1408 Bellow Falls Place Unit 183 Columbus, OH 43228

Sweetwater NeighborhoodEstimated Value: $322,000 - $348,000

3

Beds

3

Baths

1,812

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 1408 Bellow Falls Place Unit 183, Columbus, OH 43228 and is currently estimated at $330,698, approximately $182 per square foot. 1408 Bellow Falls Place Unit 183 is a home located in Franklin County with nearby schools including Hilliard Horizon Elementary School, Hilliard Station Sixth Grade Elementary School, and Hilliard Memorial Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2022

Sold by

Hagberg Meghan and Reed Meghan E

Bought by

Matheny Maximillian M and Cisco Samantha N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$289,656

Outstanding Balance

$277,968

Interest Rate

6%

Mortgage Type

FHA

Estimated Equity

$52,730

Purchase Details

Closed on

Jul 27, 2017

Sold by

Dhruve Saurabh and Dhruve Tejal

Bought by

Reed Meghan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,400

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 13, 2011

Sold by

Dominion Homes Inc

Bought by

Dhruve Saurabh and Dhruve Tejal

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

5.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Matheny Maximillian M | $295,000 | Stewart Title | |

| Reed Meghan E | $178,000 | Landsel Title Box | |

| Dhruve Saurabh | $149,400 | Alliance Ti |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Matheny Maximillian M | $289,656 | |

| Previous Owner | Reed Meghan E | $142,400 | |

| Previous Owner | Dhruve Saurabh | $120,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,351 | $94,750 | $13,300 | $81,450 |

| 2023 | $4,636 | $94,745 | $13,300 | $81,445 |

| 2022 | $4,188 | $68,540 | $10,610 | $57,930 |

| 2021 | $4,184 | $68,540 | $10,610 | $57,930 |

| 2020 | $4,172 | $68,540 | $10,610 | $57,930 |

| 2019 | $4,093 | $57,410 | $8,860 | $48,550 |

| 2018 | $3,870 | $57,410 | $8,860 | $48,550 |

| 2017 | $3,992 | $57,410 | $8,860 | $48,550 |

| 2016 | $3,909 | $51,000 | $9,910 | $41,090 |

| 2015 | $3,664 | $51,000 | $9,910 | $41,090 |

| 2014 | $3,670 | $51,000 | $9,910 | $41,090 |

| 2013 | $1,859 | $50,995 | $9,905 | $41,090 |

Source: Public Records

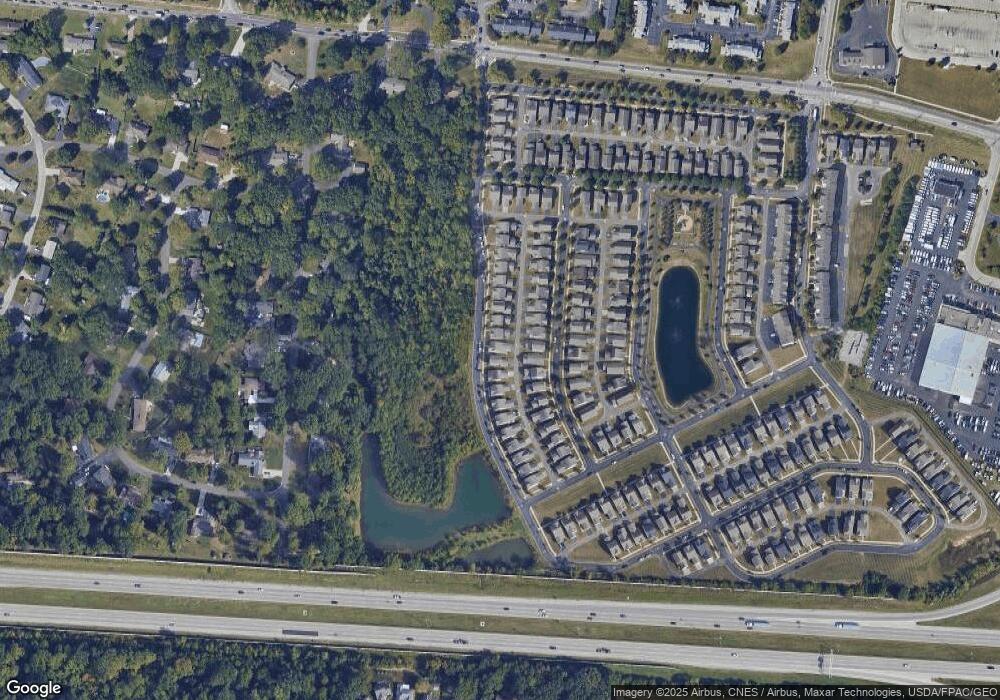

Map

Nearby Homes

- 1432 Bellow Falls Place

- 1391 Ithaca Dr

- 5680 Battle Creek Way

- 5699 Battle Creek Way

- 5706 Rutgers Ln Unit 180A

- 5974 Timberbrook Ln

- 1566 Galleon Blvd

- 1652 Bennigan Dr Unit 175A

- 5703 Palos Ln Unit 167E

- 1380 Brenthaven Place

- 1768 Ridgebury Dr Unit 135A

- 6037 Carmell Dr

- 1807 Messner Dr Unit 65D

- 5932 Waterview Dr

- 1856 Hobbes Dr Unit 73C

- 5536 Waldwick Unit 5536

- 1854 Galleon Blvd

- 5983 Cape Coral Ln

- 1152 Kinneton Unit 1152

- 1000 Thornapple Grove

- 1408 Bellow Falls Place

- 1404 Bellow Falls Place

- 1404 Bellow Falls Place Unit 184

- 1404 Bellow Falls Place

- 1412 Bellow Falls Place

- 1400 Bellow Falls Place Unit 185

- 1416 Bellow Falls Place Unit 181

- 1403 Ithaca Dr

- 1403 Ithaca Dr Unit 158

- 1407 Ithaca Dr

- 1411 Ithaca Dr

- 1411 Ithaca Dr Unit 156

- 1396 Bellow Falls Place Unit 186

- 1399 Ithaca Dr

- 1399 Ithaca Dr Unit 159

- 1420 Bellow Falls Place Unit 180

- 1415 Ithaca Dr

- 1395 Ithaca Dr

- 1395 Ithaca Dr Unit 160

- 1424 Bellow Falls Place