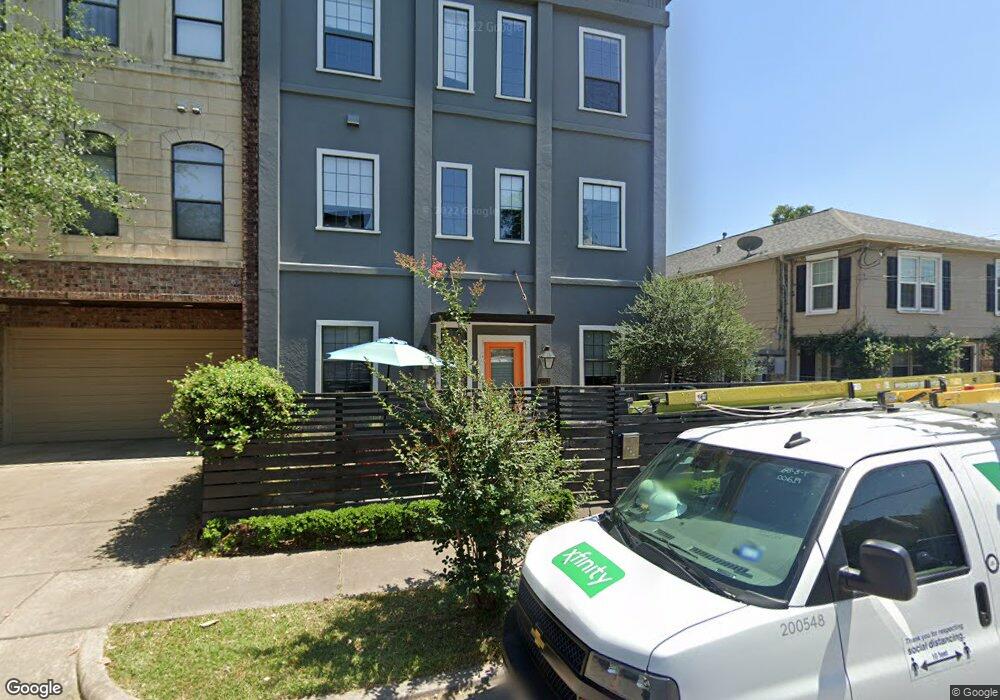

1401 Maryland St Unit B Houston, TX 77006

Montrose NeighborhoodEstimated Value: $481,000 - $653,000

3

Beds

3

Baths

2,263

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 1401 Maryland St Unit B, Houston, TX 77006 and is currently estimated at $548,333, approximately $242 per square foot. 1401 Maryland St Unit B is a home located in Harris County with nearby schools including Baker Montessori, Lanier Middle School, and Lamar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2019

Sold by

Powers Jean M and Powers Jonathan

Bought by

Demireva Petya D and Parreira Luis M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Outstanding Balance

$155,840

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$392,493

Purchase Details

Closed on

Jul 22, 2015

Sold by

Pearce Aaron and Pearce Rebecca

Bought by

Powers Jean M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$353,400

Interest Rate

4.08%

Purchase Details

Closed on

Aug 24, 2006

Sold by

Kay Franklin J and Pollman Kay Sandra L

Bought by

Pearce Aaron and Richard Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,600

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 5, 2001

Sold by

Inner Loop Properties Inc

Bought by

Kay Franklin J and Kay Sandra L Pollman

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Demireva Petya D | -- | Title Houston Holdings Ltd | |

| Powers Jean M | -- | None Available | |

| Pearce Aaron | -- | Southern American Title | |

| Kay Franklin J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Demireva Petya D | $244,000 | |

| Previous Owner | Powers Jean M | $353,400 | |

| Previous Owner | Pearce Aaron | $245,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,708 | $451,827 | $144,780 | $307,047 |

| 2024 | $8,708 | $419,000 | $137,160 | $281,840 |

| 2023 | $8,708 | $432,200 | $137,160 | $295,040 |

| 2022 | $8,652 | $392,922 | $137,160 | $255,762 |

| 2021 | $8,755 | $375,652 | $137,160 | $238,492 |

| 2020 | $9,310 | $384,464 | $137,160 | $247,304 |

| 2019 | $9,419 | $372,232 | $114,300 | $257,932 |

| 2018 | $7,982 | $407,172 | $125,730 | $281,442 |

| 2017 | $10,805 | $407,172 | $125,730 | $281,442 |

| 2016 | $10,805 | $407,172 | $125,730 | $281,442 |

| 2015 | $6,445 | $403,894 | $108,966 | $294,928 |

| 2014 | $6,445 | $344,012 | $83,820 | $260,192 |

Source: Public Records

Map

Nearby Homes

- 1406 Fairview Ave

- 1406 Maryland St

- 1335 Fairview Ave

- 1324 Fairview St

- 2403 Commonwealth St

- 2407 Waugh Dr

- 1316 Hyde Park Blvd

- 1412 Michigan St

- 1223 W Drew St

- 1405 Indiana St Unit B

- 1407 Indiana St

- 1409 Indiana St

- 2506 Van Buren St

- 1410 Indiana St

- 1229 Welch St

- 1515 Hyde Park Blvd Unit 14

- 2516 Commonwealth St Unit 102

- 1506 Indiana St

- 1118 Jackson Blvd

- 1112 Jackson Blvd

- 1401 Maryland St

- 2306 Waugh Dr

- 1403 Maryland St

- 2308 Waugh Dr

- 2310 Waugh Dr

- 2310 Waugh Dr

- 2310 Waugh Dr

- 1405 Maryland St

- 2312 Waugh Dr

- 2314 Waugh Dr

- 2316 Waugh Dr

- 1404 Maryland St

- 2301 Waugh Dr

- 1406 Fairview St

- 1340 Fairview St

- 1340 Fairview Ave

- 1410 Fairview St

- 1402 Fairview St

- 1402 Fairview Ave

- 1409 Maryland St Unit A