1411 Breckenridge Unit 50 West Covina, CA 91791

Estimated Value: $600,000 - $626,751

3

Beds

3

Baths

1,480

Sq Ft

$418/Sq Ft

Est. Value

About This Home

This home is located at 1411 Breckenridge Unit 50, West Covina, CA 91791 and is currently estimated at $617,938, approximately $417 per square foot. 1411 Breckenridge Unit 50 is a home located in Los Angeles County with nearby schools including Merced Elementary School, Hollencrest Middle School, and West Covina High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 17, 2006

Sold by

Spolansky Jorge Alberto

Bought by

Deleon Roland and Deleon Patty

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$341,600

Outstanding Balance

$196,872

Interest Rate

6.41%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$421,066

Purchase Details

Closed on

Nov 17, 1999

Sold by

Ngo Ming K

Bought by

Spolansky Jorge Alberto and Schwartz Esther I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,800

Interest Rate

7.82%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deleon Roland | $429,000 | New Century Title Company | |

| Spolansky Jorge Alberto | $140,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deleon Roland | $341,600 | |

| Previous Owner | Spolansky Jorge Alberto | $135,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,033 | $586,246 | $436,617 | $149,629 |

| 2024 | $7,033 | $574,752 | $428,056 | $146,696 |

| 2023 | $6,671 | $563,483 | $419,663 | $143,820 |

| 2022 | $6,733 | $552,435 | $411,435 | $141,000 |

| 2021 | $5,291 | $431,000 | $320,000 | $111,000 |

| 2020 | $5,365 | $431,000 | $320,000 | $111,000 |

| 2019 | $4,954 | $401,000 | $298,000 | $103,000 |

| 2018 | $4,882 | $401,000 | $298,000 | $103,000 |

| 2016 | $4,146 | $356,000 | $265,000 | $91,000 |

| 2015 | $3,906 | $336,000 | $250,400 | $85,600 |

| 2014 | $3,584 | $301,700 | $224,800 | $76,900 |

Source: Public Records

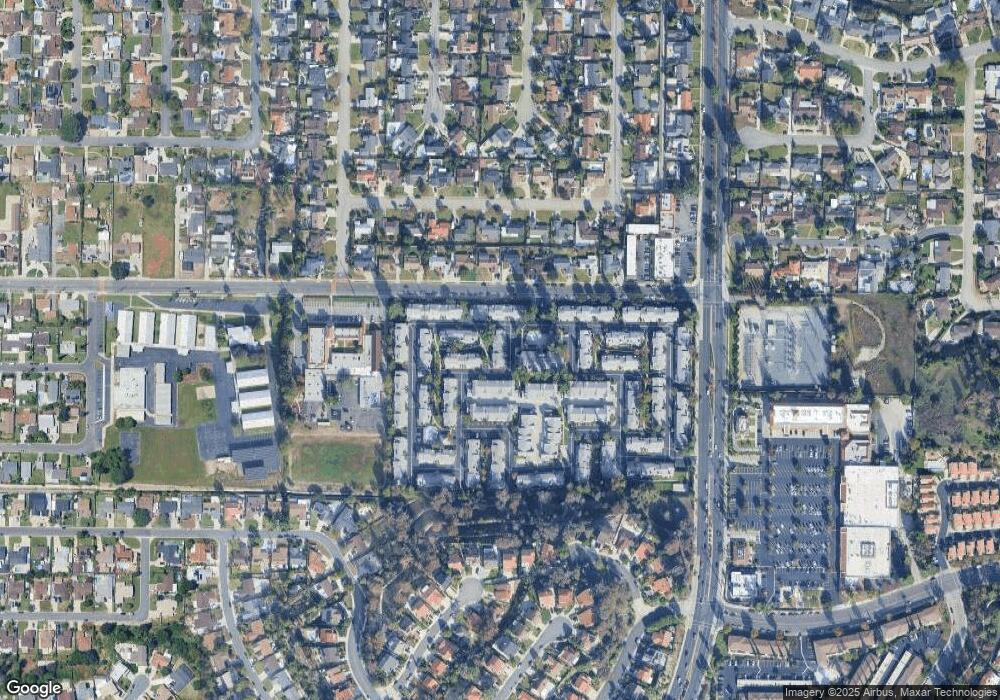

Map

Nearby Homes

- 1694 Bridgeport Unit 99

- 1495 Mccabe Way

- 1450 Westcastle

- 1623 E Francisquito Ave

- 1408 Millcreek

- 1516 Wimbledon Ct

- 1300 S Fleetwell Ave

- 1306 S Cajon Ave

- 17040 E Holton St

- 1635 Park Vista Way

- 2043 Abrazo Dr

- 1512 Seneca Dr

- 1507 Elkwood Dr Unit 61

- 1910 E Calico Dr

- 2059 E Aroma Dr

- 1937 Jacaranda St

- 1408 Queen Summit Dr

- 16645 Holton St

- 1681 Aspen Village Way

- 1515 S Westridge Rd

- 1421 Breckenridge

- 1710 Bridgeport

- 1706 Bridgeport Unit 105

- 1696 Bridgeport

- 1642 Bridgeport

- 1698 Bridgeport

- 1653 Bridgeport

- 1702 Bridgeport

- 1661 Bridgeport Unit 2

- 1644 Bridgeport Unit 48

- 1625 Bridgeport

- 1647 Amberwick Unit 54

- 1640 Bridgeport

- 1621 Bridgeport

- 1405 Breckenridge

- 1706 Bridgeport

- 1704 Bridgeport

- 1688 Bridgeport

- 1651 Amberwick Unit 53

- 1415 Breckenridge