1421 Princeton Ct Unit 1805 Wheaton, IL 60189

Southeast Wheaton NeighborhoodEstimated Value: $198,000 - $239,936

1

Bed

1

Bath

1,056

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 1421 Princeton Ct Unit 1805, Wheaton, IL 60189 and is currently estimated at $222,734, approximately $210 per square foot. 1421 Princeton Ct Unit 1805 is a home located in DuPage County with nearby schools including Lincoln Elementary School, Edison Middle School, and Wheaton Warrenville South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 11, 2018

Sold by

Lage Dercy and Lage Carlos

Bought by

Toran Duaniia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,400

Outstanding Balance

$102,438

Interest Rate

5.5%

Mortgage Type

New Conventional

Estimated Equity

$120,296

Purchase Details

Closed on

Sep 15, 2009

Sold by

Lage Carlos and Lage Dercy

Bought by

Lage Carlos A and Lage Dercy

Purchase Details

Closed on

Sep 2, 2009

Sold by

Wells Fargo Bank National Association

Bought by

Lage Carlos and Lage Dercy

Purchase Details

Closed on

Feb 24, 2009

Sold by

Peters Howard J and Case #07 Ch 3474

Bought by

Wells Fargo Bank National Association

Purchase Details

Closed on

Sep 27, 1999

Sold by

Castelluccio Joanne M and Castelluccio Eric T

Bought by

Peters Howard J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,700

Interest Rate

7.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Toran Duaniia | $120,000 | Chicago Title Company | |

| Lage Carlos A | -- | None Available | |

| Lage Carlos | $96,000 | First American Title | |

| Wells Fargo Bank National Association | -- | None Available | |

| Peters Howard J | $97,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Toran Duaniia | $116,400 | |

| Previous Owner | Peters Howard J | $94,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,252 | $58,449 | $7,290 | $51,159 |

| 2023 | $3,095 | $53,800 | $6,710 | $47,090 |

| 2022 | $3,031 | $49,770 | $5,390 | $44,380 |

| 2021 | $3,014 | $48,590 | $5,260 | $43,330 |

| 2020 | $3,002 | $48,140 | $5,210 | $42,930 |

| 2019 | $2,926 | $46,870 | $5,070 | $41,800 |

| 2018 | $3,130 | $43,210 | $4,780 | $38,430 |

| 2017 | $2,906 | $39,150 | $4,330 | $34,820 |

| 2016 | $2,873 | $37,590 | $4,160 | $33,430 |

| 2015 | $2,858 | $35,860 | $3,970 | $31,890 |

| 2014 | $2,651 | $40,370 | $4,390 | $35,980 |

| 2013 | $3,188 | $40,490 | $4,400 | $36,090 |

Source: Public Records

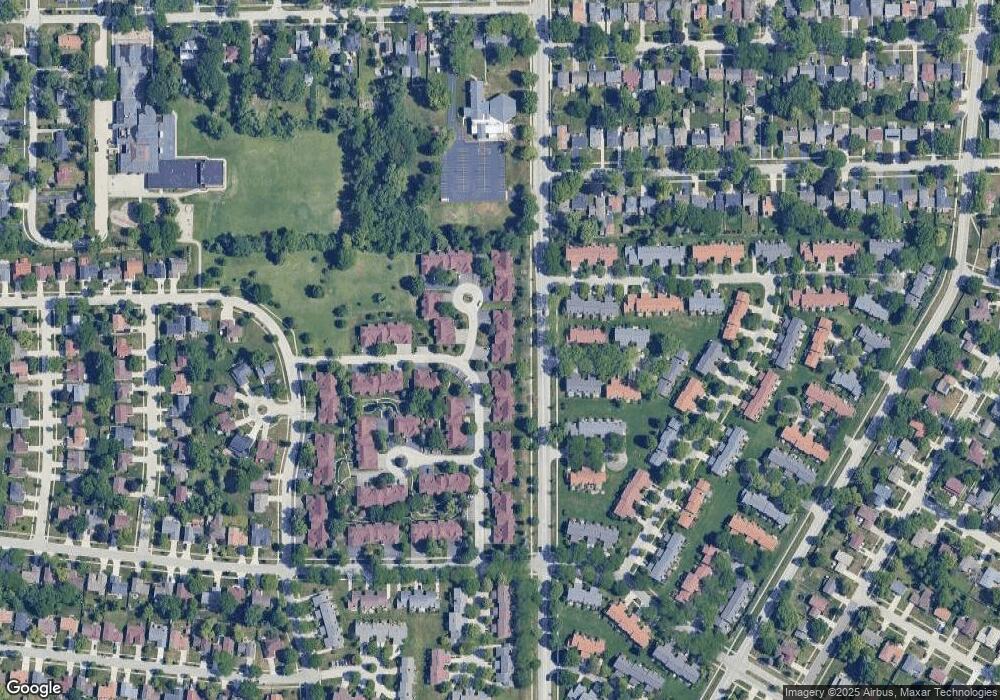

Map

Nearby Homes

- 840 Sheldon Ct Unit B

- 1026 Briarcliffe Blvd

- 1129 Rhodes Ct

- 1315 Underwood Terrace

- 570 Riva Ct

- 1216 E Elm St

- 1581 Groton Ln

- 1601 Castbourne Ct

- 1180 Mount Vernon Ct Unit C

- 1135 Mount Vernon Ct Unit B

- 1120 Mount Vernon Ct Unit C

- 1678 Groton Ct

- 1019 Pershing Ave

- 1344 S Lorraine Rd Unit C

- 1000 S Lorraine Rd Unit 214

- 715 S Naperville Rd

- 510 S President St

- 502 S Summit St

- 1720 Lakecliffe Dr Unit A

- 1705 Lakecliffe Dr Unit D

- 1450 Johnstown Ln Unit C

- 1465 Johnstown Ln Unit 2004

- 1401 Princeton Ct Unit 1704

- 845 Sheldon Ct Unit B

- 885 Farnham Ln Unit 1105

- 1450 Johnstown Ln

- 845 Sheldon Ct Unit C

- 1471 Haverhill Dr Unit C

- 1408 Princeton Ct Unit A

- 845 Farnham Ln Unit C

- 885 Farnham Ln Unit D

- 1408 Princeton Ct Unit B

- 1402 Princeton Ct Unit C

- 1421 Princeton Ct Unit B

- 855 Johnstown Ln Unit B

- 1412 Princeton Ct Unit C

- 1485 Johnstown Ln Unit D

- 1450 Johnstown Ln Unit 1306D

- 1461 Haverhill Dr Unit A

- 1475 Johnstown Ln Unit B

Your Personal Tour Guide

Ask me questions while you tour the home.