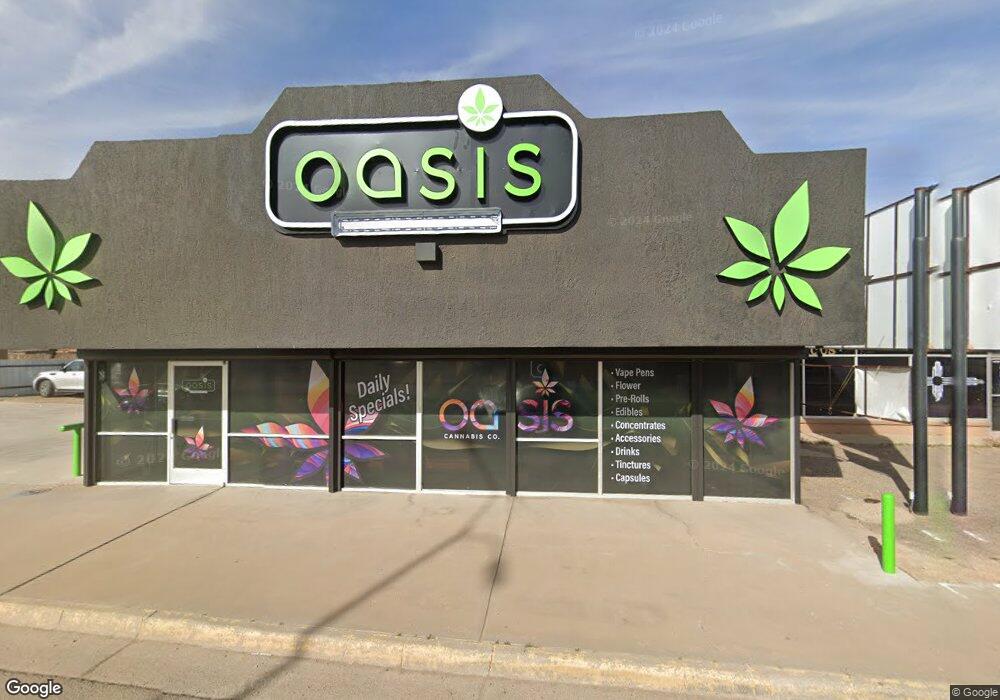

1407 W 2nd St Roswell, NM 88201

Estimated Value: $205,000 - $205,971

Studio

--

Bath

3,360

Sq Ft

$61/Sq Ft

Est. Value

About This Home

This home is located at 1407 W 2nd St, Roswell, NM 88201 and is currently estimated at $205,486, approximately $61 per square foot. 1407 W 2nd St is a home located in Chaves County with nearby schools including Washington Avenue Elementary School, Sierra Middle School, and Goddard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 31, 2024

Sold by

B E Holdings Llc

Bought by

Rpr Holdings Llc

Current Estimated Value

Purchase Details

Closed on

May 10, 2022

Sold by

Kenneth J Bopp Trust

Bought by

Be Holdings Llc

Purchase Details

Closed on

Sep 30, 2013

Sold by

Tucker Mike and Tucker Donna

Bought by

Finger Juanita A

Purchase Details

Closed on

Mar 23, 2010

Sold by

Tucker Mike and Tucker Donna

Bought by

Tucker Mike and Tucker Donna

Purchase Details

Closed on

Oct 5, 2007

Sold by

Guevara Bernie S and Guevara Ana M

Bought by

Tucker Mike and Tucker Donna

Purchase Details

Closed on

Jul 10, 2006

Sold by

Dean Pearl

Bought by

Dean Benjamin L

Purchase Details

Closed on

Apr 29, 2005

Sold by

Dean Daniel and Dean Pearl

Bought by

Guevara Bernie S and Guevara Ana M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rpr Holdings Llc | -- | None Listed On Document | |

| Be Holdings Llc | -- | Fidelity National Title | |

| Finger Juanita A | -- | Landmark Title | |

| Tucker Mike | -- | None Available | |

| Tucker Mike | -- | Landamerica Lawyers Title | |

| Dean Benjamin L | -- | None Available | |

| Guevara Bernie S | -- | Landamerican Lawyers Title | |

| Guevara Bernie S | -- | Landamerica Lawyers Title |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,050 | $62,952 | $15,125 | $47,827 |

| 2024 | $2,050 | $64,932 | $15,125 | $49,807 |

| 2023 | $1,917 | $56,372 | $15,125 | $41,247 |

| 2022 | $1,591 | $46,784 | $15,125 | $31,659 |

| 2021 | $1,596 | $46,210 | $15,125 | $31,085 |

| 2020 | $1,594 | $46,144 | $15,125 | $31,019 |

| 2019 | $1,632 | $47,276 | $15,125 | $32,151 |

| 2018 | $1,654 | $48,130 | $15,125 | $33,005 |

| 2017 | $1,685 | $49,829 | $15,125 | $34,704 |

| 2016 | $1,101 | $33,370 | $15,125 | $18,245 |

| 2015 | $1,153 | $32,403 | $15,125 | $17,278 |

| 2014 | $2,300 | $32,325 | $15,125 | $17,200 |

Source: Public Records

Map

Nearby Homes

- 1217 W 3rd St

- 1300 W 4th St

- 1201 W 3rd St

- 1600 W 3rd St

- 103 N Delaware Ave

- 1007 W 3rd St

- 206 S Delaware Ave

- 1202 Highland Rd

- 1307 Highland Rd

- 504 N Wyoming Ave

- 1109 W Tilden St

- 310 S Delaware Ave

- 1620 W Juniper St

- 1708 W 3rd St

- 304 N Michigan Ave

- 205 S Kansas Ave

- 306 N Michigan Ave

- 703 W 5th St

- 6399 W 2nd St

- 1506 W Albuquerque St