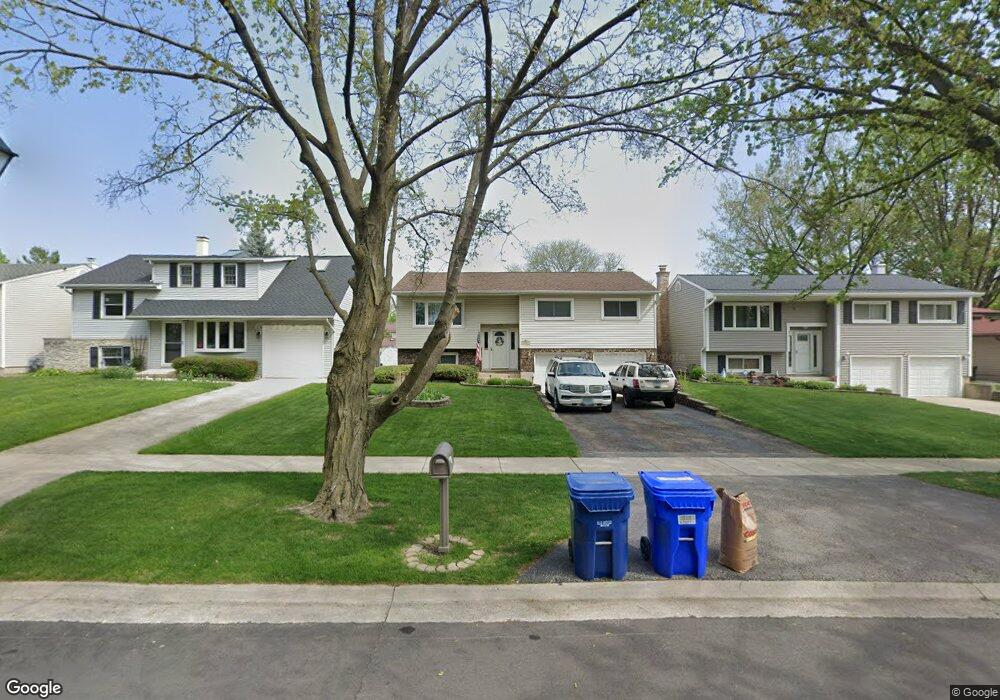

1415 E Elm St Wheaton, IL 60189

Southeast Wheaton NeighborhoodEstimated Value: $385,984 - $514,000

3

Beds

2

Baths

1,142

Sq Ft

$391/Sq Ft

Est. Value

About This Home

This home is located at 1415 E Elm St, Wheaton, IL 60189 and is currently estimated at $446,746, approximately $391 per square foot. 1415 E Elm St is a home located in DuPage County with nearby schools including Lincoln Elementary School, Edison Middle School, and Wheaton Warrenville South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 1996

Sold by

Mercer Gregory G and Mercer Melanie E

Bought by

Maggio Leo and Maggio Kathleen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,950

Outstanding Balance

$8,898

Interest Rate

8.23%

Estimated Equity

$437,848

Purchase Details

Closed on

Nov 19, 1993

Sold by

Mercer Gregory G and Mercer Melanie E

Bought by

Mercer Gregory G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,250

Interest Rate

7.35%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maggio Leo | $161,000 | Attorneys Title Guaranty Fun | |

| Mercer Gregory G | -- | Lenders Title Guaranty |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Maggio Leo | $152,950 | |

| Previous Owner | Mercer Gregory G | $109,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,432 | $123,317 | $36,970 | $86,347 |

| 2023 | $7,130 | $113,510 | $34,030 | $79,480 |

| 2022 | $7,013 | $107,270 | $32,160 | $75,110 |

| 2021 | $6,988 | $104,730 | $31,400 | $73,330 |

| 2020 | $6,965 | $103,760 | $31,110 | $72,650 |

| 2019 | $6,803 | $101,020 | $30,290 | $70,730 |

| 2018 | $6,572 | $96,730 | $28,540 | $68,190 |

| 2017 | $6,469 | $93,160 | $27,490 | $65,670 |

| 2016 | $6,378 | $89,440 | $26,390 | $63,050 |

| 2015 | $6,323 | $85,330 | $25,180 | $60,150 |

| 2014 | $6,118 | $81,450 | $16,910 | $64,540 |

| 2013 | $5,960 | $81,690 | $16,960 | $64,730 |

Source: Public Records

Map

Nearby Homes

- 1216 E Elm St

- 1000 S Lorraine Rd Unit 214

- 1344 S Lorraine Rd Unit C

- 1019 Pershing Ave

- 1601 Castbourne Ct

- 1581 Groton Ln

- 510 S President St

- 1678 Groton Ct

- 840 Sheldon Ct Unit B

- 213 S Summit St

- 1129 Rhodes Ct

- 1315 Underwood Terrace

- 185 N Ott Ave

- 715 S Naperville Rd

- 429 Sandhurst Cir Unit 1

- 570 Riva Ct

- 450 Raintree Ct Unit 2M

- 450 Raintree Ct Unit 2B

- 478 Raintree Ct Unit 2B

- 953 Cordova Ct

Your Personal Tour Guide

Ask me questions while you tour the home.