14041 Night Song Ct Chino Hills, CA 91709

North Chino Hills NeighborhoodEstimated Value: $1,781,000 - $2,599,000

5

Beds

5

Baths

4,398

Sq Ft

$520/Sq Ft

Est. Value

About This Home

This home is located at 14041 Night Song Ct, Chino Hills, CA 91709 and is currently estimated at $2,288,562, approximately $520 per square foot. 14041 Night Song Ct is a home located in San Bernardino County with nearby schools including Gerald F. Litel Elementary School, Canyon Hills Junior High School, and Ruben S. Ayala High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2023

Sold by

Carlito G And Alicia C Aguba Living Trus

Bought by

Carlito G And Alicia C Aguba Living Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Outstanding Balance

$82,584

Interest Rate

6.27%

Mortgage Type

New Conventional

Estimated Equity

$2,205,978

Purchase Details

Closed on

Oct 7, 1999

Sold by

Aguba Carlito G and Aguba Alicia C

Bought by

Aguba Carlito and Aguba Alicia C

Purchase Details

Closed on

Mar 23, 1998

Sold by

Toll At Payne Ranch Lp

Bought by

Aguba Carlito G and Aguba Alicia C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$640,000

Interest Rate

7.18%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carlito G And Alicia C Aguba Living Trust | -- | Lawyers Title | |

| Aguba Carlito | -- | -- | |

| Aguba Carlito G | $815,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carlito G And Alicia C Aguba Living Trust | $85,000 | |

| Previous Owner | Aguba Carlito G | $640,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,815 | $1,276,988 | $391,934 | $885,054 |

| 2024 | $13,815 | $1,251,949 | $384,249 | $867,700 |

| 2023 | $13,432 | $1,227,401 | $376,715 | $850,686 |

| 2022 | $13,351 | $1,203,334 | $369,328 | $834,006 |

| 2021 | $13,092 | $1,179,739 | $362,086 | $817,653 |

| 2020 | $12,922 | $1,167,642 | $358,373 | $809,269 |

| 2019 | $12,695 | $1,144,747 | $351,346 | $793,401 |

| 2018 | $12,414 | $1,122,301 | $344,457 | $777,844 |

| 2017 | $12,193 | $1,100,295 | $337,703 | $762,592 |

| 2016 | $11,394 | $1,078,720 | $331,081 | $747,639 |

| 2015 | $11,165 | $1,062,517 | $326,108 | $736,409 |

| 2014 | $10,943 | $1,041,704 | $319,720 | $721,984 |

Source: Public Records

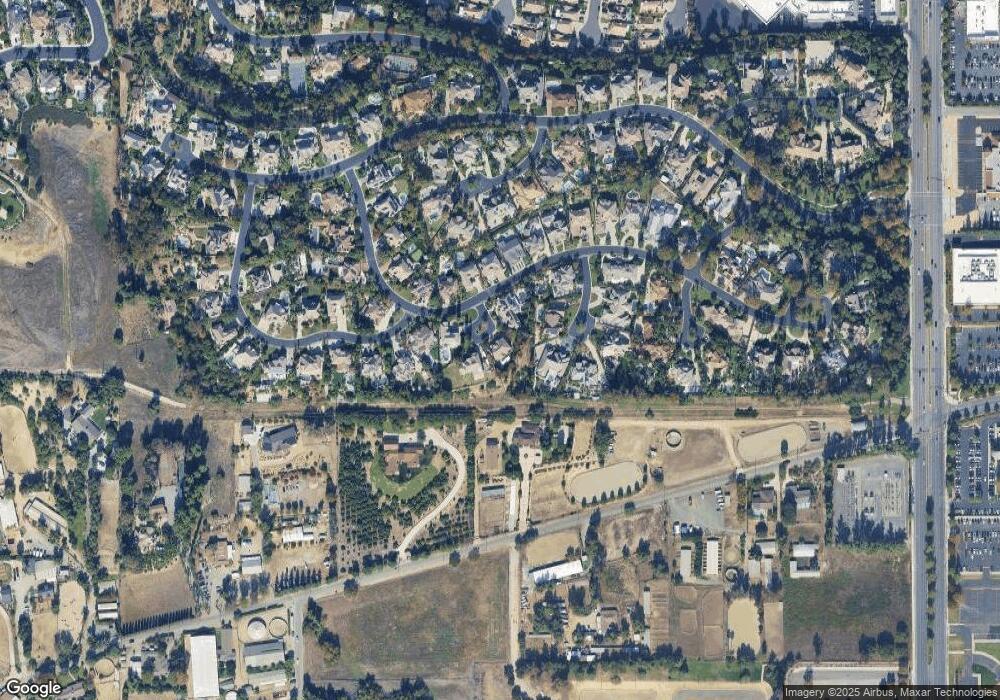

Map

Nearby Homes

- 3056 Giant Forest Loop

- 3248 Giant Forest Loop

- 13530 Tawny Ln

- 13798 Roswell Ave

- 3546 Garden Ct

- 3199 Morningfield Dr

- 3159 Morningfield Dr

- 3167 Morningfield Dr

- 2460 Windmill Creek Rd

- 13593 Monte Royale Dr

- 2515 Pointe Coupee

- 3786 Daisy Dr

- 13255 Sonrisa Dr

- 3714 Garden Ct

- 2286 Black Pine Rd

- 14726 Moon Crest Ln Unit E

- 13194 Spire Cir

- 2509 Moon Dust Dr Unit A

- 13190 Spire Cir

- 2432 Moon Dust Dr Unit B

- 14058 Evening Primrose Place

- 14045 Night Song Ct

- 14039 Night Song Ct

- 14046 Evening Primrose Place

- 14040 Night Song Ct

- 14071 Evening Primrose Place

- 3142 English Rd

- 14034 Evening Primrose Place

- 3059 Song of The Winds

- 3080 Giant Forest Loop

- 3092 Giant Forest Loop

- 3068 Giant Forest Loop

- 3051 Song of The Winds

- 14059 Evening Primrose Place

- 3104 Giant Forest Loop

- 14047 Evening Primrose Place

- 3043 Song of The Winds

- 3161 Giant Forest Loop

- 13979 Break of Day Ct

- 3128 Giant Forest Loop