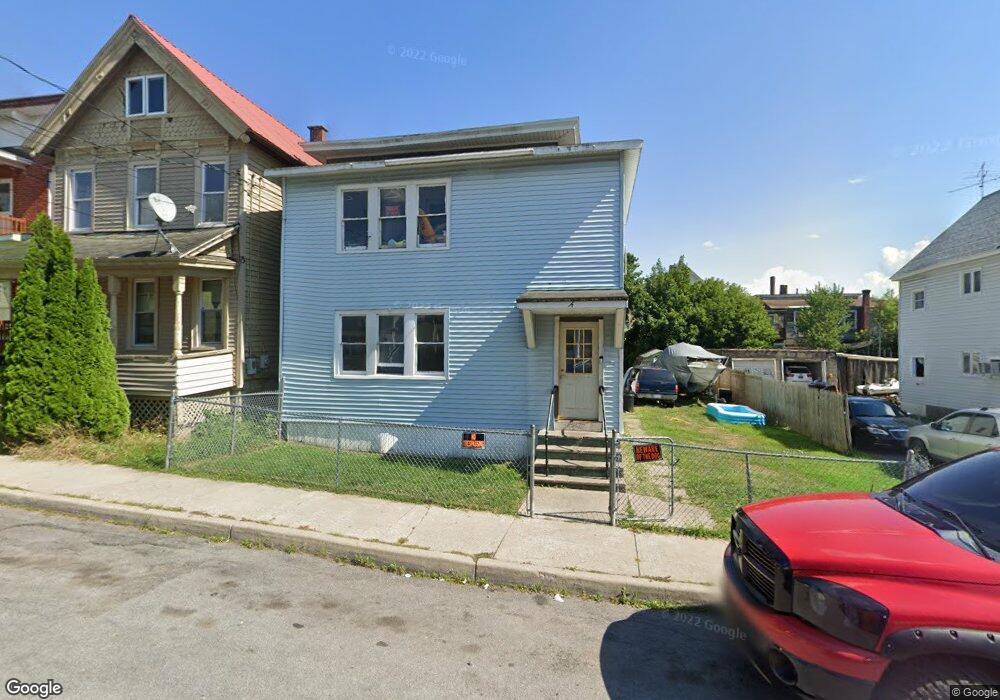

14 Swan St Amsterdam, NY 12010

Estimated Value: $82,000 - $123,000

6

Beds

2

Baths

1,870

Sq Ft

$54/Sq Ft

Est. Value

About This Home

This home is located at 14 Swan St, Amsterdam, NY 12010 and is currently estimated at $100,815, approximately $53 per square foot. 14 Swan St is a home located in Montgomery County with nearby schools including Amsterdam High School and St. Mary's Institute.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 12, 2023

Sold by

Williams Mark Est and Williams

Bought by

Williams Jonathon

Current Estimated Value

Purchase Details

Closed on

Jan 12, 2016

Sold by

Agresta - As Controller Matthew A

Bought by

City Of Amsterdam

Purchase Details

Closed on

Dec 12, 2011

Sold by

Referee Weinheimer Richard

Bought by

Safe 2009 - I Llc

Purchase Details

Closed on

Aug 18, 2003

Sold by

Smith Gerald E and Smith Margaret M.

Bought by

His Unlimited Inc

Purchase Details

Closed on

May 4, 2001

Sold by

Beneficial Homeowner Service Corp

Bought by

Smith Gerald E

Purchase Details

Closed on

Aug 25, 2000

Sold by

Ortiz Milagro

Bought by

Beneficial Homeowner Service Corporation

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Jonathon | -- | None Available | |

| City Of Amsterdam | $29,723 | William Lorman | |

| Safe 2009 - I Llc | -- | Wabnik Stagg, Tenenzi, Confu | |

| His Unlimited Inc | $15,500 | Douglas E. Landon | |

| Smith Gerald E | $9,000 | James Hayes | |

| Beneficial Homeowner Service Corporation | $28,200 | Richard Grayson |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,535 | $29,000 | $1,300 | $27,700 |

| 2023 | $1,465 | $29,000 | $1,300 | $27,700 |

| 2022 | $1,405 | $29,000 | $1,300 | $27,700 |

| 2021 | $1,399 | $29,000 | $1,300 | $27,700 |

| 2020 | $1,313 | $29,000 | $1,300 | $27,700 |

| 2019 | $753 | $29,000 | $1,300 | $27,700 |

| 2018 | $1,928 | $29,000 | $1,300 | $27,700 |

| 2017 | $6,370 | $29,000 | $1,300 | $27,700 |

| 2016 | $1,280 | $29,000 | $1,300 | $27,700 |

| 2015 | -- | $29,000 | $1,300 | $27,700 |

| 2014 | -- | $29,000 | $1,300 | $27,700 |

Source: Public Records

Map

Nearby Homes

Your Personal Tour Guide

Ask me questions while you tour the home.