Estimated Value: $685,961 - $770,000

2

Beds

2

Baths

1,200

Sq Ft

$618/Sq Ft

Est. Value

About This Home

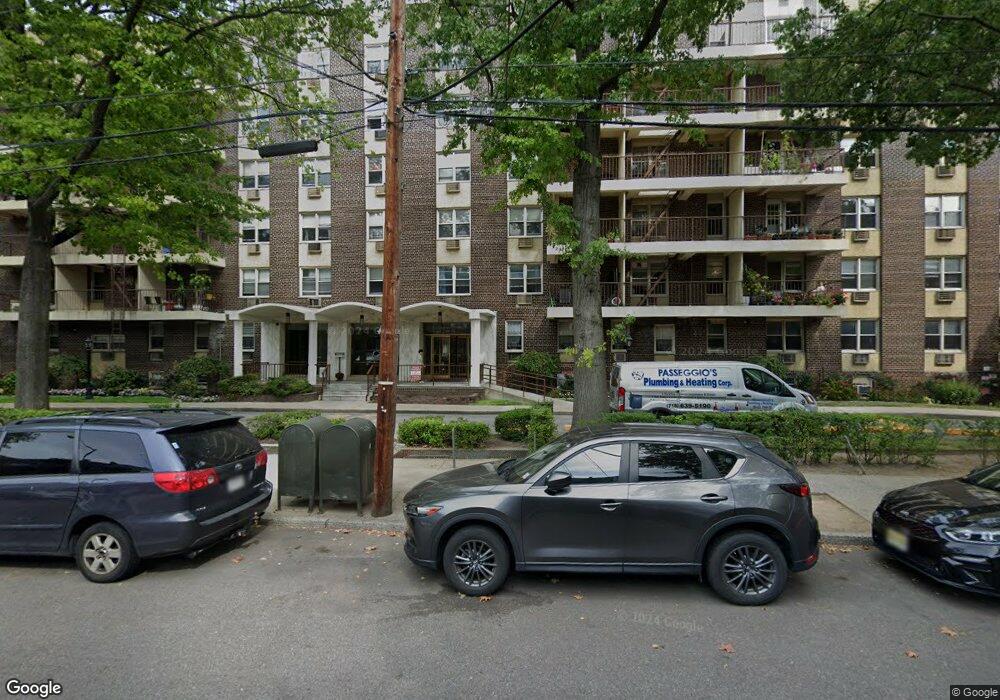

This home is located at 140-55 34th Ave Unit 2M, Flushing, NY 11354 and is currently estimated at $741,240, approximately $617 per square foot. 140-55 34th Ave Unit 2M is a home located in Queens County with nearby schools including P.S. 21 Edward Hart, Jhs 185 Edward Bleeker, and Flushing High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2022

Sold by

Kong Man Yi and Kong Tat Chung

Bought by

Liang Hailong and Qiu Xue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$499,999

Outstanding Balance

$461,923

Interest Rate

3.45%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$279,317

Purchase Details

Closed on

May 27, 2016

Sold by

Henry B Kim As Trustee and Kee Hee Kim As Trustee

Bought by

Kong Man Yi and Kong Tat Chung

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Interest Rate

3.66%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 7, 2012

Sold by

Kim Young Ja

Bought by

Kim Trustee Henry B and Young Ja Kim Living Trust Dated July 20

Purchase Details

Closed on

Feb 2, 2012

Sold by

Estate Of Ock Kim and Henry B Kim Executor

Bought by

Kim Young Ja

Purchase Details

Closed on

Jun 24, 2003

Sold by

Kim Ock and Kim Young Ja

Bought by

Kim Ock and Kim Young Ja

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Liang Hailong | $728,000 | -- | |

| Liang Hailong | $728,000 | -- | |

| Liang Hailong | $728,000 | -- | |

| Kong Man Yi | $535,000 | -- | |

| Kong Man Yi | $535,000 | -- | |

| Kong Man Yi | $535,000 | -- | |

| Kim Trustee Henry B | -- | -- | |

| Kim Trustee Henry B | -- | -- | |

| Kim Young Ja | -- | -- | |

| Kim Young Ja | -- | -- | |

| Kim Ock | -- | -- | |

| Kim Ock | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Liang Hailong | $499,999 | |

| Closed | Liang Hailong | $499,999 | |

| Previous Owner | Kong Man Yi | $350,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,622 | $46,129 | $13,100 | $33,029 |

| 2024 | $4,205 | $44,970 | $11,867 | $33,103 |

| 2023 | $5,533 | $44,255 | $10,634 | $33,621 |

| 2022 | $5,349 | $45,955 | $13,100 | $32,855 |

| 2021 | $4,793 | $39,072 | $13,100 | $25,972 |

| 2020 | $5,118 | $44,096 | $6,935 | $37,161 |

| 2019 | $4,848 | $44,477 | $6,935 | $37,542 |

| 2018 | $4,128 | $35,378 | $6,935 | $28,443 |

| 2017 | $4,128 | $32,457 | $6,935 | $25,522 |

| 2016 | $4,003 | $32,457 | $6,935 | $25,522 |

Source: Public Records

About This Building

Map

Nearby Homes

- 33-38 Parsons Blvd Unit 6G

- 33-38 Parsons Blvd Unit 5E

- 140-55 34th Ave Unit 3B

- 140-55 34th Ave Unit 6

- 140-55 34th Ave Unit 3E

- 33-02 Parsons Blvd

- 34-20 Parsons Blvd Unit 3

- 34-20 Parsons Blvd Unit 6V

- 14134 33rd Ave Unit 2D

- 140-33 34th Ave Unit 5C

- 140-40 34th Ave Unit 2A

- 140-40 34th Ave Unit 4A

- 140-39 34th Ave Unit 2T

- 33-05 143rd St Unit 1405

- 139-76 35th Ave Unit 2B

- 139-76 35th Ave Unit 7F

- 139-39 35th Ave Unit 5C

- 138-35 39th Ave Unit 12L

- 138-35 39th Ave Unit 17H

- 138-35 39th Ave Unit 4K

- 140-55 34th Ave Unit 5A

- 140-55 34th Ave Unit 1F

- 140-55 34th Ave Unit 49S

- 140-55 34th Ave Unit 5E

- 140-55 34th Ave Unit 3F

- 140-55 34th Ave Unit 6A

- 140-55 34th Ave Unit 2A

- 140-55 34th Ave Unit 3C

- 140-55 34th Ave Unit 2R

- 140-55 34th Ave Unit 4K

- 140-55 34th Ave Unit 2

- 140-55 34th Ave Unit 2B

- 140-55 34th Ave Unit 3A

- 140-55 34th Ave Unit 6G

- 140-55 34th Ave Unit 3R

- 140-55 34th Ave Unit 1L

- 140-55 34th Ave Unit 3S

- 140-55 34th Ave Unit 1P

- 140-55 34th Ave Unit 2E

- 140-55 34th Ave Unit 3G