141 Sundown Rd Thousand Oaks, CA 91361

Estimated Value: $2,376,000 - $2,784,000

3

Beds

2

Baths

2,384

Sq Ft

$1,072/Sq Ft

Est. Value

About This Home

This home is located at 141 Sundown Rd, Thousand Oaks, CA 91361 and is currently estimated at $2,555,522, approximately $1,071 per square foot. 141 Sundown Rd is a home located in Ventura County with nearby schools including Conejo Elementary School, Colina Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2008

Sold by

Mcgrath Timothy and Mcgrath Tori

Bought by

Mcgrath Timothy and Mcgrath Tori

Current Estimated Value

Purchase Details

Closed on

Aug 25, 2000

Sold by

Oaks Abh

Bought by

The City Of Thousand Oaks

Purchase Details

Closed on

Oct 4, 1999

Sold by

Conte Naomi M

Bought by

Mcgrath Timothy and Mcgrath Tori

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$484,000

Interest Rate

7.68%

Purchase Details

Closed on

Jul 10, 1997

Sold by

Conte Naomi M

Bought by

Conte Naomi M

Purchase Details

Closed on

Jan 21, 1997

Sold by

Roy Brasher

Bought by

Conte Naomi M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$351,000

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcgrath Timothy | -- | First American Title Co La | |

| The City Of Thousand Oaks | -- | -- | |

| Mcgrath Timothy | $605,000 | Investors Title Company | |

| Conte Naomi M | -- | -- | |

| Conte Naomi M | $577,500 | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mcgrath Timothy | $484,000 | |

| Previous Owner | Conte Naomi M | $351,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,904 | $956,974 | $691,633 | $265,341 |

| 2024 | $9,904 | $938,210 | $678,071 | $260,139 |

| 2023 | $9,656 | $919,814 | $664,775 | $255,039 |

| 2022 | $9,494 | $901,779 | $651,740 | $250,039 |

| 2021 | $9,340 | $884,098 | $638,961 | $245,137 |

| 2020 | $9,220 | $875,034 | $632,410 | $242,624 |

| 2019 | $8,977 | $857,877 | $620,010 | $237,867 |

| 2018 | $8,797 | $841,056 | $607,853 | $233,203 |

| 2017 | $8,627 | $824,566 | $595,935 | $228,631 |

| 2016 | $8,547 | $808,399 | $584,250 | $224,149 |

| 2015 | $8,397 | $796,258 | $575,475 | $220,783 |

| 2014 | $8,277 | $780,662 | $564,203 | $216,459 |

Source: Public Records

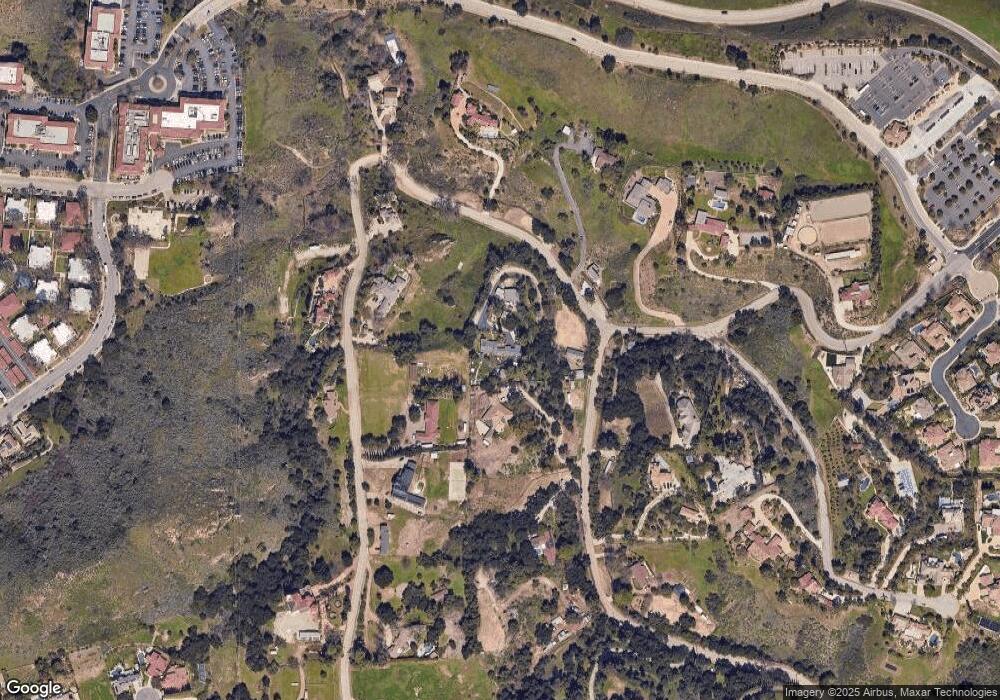

Map

Nearby Homes

- 139 Los Padres Dr

- 1000 E Thousand Oaks Blvd

- 163 Houston Dr

- 245 Houston Dr

- 978 Bower Way

- 647 Brossard Dr

- 231 Green Lea Place

- 1342 E Hillcrest Dr Unit 20

- 1340 E Hillcrest Dr Unit 8

- 110 Maegan Place Unit 13

- 62 Maegan Place Unit 4

- 1710 E Thousand Oaks Blvd

- 68 Maegan Place Unit 7

- 56 Maegan Place Unit 4

- 86 Maegan Place Unit 4

- 96 Erbes Rd

- 566 Rancho Rd

- 170 Erbes Rd

- 918 Rancho Rd

- 151 Sundown Rd

- 272 Rimrock Rd

- 228 Rimrock Rd

- 306 Rimrock Rd

- 157 Rimrock Rd

- 303 Rimrock Rd

- 243 Rimrock Rd

- 159 Rimrock Rd

- 8 Rimrock 01 Rd

- 750 Rolling Oaks Dr

- 115 Saddle Trail

- 161 Sundown Rd

- 180 Sundown Rd

- 310 Rimrock Rd

- 167 Rimrock Rd

- 177 Rimrock Rd

- 147 Rimrock Rd

- 127 Saddle Trail

- 209 Rimrock Rd

- 202 Sundown Rd