14051 Caminito Vistana San Diego, CA 92130

Black Mountain Ranch NeighborhoodEstimated Value: $4,388,000 - $4,921,000

5

Beds

6

Baths

5,664

Sq Ft

$803/Sq Ft

Est. Value

About This Home

This home is located at 14051 Caminito Vistana, San Diego, CA 92130 and is currently estimated at $4,547,315, approximately $802 per square foot. 14051 Caminito Vistana is a home located in San Diego County with nearby schools including Willow Grove Elementary School, Black Mountain Middle School, and Westview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2019

Sold by

Ostrow Gregory Isaac and Ostrow Stacy Silverman

Bought by

Ostrow Gregory I and Ostrow Stacy S

Current Estimated Value

Purchase Details

Closed on

Apr 25, 2011

Sold by

Goodman Mark B and Goodman Sheryl A

Bought by

Ostrow Gregory Isaac and Ostrow Stacy Silverman

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,400,000

Outstanding Balance

$967,678

Interest Rate

4.84%

Mortgage Type

New Conventional

Estimated Equity

$3,579,637

Purchase Details

Closed on

Sep 14, 2004

Sold by

Goodman Mark B and Goodman Sheryl A

Bought by

Goodman Mark B and Goodman Sheryl A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$800,000

Interest Rate

4.87%

Mortgage Type

Unknown

Purchase Details

Closed on

Jan 14, 2003

Sold by

Goodman Mark and Goodman Sheryl

Bought by

Goodman Mark B and Goodman Sheryl A

Purchase Details

Closed on

Nov 16, 2000

Sold by

Sahba Bruce and Sahba Fatemah

Bought by

Goodman Mark and Goodman Sheryl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$841,500

Interest Rate

7.25%

Purchase Details

Closed on

Dec 23, 1999

Sold by

Fairbanks Highlands Llc

Bought by

Sahba Bruce and Sahba Fatemah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$750,000

Interest Rate

7.89%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ostrow Gregory I | -- | None Available | |

| Ostrow Gregory Isaac | $1,750,000 | Fidelity National Title | |

| Goodman Mark B | -- | -- | |

| Goodman Mark B | -- | Commerce Title Company | |

| Goodman Mark B | -- | -- | |

| Goodman Mark | $1,275,000 | Commonwealth Land Title Co | |

| Sahba Bruce | $1,044,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ostrow Gregory Isaac | $1,400,000 | |

| Previous Owner | Goodman Mark B | $800,000 | |

| Previous Owner | Goodman Mark | $841,500 | |

| Previous Owner | Sahba Bruce | $750,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $30,075 | $2,464,060 | $1,024,937 | $1,439,123 |

| 2024 | $30,075 | $2,415,746 | $1,004,841 | $1,410,905 |

| 2023 | $29,563 | $2,368,380 | $985,139 | $1,383,241 |

| 2022 | $29,133 | $2,321,942 | $965,823 | $1,356,119 |

| 2021 | $28,533 | $2,276,415 | $946,886 | $1,329,529 |

| 2020 | $28,355 | $2,253,074 | $937,177 | $1,315,897 |

| 2019 | $25,824 | $2,009,877 | $918,801 | $1,091,076 |

| 2018 | $25,563 | $1,970,469 | $900,786 | $1,069,683 |

| 2017 | $82 | $1,931,833 | $883,124 | $1,048,709 |

| 2016 | $24,634 | $1,893,955 | $865,808 | $1,028,147 |

| 2015 | $24,436 | $1,865,507 | $852,803 | $1,012,704 |

| 2014 | $24,437 | $1,828,965 | $836,098 | $992,867 |

Source: Public Records

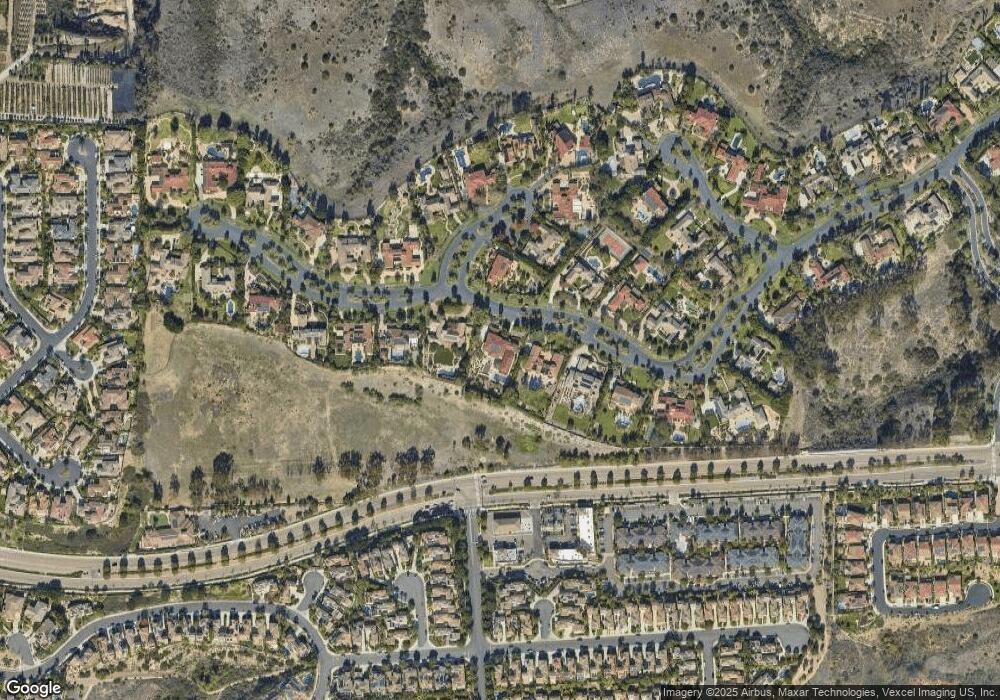

Map

Nearby Homes

- 13800 Torrey Del Mar Dr

- 7001 Via Agave

- 13338 Via Magdalena Unit 1

- 7930 Entrada Lazanja

- 7855 Via Belfiore Unit 1

- 6744 Monterra Trail

- 13236 Corte Stellina

- 0 Niemann Ranch Rd Unit 79

- 7371 Rancho Catalina Trail

- 7425 Rancho Cabrillo Trail

- 7551 Delfina

- 7442 Rancho Cabrillo Trail

- 13135 Via Mesa Dr

- 14530 Camino de la Luna Unit 1

- 14523 Caminito Lazanja

- 13568 Bolero Way

- 7424 La Mantanza

- 14582 Luna Media

- 6906 Royal Birkdale Place

- 13563 Chamise Vista Ln

- 14027 Caminito Vistana

- 14057 Caminito Vistana

- 14035 Caminito Vistana

- 14047 Caminito Vistana

- 14059 Caminito Vistana

- 14023 Caminito Vistana

- 14041 Caminito Vistana

- 14054 Caminito Vistana

- 14032 Caminito Vistana

- 14063 Caminito Vistana

- 14019 Caminito Vistana

- 14036 Caminito Vistana

- 14045 Caminito Vistana

- 14040 Caminito Vistana

- 14062 Caminito Vistana

- 14018 Caminito Vistana

- 14015 Caminito Vistana

- 14067 Caminito Vistana

- 13859 Carmel Valley Rd

- 13983 Amber Place