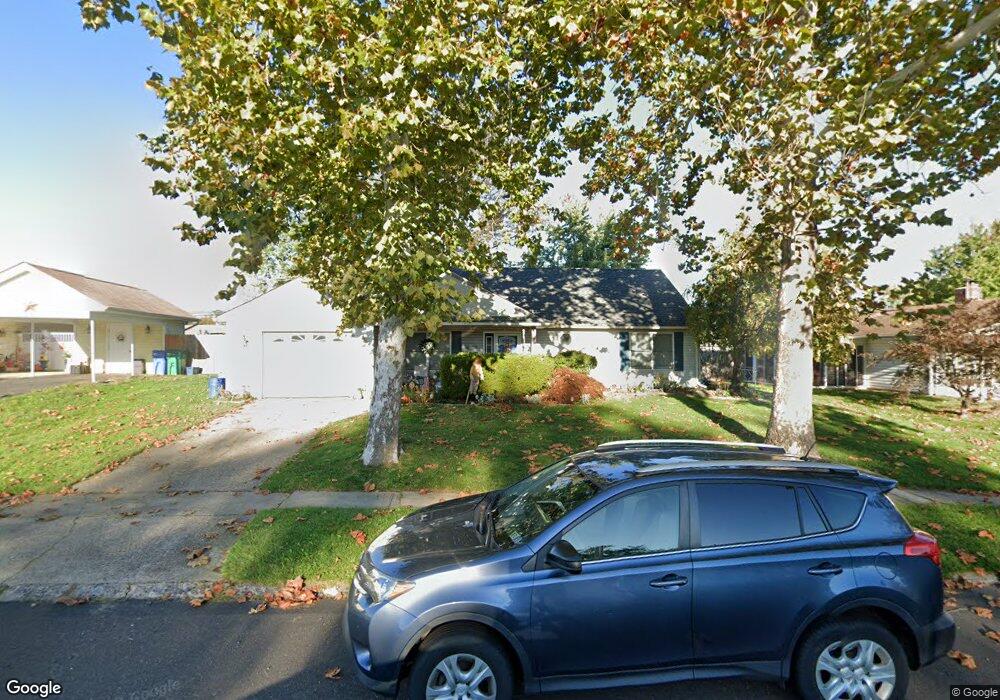

14 Beechtree Rd Levittown, PA 19057

Estimated Value: $381,000 - $418,000

3

Beds

2

Baths

1,824

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 14 Beechtree Rd, Levittown, PA 19057 and is currently estimated at $401,432, approximately $220 per square foot. 14 Beechtree Rd is a home located in Bucks County with nearby schools including Truman Senior High School, First Presbyterian Church School, and Hope Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2009

Sold by

Donahue Kathy L and Donahue Gooch Kathy L

Bought by

Vilarino Daniel J and Vilarino Theresa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,777

Outstanding Balance

$164,492

Interest Rate

5.01%

Mortgage Type

VA

Estimated Equity

$236,940

Purchase Details

Closed on

Oct 23, 2002

Sold by

Donahue Robert R and Donahue Kathy L Potts

Bought by

Donahue Kathy

Purchase Details

Closed on

Oct 16, 2001

Sold by

Donahue Robert R and Donahue Kathy L

Bought by

Donahue Robert R and Donahue Kathy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Interest Rate

6.77%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vilarino Daniel J | $244,900 | None Available | |

| Donahue Kathy | -- | -- | |

| Donahue Robert R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vilarino Daniel J | $250,777 | |

| Previous Owner | Donahue Robert R | $108,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,616 | $20,680 | $4,080 | $16,600 |

| 2024 | $5,616 | $20,680 | $4,080 | $16,600 |

| 2023 | $5,575 | $20,680 | $4,080 | $16,600 |

| 2022 | $5,575 | $20,680 | $4,080 | $16,600 |

| 2021 | $5,575 | $20,680 | $4,080 | $16,600 |

| 2020 | $5,575 | $20,680 | $4,080 | $16,600 |

| 2019 | $5,554 | $20,680 | $4,080 | $16,600 |

| 2018 | $5,465 | $20,680 | $4,080 | $16,600 |

| 2017 | $5,382 | $20,680 | $4,080 | $16,600 |

| 2016 | $5,382 | $20,680 | $4,080 | $16,600 |

| 2015 | $3,900 | $20,680 | $4,080 | $16,600 |

| 2014 | $3,900 | $20,680 | $4,080 | $16,600 |

Source: Public Records

Map

Nearby Homes

- 35 Beechtree Rd

- 46 Butternut Rd

- 53 Pamela Ct Unit 318

- 238 Colette Ct Unit 1311

- 2715 Crest Ave

- 28 Macintosh Rd

- 5717 Fleetwing Dr

- 1019 Green Ln

- 30 Misty Pine Rd

- 111 Border Rock Rd

- 2510 Green Ave

- 2519 Woodlawn Dr

- 86 Wildflower Rd

- 137 Idlewild Rd

- 4617 Magnolia Ave

- 10 Inbrook Rd

- 56 Goldenridge Dr

- 43 Petunia Rd

- 12 Geranium Rd

- 122 Ivy Hill Rd

- 10 Beechtree Rd

- 18 Beechtree Rd

- 11 Butternut Rd

- 9 Butternut Rd

- 17 Butternut Rd

- 22 Beechtree Rd

- 6 Beechtree Rd

- 9 Beechtree Rd

- 5 Butternut Rd

- 21 Butternut Rd

- 15 Beechtree Rd

- 5 Beechtree Rd

- 19 Beechtree Rd

- 14 Butternut Rd

- 26 Beechtree Rd

- 10 Butternut Rd

- 6 Butternut Rd

- 25 Butternut Rd

- 18 Butternut Rd

- 237 Blue Ridge Dr

Your Personal Tour Guide

Ask me questions while you tour the home.