1410 Akron Rd Templeton, CA 93465

Estimated Value: $493,689 - $1,483,000

--

Bed

--

Bath

--

Sq Ft

4.36

Acres

About This Home

This home is located at 1410 Akron Rd, Templeton, CA 93465 and is currently estimated at $929,672. 1410 Akron Rd is a home located in San Luis Obispo County with nearby schools including Templeton Elementary School, Vineyard Elementary School, and Templeton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2018

Sold by

Maxwell Tommy Roger and Maxwell Susan Frances

Bought by

Maxwell Tommy R and Maxwell Susan F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

4.5%

Mortgage Type

Commercial

Purchase Details

Closed on

Jul 7, 1998

Sold by

Maxwell Tommy R and Maxwell Susan F

Bought by

Maxwell Tommy Roger and Maxwell Susan Frances

Purchase Details

Closed on

Apr 1, 1998

Sold by

Maxwell T R and Maxwell Susan F

Bought by

Maxwell Tommy R and Maxwell Susan F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,900

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maxwell Tommy R | -- | First American Title Co | |

| Maxwell Tommy Roger | -- | -- | |

| Maxwell Tommy R | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Maxwell Tommy R | $50,000 | |

| Closed | Maxwell Tommy R | $83,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,845 | $181,568 | $88,791 | $92,777 |

| 2024 | $1,811 | $178,008 | $87,050 | $90,958 |

| 2023 | $1,811 | $174,519 | $85,344 | $89,175 |

| 2022 | $1,774 | $171,098 | $83,671 | $87,427 |

| 2021 | $1,738 | $167,744 | $82,031 | $85,713 |

| 2020 | $1,719 | $166,025 | $81,190 | $84,835 |

| 2019 | $1,684 | $162,771 | $79,599 | $83,172 |

| 2018 | $1,650 | $159,581 | $78,039 | $81,542 |

| 2017 | $1,616 | $156,453 | $76,509 | $79,944 |

| 2016 | $1,583 | $153,386 | $75,009 | $78,377 |

| 2015 | $1,558 | $151,083 | $73,883 | $77,200 |

| 2014 | $1,499 | $148,124 | $72,436 | $75,688 |

Source: Public Records

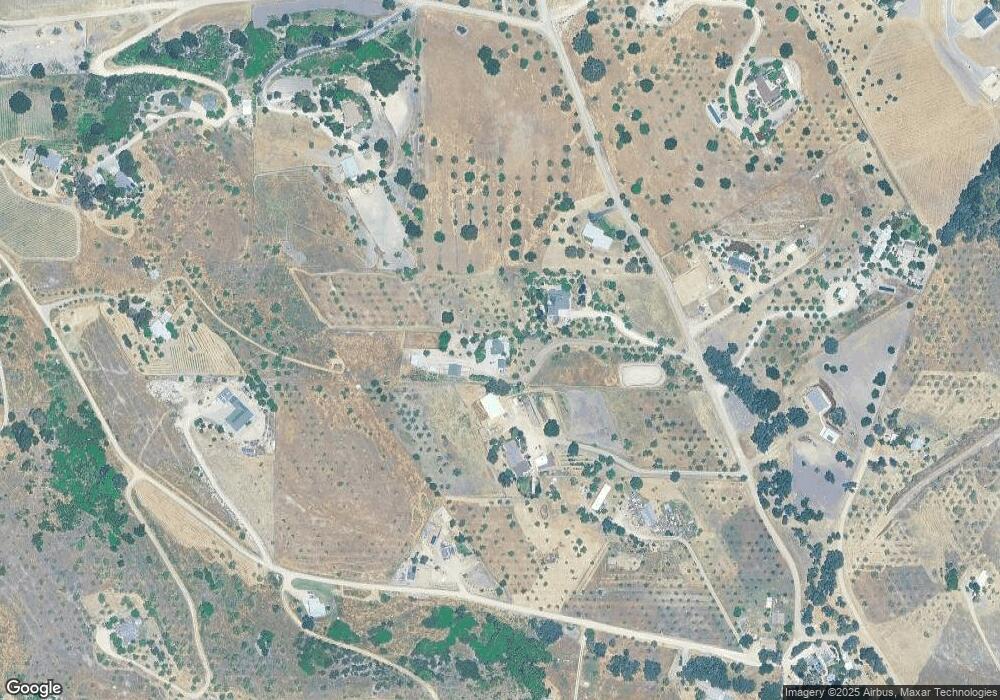

Map

Nearby Homes

- 990 Akron Rd

- 725 Spring Creek Way

- 0 Hermosa Rd

- 4310 Almond Dr

- 4003 El Pomar Dr

- 3545 Blackhawk Dr

- 2985 Templeton Rd

- 5575 El Pomar Dr

- 3030 Templeton Rd

- 1455 Eureka Ln

- 4725 Miramon Ave

- 4835 Miramon Ave

- 4790 Miramon Ave

- 5985 Dolores Ave

- 4940 Arizona Ave

- 4490 San Jacinto Ave

- 4960 Alamo Ave

- 4520 Mananita Ave

- 4530 San Jacinto Ave

- 3856 Orillas Way

- 1280 Akron Rd

- 1480 Akron Rd

- 1220 Akron Rd

- 3890 Hillcrest Dr

- 1255 Akron Rd

- 3880 Hillcrest Dr

- 3955 High Grove Rd

- 1477 Akron Rd

- 3830 Hillcrest Dr

- 3911 Hillcrest Dr

- 4214 High Grove Rd

- 3885 High Grove Rd

- 3924 Hillcrest Dr

- 3895 Hillcrest Dr

- 1221 Kiln House Rd

- 3895 High Grove Rd

- 1455 Akron Rd

- 3925 Hillcrest Dr

- 4025 Rancho Rd

- 3875 Hillcrest Dr