14170 Mountain Quail Rd Salinas, CA 93908

Corral de Tierra NeighborhoodEstimated Value: $912,000 - $1,153,000

3

Beds

2

Baths

2,064

Sq Ft

$512/Sq Ft

Est. Value

About This Home

This home is located at 14170 Mountain Quail Rd, Salinas, CA 93908 and is currently estimated at $1,055,931, approximately $511 per square foot. 14170 Mountain Quail Rd is a home located in Monterey County with nearby schools including Toro Park Elementary School, Washington Elementary School, and San Benancio Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2021

Sold by

Bader John and Linda Bader Living Trust

Bought by

Donahue Kenneth J and Salmon Josephine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$739,450

Outstanding Balance

$674,309

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$381,622

Purchase Details

Closed on

Aug 2, 2021

Sold by

Bader Urbain Mildred Louise

Bought by

Mildred Bader Urbain Trust

Purchase Details

Closed on

Jul 22, 2021

Sold by

Bader John Henry and Mildred Bader Urbain Trust

Bought by

Bader John and John And Linda Bader Living Tr

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Donahue Kenneth J | $875,000 | Old Republic Title Company | |

| Mildred Bader Urbain Trust | -- | -- | |

| Bader John | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Donahue Kenneth J | $739,450 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,028 | $928,557 | $265,302 | $663,255 |

| 2024 | $10,028 | $910,350 | $260,100 | $650,250 |

| 2023 | $9,667 | $892,500 | $255,000 | $637,500 |

| 2022 | $9,737 | $875,000 | $250,000 | $625,000 |

| 2021 | $3,431 | $312,417 | $78,052 | $234,365 |

| 2020 | $3,356 | $309,214 | $77,252 | $231,962 |

| 2019 | $3,342 | $303,152 | $75,738 | $227,414 |

| 2018 | $3,272 | $297,208 | $74,253 | $222,955 |

| 2017 | $3,321 | $291,382 | $72,798 | $218,584 |

| 2016 | $3,221 | $285,670 | $71,371 | $214,299 |

| 2015 | $3,189 | $281,380 | $70,299 | $211,081 |

| 2014 | $3,084 | $275,869 | $68,922 | $206,947 |

Source: Public Records

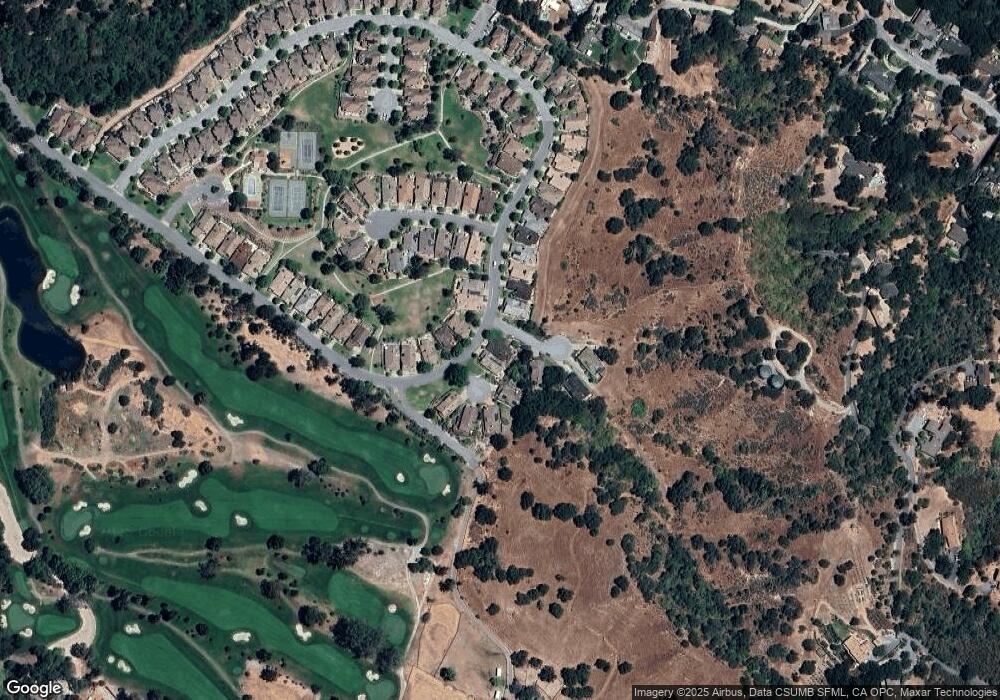

Map

Nearby Homes

- 14220 Mountain Quail Rd

- 14105 Mountain Quail Rd

- 23799 Monterey Salinas Hwy Unit 18

- 23799 Monterey Salinas Hwy Unit 13

- 23799 Monterey Salinas Hwy Unit 20

- 25603 Creekview Cir

- 13500 Paseo Terrano

- 15460 Weather Rock Way

- 180 San Benancio Rd

- 90 Harper Canyon Rd

- 274 Corral de Tierra Rd

- 12167 Saddle Rd

- 26135 Laureles Grade

- 26131 Laureles Grade

- 25940 Colt Ln

- 22720 Picador Dr

- 0 Corral de Tierra Rd

- 315 Pasadera Ct

- 382 Corral de Tierra Rd

- 20435 Franciscan Way

- 14160 Mountain Quail Rd

- 24310 Barn Owl Ct

- 14180 Mountain Quail Rd

- 24315 Eagles Nest Ct

- 14165 Mountain Quail Rd

- 14175 Mountain Quail Rd

- 14155 Mountain Quail Rd

- 14190 Mountain Quail Rd

- 14185 Mountain Quail Rd

- 24322 Eagles Nest Ct

- 14145 Mountain Quail Rd

- 24302 Eagles Nest Ct

- 14200 Mountain Quail Rd

- 24312 Eagles Nest Ct

- 24320 Barn Owl Ct

- 24325 Barn Owl Ct

- 0 Barn Owl Ct

- 14135 Mountain Quail Rd

- 14210 Mountain Quail Rd

- 24295 Pheasant Ct