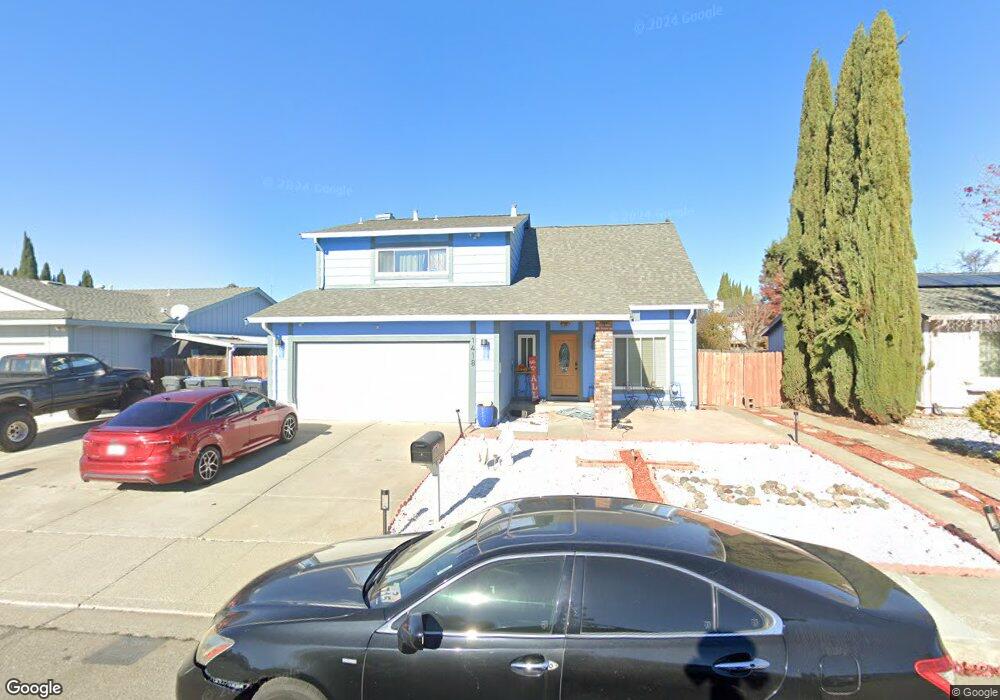

1418 Shasta St Suisun City, CA 94585

Estimated Value: $542,000 - $579,029

4

Beds

3

Baths

1,824

Sq Ft

$309/Sq Ft

Est. Value

About This Home

This home is located at 1418 Shasta St, Suisun City, CA 94585 and is currently estimated at $564,257, approximately $309 per square foot. 1418 Shasta St is a home located in Solano County with nearby schools including Dan O. Root Elementary School, Crystal Middle School, and Armijo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2024

Sold by

Greene Gerald D

Bought by

Gerald D Greene Jr Revocable Living Trust and Greene

Current Estimated Value

Purchase Details

Closed on

Oct 25, 2019

Sold by

Greene Kimberly

Bought by

Greene Gerald

Purchase Details

Closed on

Aug 14, 2017

Sold by

Greene Gerald D

Bought by

Greene Gerald D and Greene Kimberly

Purchase Details

Closed on

Apr 8, 2013

Sold by

Connelly Coleman S and Connelly Elisa S

Bought by

Greene Gerald D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,015

Interest Rate

3.62%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 26, 2006

Sold by

Connolly Noriko H

Bought by

Connolly Cline Noriko H and Connolly Coleman S

Purchase Details

Closed on

Sep 2, 1993

Sold by

Connolly Joseph P and Connolly Noriko H

Bought by

Connolly Noriko

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,600

Interest Rate

7.2%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gerald D Greene Jr Revocable Living Trust | -- | None Listed On Document | |

| Greene Gerald | -- | None Available | |

| Greene Gerald D | -- | None Available | |

| Greene Gerald D | $230,000 | Old Republic Title Company | |

| Connolly Cline Noriko H | -- | None Available | |

| Connolly Noriko | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Greene Gerald D | $216,015 | |

| Previous Owner | Connolly Noriko | $82,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,993 | $283,218 | $73,880 | $209,338 |

| 2024 | $3,993 | $277,666 | $72,432 | $205,234 |

| 2023 | $3,895 | $272,222 | $71,012 | $201,210 |

| 2022 | $3,855 | $266,885 | $69,620 | $197,265 |

| 2021 | $3,823 | $261,653 | $68,255 | $193,398 |

| 2020 | $3,752 | $258,971 | $67,556 | $191,415 |

| 2019 | $2,897 | $253,894 | $66,232 | $187,662 |

| 2018 | $3,012 | $248,917 | $64,934 | $183,983 |

| 2017 | $2,877 | $244,037 | $63,661 | $180,376 |

| 2016 | $2,851 | $239,253 | $62,413 | $176,840 |

| 2015 | $2,666 | $235,660 | $61,476 | $174,184 |

| 2014 | $2,646 | $231,044 | $60,272 | $170,772 |

Source: Public Records

Map

Nearby Homes

- 1411 Klamath Dr

- 1415 Pelican Way

- 1416 Prospect Way

- 1201 Deanza Ct

- 610 Placer Ln

- 1504 El Morro Ln

- 819 Bluejay Dr

- 1309 Hall Ln

- 1109 Canary Dr

- 607 Crested Dr

- 1413 Spence Ct

- 330 Engell Ct

- 1280 Mayfield Cir

- 301 Childs Ct

- 1651 Little Rock Cir

- 616 Emperor Dr

- 808 Pochard Way

- 1756 Keesler Cir

- 906 Trumpeter Ct

- 412 Craven Dr

- 1420 Shasta St

- 1416 Shasta St

- 1417 Humbolt Dr

- 1422 Shasta St

- 1414 Shasta St

- 1415 Humbolt Dr

- 1403 Donner Ct

- 601 Humbolt Dr

- 1417 Shasta St

- 1405 Donner Ct

- 1419 Shasta St

- 1424 Shasta St

- 1412 Shasta St

- 1413 Humbolt Dr

- 603 Humbolt Dr

- 600 Shasta Ct

- 608 Klamath Way

- 1407 Donner Ct

- 603 Shasta Ct

- 606 Klamath Way