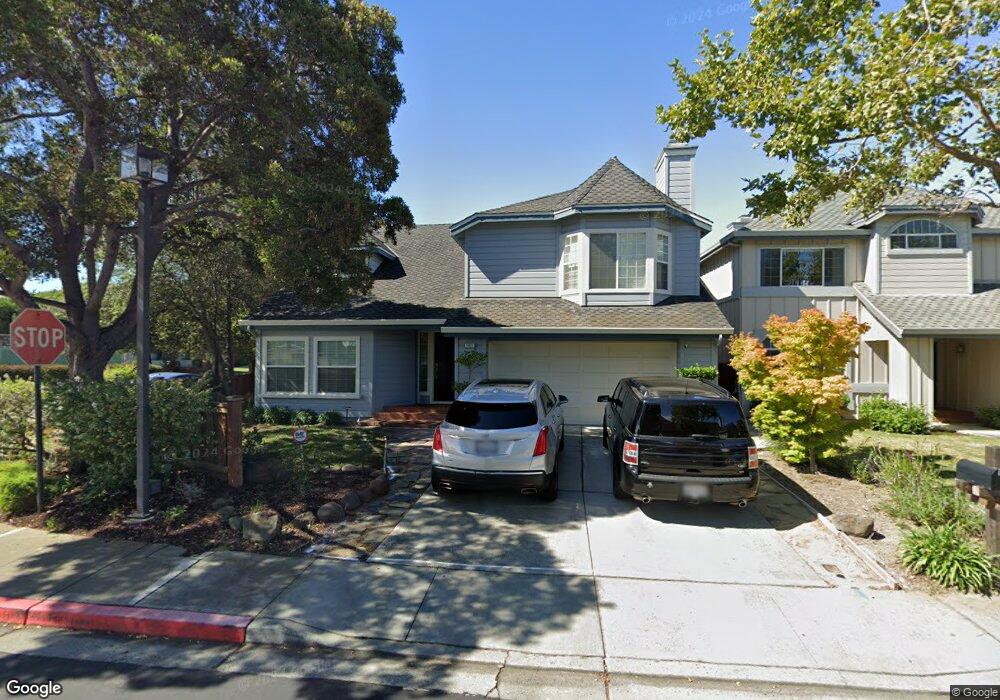

1411 Leeward Ln Foster City, CA 94404

Sea Colony NeighborhoodEstimated Value: $2,566,922 - $2,978,000

5

Beds

3

Baths

2,300

Sq Ft

$1,201/Sq Ft

Est. Value

About This Home

This home is located at 1411 Leeward Ln, Foster City, CA 94404 and is currently estimated at $2,762,231, approximately $1,200 per square foot. 1411 Leeward Ln is a home located in San Mateo County with nearby schools including Foster City Elementary School, Bowditch Middle School, and San Mateo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2012

Sold by

Burnett Robert E

Bought by

Ferrigno Lisa Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,000

Outstanding Balance

$213,708

Interest Rate

3.34%

Mortgage Type

New Conventional

Estimated Equity

$2,548,523

Purchase Details

Closed on

Nov 14, 2012

Sold by

Ferrigno Lisa Ann

Bought by

Ferrigno Lisa Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,000

Outstanding Balance

$213,708

Interest Rate

3.34%

Mortgage Type

New Conventional

Estimated Equity

$2,548,523

Purchase Details

Closed on

Mar 14, 2006

Sold by

Ferrigno Lisa

Bought by

Ferrigno Lisa Ann

Purchase Details

Closed on

Mar 17, 2004

Sold by

Ferrigno Lisa Ann

Bought by

Ferrigno Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,000

Interest Rate

5.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 3, 2002

Sold by

Ferrigno Lisa A

Bought by

Ferrigno Lisa Ann

Purchase Details

Closed on

Jan 31, 2002

Sold by

Oleary Vincent P

Bought by

Ferrigno Lisa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.5%

Purchase Details

Closed on

May 13, 1999

Sold by

Oleary Victoria Ann

Bought by

Oleary Vincent P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,500

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ferrigno Lisa Ann | -- | North American Title Co Inc | |

| Ferrigno Lisa Ann | -- | North American Title Co Inc | |

| Ferrigno Lisa Ann | -- | North American Title Co Inc | |

| Ferrigno Lisa Ann | -- | None Available | |

| Ferrigno Lisa | -- | Alliance Title Company | |

| Ferrigno Lisa Ann | -- | -- | |

| Ferrigno Lisa A | $885,000 | Alliance Title Company | |

| Oleary Vincent P | -- | Old Republic Title Ins Compa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ferrigno Lisa Ann | $310,000 | |

| Closed | Ferrigno Lisa | $295,000 | |

| Closed | Ferrigno Lisa A | $300,000 | |

| Previous Owner | Oleary Vincent P | $236,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,196 | $1,307,396 | $653,698 | $653,698 |

| 2023 | $15,196 | $1,256,630 | $628,315 | $628,315 |

| 2022 | $14,684 | $1,231,992 | $615,996 | $615,996 |

| 2021 | $14,494 | $1,207,836 | $603,918 | $603,918 |

| 2020 | $14,096 | $1,195,452 | $597,726 | $597,726 |

| 2019 | $13,355 | $1,172,012 | $586,006 | $586,006 |

| 2018 | $12,824 | $1,149,032 | $574,516 | $574,516 |

| 2017 | $12,680 | $1,126,502 | $563,251 | $563,251 |

| 2016 | $12,625 | $1,104,414 | $552,207 | $552,207 |

| 2015 | $12,332 | $1,087,826 | $543,913 | $543,913 |

| 2014 | $12,018 | $1,066,518 | $533,259 | $533,259 |

Source: Public Records

Map

Nearby Homes

- 707 Santa Cruz Ln

- 26 Binnacle Ln

- 619 Mystic Ln

- 101 Shorebird Cir

- 203 Shorebird Cir

- 667 Sandy Hook Ct

- 1024 Rudder Ln

- 910 Beach Park Blvd Unit 106

- 910 Beach Park Blvd Unit 97

- 223 Shorebird Cir

- 366 Treasure Island Dr

- 24 Pelican Ln

- 59 Cove Ln

- 851 Peary Ln

- 69 Cove Ln

- 1017 Shell Blvd Unit 12

- 1041 Shell Blvd Unit 8

- 756 Newport Cir

- 879 Carina Ln

- 803 Peary Ln

- 1409 Leeward Ln

- 604 Saint Croix Ln

- 605 Saint Croix Ln

- 1410 Leeward Ln

- 1408 Leeward Ln

- 1406 Leeward Ln

- 602 Saint Croix Ln

- 1405 Leeward Ln

- 1404 Leeward Ln

- 697 Baffin St

- 1403 Leeward Ln

- 1407 Melbourne St

- 600 St Croix

- 600 Saint Croix Ln

- 1402 Leeward Ln

- 1405 Melbourne St

- 1401 Leeward Ln

- 616 Cornwallis Ln

- 699 Baffin St

- 1403 Melbourne St