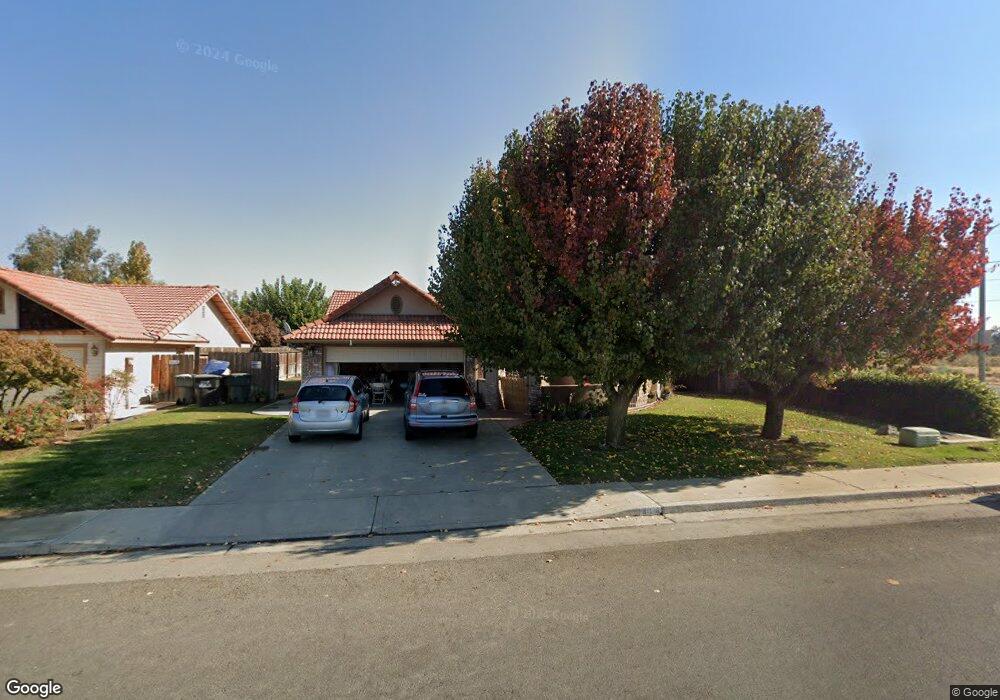

1414 N Goddard St Visalia, CA 93292

Northeast Visalia NeighborhoodEstimated Value: $348,000 - $368,121

3

Beds

2

Baths

1,300

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 1414 N Goddard St, Visalia, CA 93292 and is currently estimated at $359,030, approximately $276 per square foot. 1414 N Goddard St is a home located in Tulare County with nearby schools including Golden Oak Elementary School, Valley Oak Middle School, and Golden West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2016

Sold by

Perez Jose L

Bought by

Ulloa Montes Diana I

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,923

Outstanding Balance

$127,156

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$231,874

Purchase Details

Closed on

Nov 22, 2004

Sold by

Montes Miguel

Bought by

Perez Jose L and Mendez Perez Berta A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

5.69%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 1, 1997

Sold by

American General Finance Inc

Bought by

Montes Miguel and Montes Rosalba Perez

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,541

Interest Rate

7.56%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 2, 1995

Sold by

Carter Dennis W

Bought by

American General Finance Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ulloa Montes Diana I | $163,000 | Chicago Title Company | |

| Perez Jose L | $210,000 | Fidelity National Title Co | |

| Montes Miguel | $97,000 | American Title Co | |

| American General Finance Inc | $110,767 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ulloa Montes Diana I | $159,923 | |

| Previous Owner | Perez Jose L | $168,000 | |

| Previous Owner | Montes Miguel | $96,541 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,076 | $192,365 | $47,351 | $145,014 |

| 2024 | $2,076 | $188,594 | $46,423 | $142,171 |

| 2023 | $2,020 | $184,897 | $45,513 | $139,384 |

| 2022 | $1,932 | $181,272 | $44,621 | $136,651 |

| 2021 | $1,934 | $177,718 | $43,746 | $133,972 |

| 2020 | $1,917 | $175,895 | $43,297 | $132,598 |

| 2019 | $1,865 | $172,446 | $42,448 | $129,998 |

| 2018 | $1,818 | $169,065 | $41,616 | $127,449 |

| 2017 | $1,801 | $165,750 | $40,800 | $124,950 |

| 2016 | $1,995 | $184,000 | $46,000 | $138,000 |

| 2015 | $1,993 | $172,000 | $43,000 | $129,000 |

| 2014 | $1,846 | $169,000 | $42,000 | $127,000 |

Source: Public Records

Map

Nearby Homes

- 2507 E Parker Ct

- 2400 E Sweet Ave

- 2615 E Norman Dr

- 2536 E Harold Ct

- 2016 E Harold Ave

- 2228 E Four Creeks Ave

- 2036 E Harold Ave

- 3203 E Houston Ave

- 1915 E Houston Ave

- 1103 N Vista St

- 2721 E Goshen Ave

- 1835 E Babcock Ave

- Ashford Plan at Maplewood

- Henley Plan at Maplewood

- Walden Plan at Maplewood

- Hawthorne Plan at Maplewood

- Kipling Plan at Maplewood

- 2121 E Goshen Ave

- 1725 E Goshen Ave

- 516 N Velie Dr

- 1428 N Goddard St

- 2525 E Arcata Ct

- 2423 E Houston Ave

- 2504 E Arcata Ct

- 2512 E Arcata Ct

- 2545 E Arcata Ct

- 2524 E Arcata Ct

- 2534 E Arcata Ct

- 1409 N Norman St

- 1933 E Murray Ave

- 1947 E Murray Ave

- 543 N Kennedy Ct

- 1827 E Murray Ave

- 1833 E Murray Ave

- 1839 E Murray Ave

- 1909 E Murray Ave

- 1925 E Murray Ave

- 2503 E Sweet Ave

- 2546 E Arcata Ct

- 1409 N Norman Ct