Estimated Value: $2,018,824 - $2,574,000

4

Beds

4

Baths

3,585

Sq Ft

$647/Sq Ft

Est. Value

About This Home

This home is located at 14123 Sky Mountain Trail Unit 4, Poway, CA 92064 and is currently estimated at $2,318,206, approximately $646 per square foot. 14123 Sky Mountain Trail Unit 4 is a home located in San Diego County with nearby schools including Garden Road Elementary, Twin Peaks Middle, and Poway High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 31, 2022

Sold by

Newham Adam

Bought by

Newham And Zavala-Newham Family Trust

Current Estimated Value

Purchase Details

Closed on

Sep 12, 2014

Sold by

Abramova Natalia V

Bought by

Newham Adam and Zavala Edna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,000

Interest Rate

3.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jan 18, 2012

Sold by

Belokonskiy Alexander V

Bought by

Abramova Natalia V

Purchase Details

Closed on

Jan 11, 2012

Sold by

Gasselle Eugene

Bought by

Abramova Natalia V

Purchase Details

Closed on

Nov 8, 2011

Sold by

Gasselle Eugene and Gasselle Gene

Bought by

Gasselle Eugene

Purchase Details

Closed on

Nov 4, 2008

Sold by

Sky Mountain Trails Inc

Bought by

Gasselle Gene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newham And Zavala-Newham Family Trust | -- | -- | |

| Newham Adam | $295,000 | Ticor Title | |

| Abramova Natalia V | -- | Chicago Title Company | |

| Abramova Natalia V | $215,000 | Chicago Title Company | |

| Gasselle Eugene | -- | None Available | |

| Gasselle Gene | $1,000,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Newham Adam | $236,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,539 | $1,321,825 | $354,538 | $967,287 |

| 2024 | $14,539 | $1,295,908 | $347,587 | $948,321 |

| 2023 | $14,230 | $1,270,499 | $340,772 | $929,727 |

| 2022 | $13,993 | $1,245,589 | $334,091 | $911,498 |

| 2021 | $13,810 | $1,221,167 | $327,541 | $893,626 |

| 2020 | $7,677 | $674,183 | $324,183 | $350,000 |

| 2019 | $3,632 | $317,827 | $317,827 | $0 |

| 2018 | $3,531 | $311,596 | $311,596 | $0 |

| 2017 | $3,438 | $305,487 | $305,487 | $0 |

| 2016 | $3,370 | $299,498 | $299,498 | $0 |

| 2015 | $3,321 | $295,000 | $295,000 | $0 |

| 2014 | $2,489 | $220,295 | $220,295 | $0 |

Source: Public Records

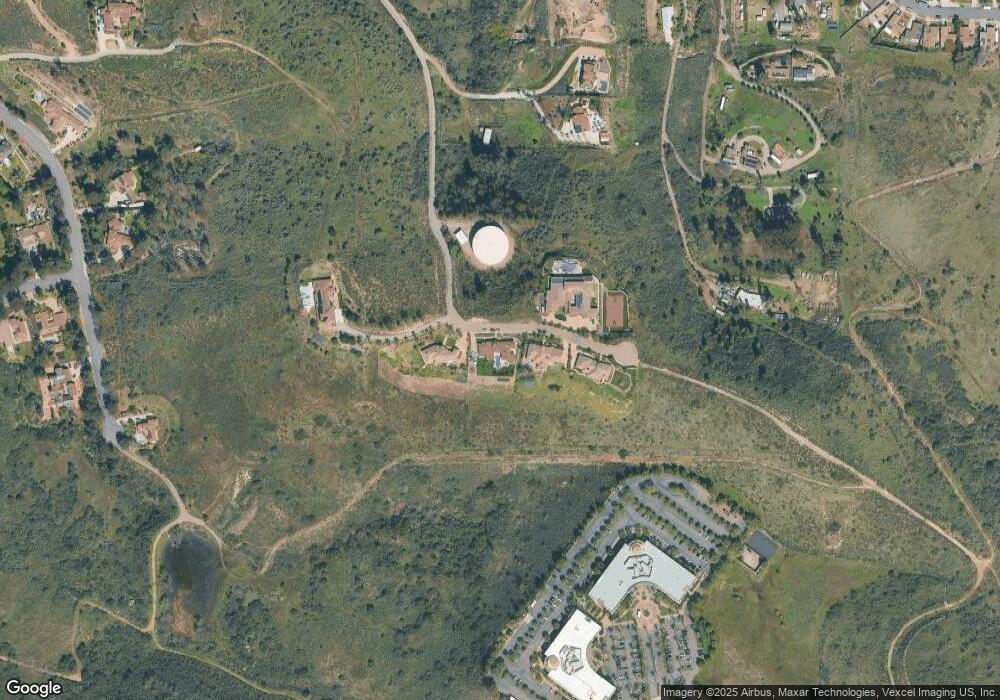

Map

Nearby Homes

- 12671 Claire Dr

- 13001 Standish Dr

- 13209 Neddick Ave

- 14525 Kittery St

- 14523 Saco St

- 13059 Acton Ave

- 13428 Standish Dr

- 13419 Sebago Ave

- 13462 Montego Dr

- 13329 Casa Vista St Unit 98

- 14610 Fairburn St

- 13643 Melissa Ln

- 12959 Creek Park Dr

- 13111 Bonita Vista St Unit 228

- 12824 Granada Dr Unit 322

- 13435 Frey Ct

- 12823 Estrella Vista St Unit 284

- 13104 Corona Way Unit 324

- 14550 Dehia St

- 000 Carlson Ct 9 Unit 9

- 14123 Sky Mountain Trail

- 14111 Sky Mountain Trail

- 14111 Sky Mountain Trail Unit 5

- 14135 Sky Mountain Trail

- 001 Welton Ln

- 0000 Welton Ln

- 000 Welton Ln W

- 000 Welton Ln W Unit pcl 15

- 14147 Sky Mountain Trail

- 14144 Sky Mountain Trail

- 14144 Sky Mountain Trail Unit 1

- 00 Welton Ln

- 00 Welton Ln Unit 56

- 14099 Sky Mountain Trail

- 12870 Welton Ln

- 12870 Welton Ln Unit 15

- 12825 Claire Dr

- 12765 Welton Ln

- 12625 Gate Dr

- 12767 Welton Ln