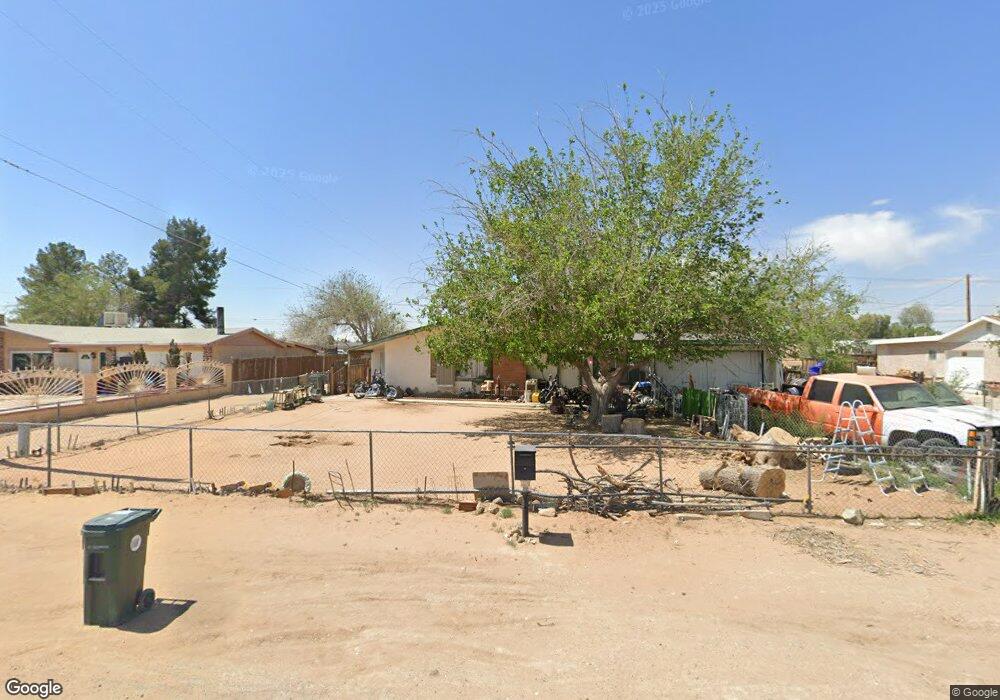

14154 Osage Rd Apple Valley, CA 92307

High Desert NeighborhoodEstimated Value: $320,000 - $375,007

3

Beds

2

Baths

1,608

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 14154 Osage Rd, Apple Valley, CA 92307 and is currently estimated at $341,752, approximately $212 per square foot. 14154 Osage Rd is a home located in San Bernardino County with nearby schools including Rancho Verde Elementary School, Granite Hills High School, and Apple Valley Christian.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2003

Sold by

Gonzales Raymond A

Bought by

Sardegna Shelly M and Reinhart Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,500

Interest Rate

5.6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 20, 2001

Sold by

Gonzales Carole L

Bought by

Gonzales Raymond A

Purchase Details

Closed on

Nov 13, 2000

Sold by

Winter Rod

Bought by

Gonzales Raymond A and Gonzales Carole L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,385

Interest Rate

7.65%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 3, 2000

Sold by

Prescott Maudie C Tr

Bought by

Winter Rod and 14154 Osage Road Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

8.19%

Purchase Details

Closed on

Aug 8, 1996

Sold by

Prescott Maudie C

Bought by

Prescott Maudie C and The Maudie C Prescott Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sardegna Shelly M | $119,500 | Southland Title Corporation | |

| Gonzales Raymond A | -- | -- | |

| Gonzales Raymond A | $79,000 | Fidelity National Title | |

| Winter Rod | $30,500 | Fidelity National Title | |

| Prescott Maudie C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sardegna Shelly M | $119,500 | |

| Previous Owner | Gonzales Raymond A | $77,385 | |

| Previous Owner | Winter Rod | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,985 | $169,903 | $33,980 | $135,923 |

| 2024 | $1,928 | $166,572 | $33,314 | $133,258 |

| 2023 | $1,909 | $163,306 | $32,661 | $130,645 |

| 2022 | $1,878 | $160,104 | $32,021 | $128,083 |

| 2021 | $1,834 | $156,965 | $31,393 | $125,572 |

| 2020 | $1,811 | $155,355 | $31,071 | $124,284 |

| 2019 | $1,776 | $152,309 | $30,462 | $121,847 |

| 2018 | $1,731 | $149,323 | $29,865 | $119,458 |

| 2017 | $1,706 | $146,395 | $29,279 | $117,116 |

| 2016 | $1,617 | $143,525 | $28,705 | $114,820 |

| 2015 | $1,592 | $141,369 | $28,274 | $113,095 |

| 2014 | $1,300 | $115,000 | $23,000 | $92,000 |

Source: Public Records

Map

Nearby Homes

- 21815 Goshute Ave

- 21865 Fox Ave

- 14280 Navajo Rd

- 21835 Dotame Ave

- 21865 Dotame Ave

- 13981 Pawnee Rd

- 21868 Isatis Ave

- 21928 Isatis Ave

- 1 California 18

- 21960 Ramona Ave

- 14176 Kiowa Rd

- 13933 Quinnault Rd

- 21815 Klickitat Ave

- 14444 Iroquois Rd

- 0 Pioneer Rd Unit RS25234657

- 0 Pioneer Rd Unit HD25263022

- 0 Pioneer Rd Unit PW23193404

- 21160 Us Highway 18

- 0 Del Mar Unit HD24157081

- 22184 Hupa Rd