140 225th St Unit 2 Steger, IL 60475

West Steger NeighborhoodEstimated Value: $355,000 - $396,000

4

Beds

3

Baths

2,190

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 140 225th St Unit 2, Steger, IL 60475 and is currently estimated at $372,778, approximately $170 per square foot. 140 225th St Unit 2 is a home located in Cook County with nearby schools including Steger Primary Center, Steger Intermediate Center, and Columbia Central School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2017

Sold by

Kozinski Jesse L and Kozinski Carol Ann

Bought by

Grady Kendric

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,994

Outstanding Balance

$160,127

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$212,651

Purchase Details

Closed on

Dec 20, 2010

Sold by

First Community Bank & Trust

Bought by

Kozinski Jesse L and Kozinski Carol Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,675

Interest Rate

4.5%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grady Kendric | $193,500 | Attorney | |

| Kozinski Jesse L | $160,000 | Cti |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Grady Kendric | $189,994 | |

| Previous Owner | Kozinski Jesse L | $177,675 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,979 | $23,946 | $5,461 | $18,485 |

| 2024 | $7,979 | $23,946 | $5,461 | $18,485 |

| 2023 | $8,334 | $23,946 | $5,461 | $18,485 |

| 2022 | $8,334 | $20,468 | $3,641 | $16,827 |

| 2021 | $7,805 | $20,467 | $3,640 | $16,827 |

| 2020 | $7,667 | $20,467 | $3,640 | $16,827 |

| 2019 | $7,537 | $20,647 | $2,730 | $17,917 |

| 2018 | $7,287 | $20,647 | $2,730 | $17,917 |

| 2017 | $6,178 | $20,647 | $2,730 | $17,917 |

| 2016 | $5,209 | $16,603 | $1,820 | $14,783 |

| 2015 | $5,740 | $18,232 | $1,820 | $16,412 |

| 2014 | $5,753 | $18,232 | $1,820 | $16,412 |

| 2013 | $5,320 | $18,466 | $1,820 | $16,646 |

Source: Public Records

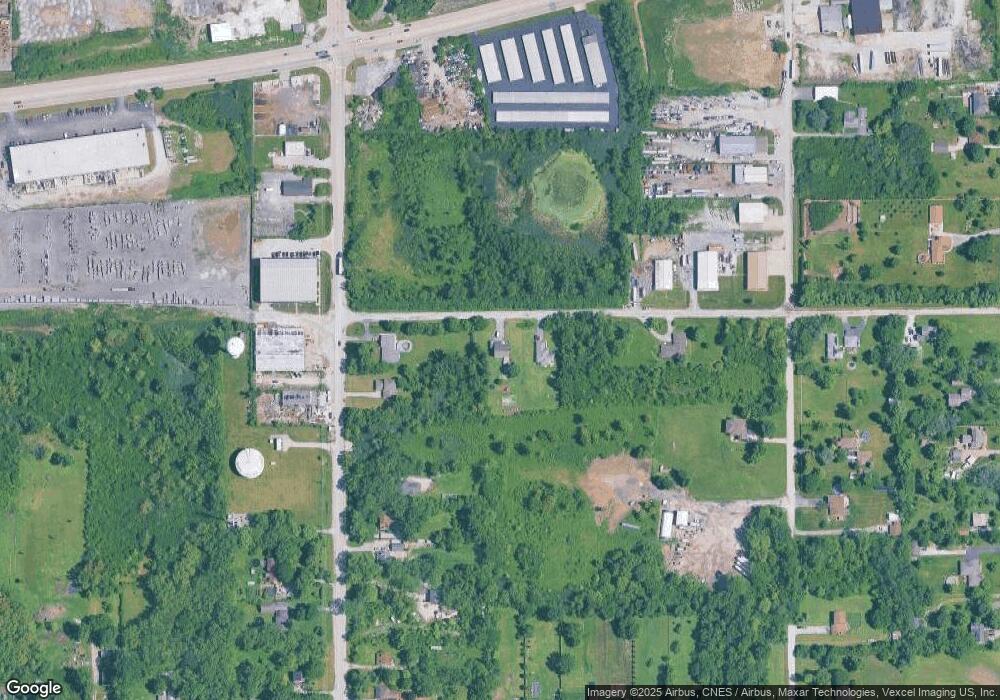

Map

Nearby Homes

- 71 227th Place

- 22939 Sherman Rd

- 23000 Sherman Rd

- 3041 Hopkins St

- 39 Hereford Dr

- 71 Hereford Dr

- 274 E 34th St

- 205 Hereford Ave

- 3449 Somerset St

- 3120 Florence Ave

- 212 Durham Dr

- 3107 Union Ave

- 3412 Hopkins St

- 3479 Innsbruck Ln

- 304 Royal Oak Dr

- 3417 Butler Ave

- 3214 Jackson Ave

- 331 E 22nd St

- 129 Cornwall Dr

- 3229 Commercial Ave

- 140 225th St

- 22501 State St

- 22425 State St

- 146 225th St

- 142 225th St

- 22503 State St

- 22507 State St

- 150 225th St

- 22540 Miller Rd

- 22511 State St

- 22515 State St

- 22550 Miller Rd

- 430 E Sauk Trail

- 22525 State St

- 22525 State St

- 22525 State St Unit 104

- 22525 State St Unit 103

- 430 E Sauk Trail

- 23330 State St

- 3100 State St

Your Personal Tour Guide

Ask me questions while you tour the home.