141 Allenhurst Cir Franklin, TN 37067

Estimated Value: $1,143,000 - $1,237,000

--

Bed

5

Baths

3,534

Sq Ft

$334/Sq Ft

Est. Value

About This Home

This home is located at 141 Allenhurst Cir, Franklin, TN 37067 and is currently estimated at $1,179,457, approximately $333 per square foot. 141 Allenhurst Cir is a home located in Williamson County with nearby schools including Kenrose Elementary School, Woodland Middle School, and Ravenwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2009

Sold by

Loeppky Gregory B and Riley Leslie C

Bought by

Wilson Richard M and Wilson Carlene K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$265,436

Interest Rate

5.15%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$914,021

Purchase Details

Closed on

May 30, 2003

Sold by

Craftsman Homes Inc

Bought by

Loeppky Gregory B and Riley Leslie C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,000

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilson Richard M | $525,000 | Southland Title & Escrow Co | |

| Loeppky Gregory B | $499,000 | Southern Title Services Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilson Richard M | $417,000 | |

| Previous Owner | Loeppky Gregory B | $399,000 | |

| Closed | Loeppky Gregory B | $49,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,845 | $178,325 | $43,125 | $135,200 |

| 2023 | $3,845 | $178,325 | $43,125 | $135,200 |

| 2022 | $3,845 | $178,325 | $43,125 | $135,200 |

| 2021 | $3,845 | $178,325 | $43,125 | $135,200 |

| 2020 | $3,595 | $139,475 | $28,750 | $110,725 |

| 2019 | $3,595 | $139,475 | $28,750 | $110,725 |

| 2018 | $3,497 | $139,475 | $28,750 | $110,725 |

| 2017 | $3,469 | $139,475 | $28,750 | $110,725 |

| 2016 | $3,427 | $139,475 | $28,750 | $110,725 |

| 2015 | -- | $127,750 | $27,500 | $100,250 |

| 2014 | -- | $127,750 | $27,500 | $100,250 |

Source: Public Records

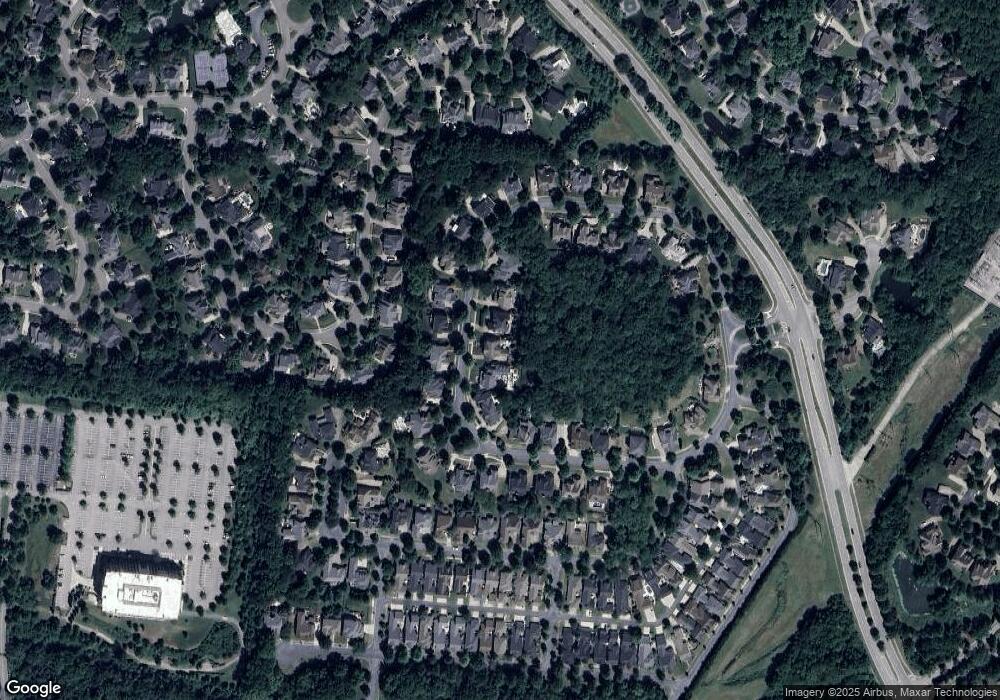

Map

Nearby Homes

- 173 Allenhurst Cir

- 106 Ashton Park Blvd

- 401 Tramore Ct

- 504 Brennan Ln

- 429 Autumn Lake Trail

- 241 King Arthur Cir

- 1406 Burnside Dr

- 111 Guineveres Retreat

- 123 Snapdragon Ct

- 3006 Coral Bell Ln

- 1033 Park Run Dr

- 3005 Coral Bell Ln

- 1027 Park Run Dr Unit 1027

- 399 the Lady of the Lake Ln

- 391 the Lady of the Lake Ln

- 216 Bateman Ave

- 1934 Turning Wheel Ln

- 111 Walters Ave

- 513 King Richards Ct

- 700 Pendragon Ct

- 145 Allenhurst Cir

- 137 Allenhurst Cir

- 133 Allenhurst Cir

- 142 Allenhurst Cir

- 144 Allenhurst Cir

- 140 Allenhurst Cir

- 129 Allenhurst Cir

- 153 Allenhurst Cir

- 125 Allenhurst Cir

- 325 Canton Stone Dr

- 148 Allenhurst Cir

- 138 Allenhurst Cir

- 327 Canton Stone Dr

- 157 Allenhurst Cir

- 121 Allenhurst Cir

- 329 Canton Stone Dr

- 150 Allenhurst Cir

- 161 Allenhurst Cir

- 323 Canton Stone Dr

- 126 Allenhurst Cir