--

Bed

--

Bath

10,444

Sq Ft

8,276

Sq Ft Lot

About This Home

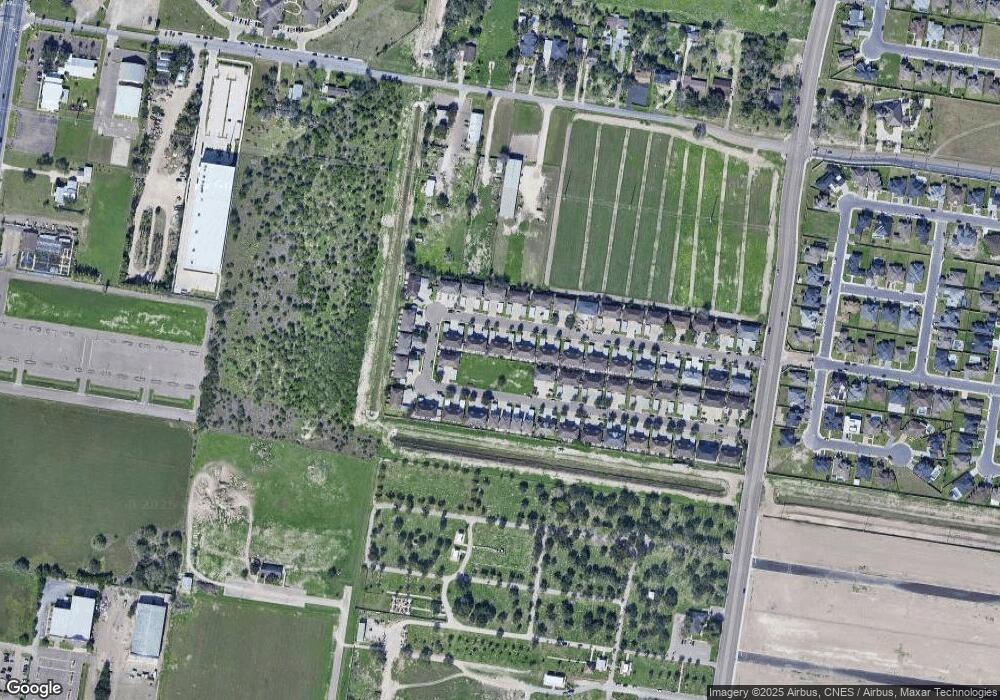

This home is located at 1407 W Fig Ave Unit 1-4, Pharr, TX 78577. 1407 W Fig Ave Unit 1-4 is a home located in Hidalgo County with nearby schools including Allen & William Arnold Elementary, Lyndon B. Johnson Middle School, and PSJA North Early College High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History Compared to Growth

Map

Nearby Homes

- 1309 W Fig Ave

- 1208 W Fig Ave

- 1106 Wesley St

- 1201 Bette St

- 01 W Minnesota Rd

- 00 W Minnesota Rd

- 806 Bette St

- 800 Wesley St

- 1301 W Nolana Loop

- 807 Wesley St

- 5603 N Mockingbird Ave

- 901 Bette St

- 908 W Iroquois Ave

- 1205 W Nolana Loop

- 1312 W Kennedy St

- 807 Bette St

- 4104-4106 M Street N M St

- 4901 N Winona Dr

- 4201 N Palm Dr

- 4105 N Palm Dr

- 1407 W Fig Ave

- 1406 W Kiwi Ave Unit 1

- 1406 W Kiwi Ave Unit 3

- 1409 W Fig Ave

- 1405 W Fig Ave Unit 1

- 1405 W Fig Ave

- 1503 W Fig Ave Unit 1,2,3,4

- 1503 W Fig Ave

- 1403 W Fig Ave Unit 4

- 1403 W Fig Ave

- 1403 W Fig Ave Unit 2

- 1403 W Fig Ave

- 1406 W Fig Ave

- 1402 W Kiwi Ave Unit 4

- 1402 W Kiwi Ave Unit 1

- 1402 W Kiwi Ave Unit 3

- 1402 W Kiwi Ave Unit 2

- 1402 W Kiwi Ave

- 1408 W Fig Ave

- 1502 W Kiwi