Estimated Value: $178,000 - $278,939

--

Bed

3

Baths

1,256

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 1423 Sunset Blvd Unit 1423, 48, Flint, MI 48507 and is currently estimated at $215,485, approximately $171 per square foot. 1423 Sunset Blvd Unit 1423, 48 is a home located in Genesee County with nearby schools including Anderson Elementary School, McGrath Elementary School, and Grand Blanc West Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2018

Sold by

Burroughs Steven L

Bought by

Burroughs Steven L and Burroughs Thomas

Current Estimated Value

Purchase Details

Closed on

Mar 3, 2017

Sold by

Christman Mark A and Christman Linda J

Bought by

Burroughs Steven L

Purchase Details

Closed on

Jun 27, 2003

Sold by

Brittany Development Inc

Bought by

Christman Mark A and Christman Linda J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burroughs Steven L | -- | None Available | |

| Burroughs Steven L | $137,000 | First American Title Ins Co | |

| Christman Mark A | $169,900 | Lawyers Title Ins |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,207 | $84,300 | $0 | $0 |

| 2024 | $1,987 | $84,300 | $0 | $0 |

| 2023 | $1,896 | $99,200 | $0 | $0 |

| 2022 | $2,843 | $90,300 | $0 | $0 |

| 2021 | $2,796 | $84,300 | $0 | $0 |

| 2020 | $1,748 | $81,300 | $0 | $0 |

| 2019 | $1,722 | $75,700 | $0 | $0 |

| 2018 | $2,450 | $65,700 | $0 | $0 |

| 2017 | $1,884 | $66,100 | $0 | $0 |

| 2016 | $1,870 | $63,200 | $0 | $0 |

| 2015 | $1,770 | $56,100 | $0 | $0 |

| 2014 | $1,209 | $53,300 | $0 | $0 |

| 2012 | -- | $48,500 | $48,500 | $0 |

Source: Public Records

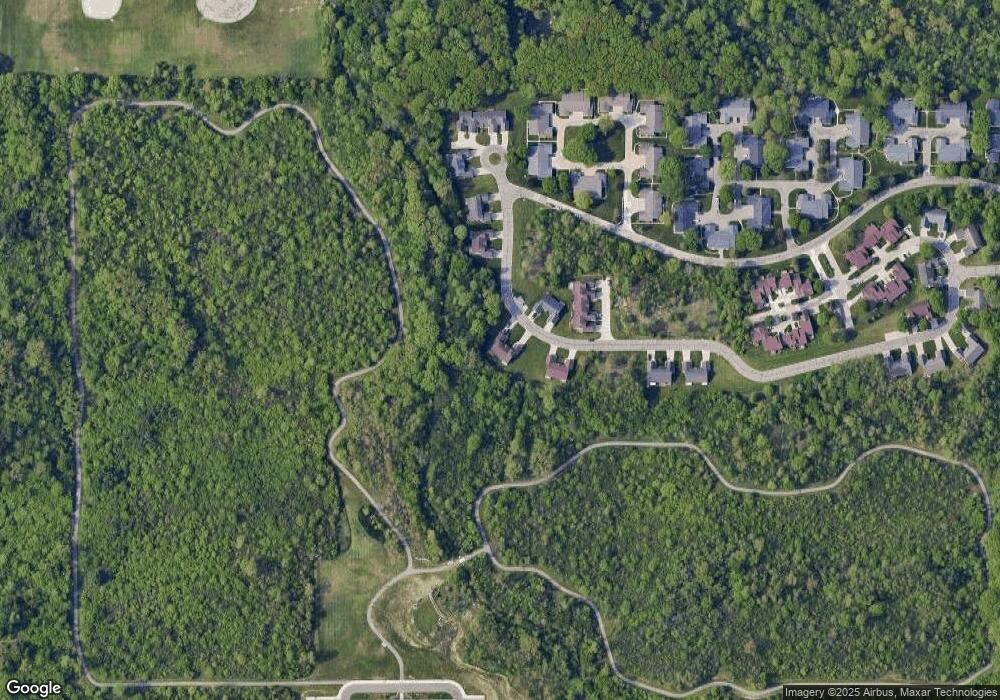

Map

Nearby Homes

- 1380 Sunset Blvd

- 1130 Leisure Dr Unit 21

- 1045 Leisure Dr Unit 7

- 00 Coolidge Dr

- 000 Coolidge Dr

- 1195 Alton Ave

- 0000 Mckinley Blvd

- 1256 W Rowland St

- 0000 Coolidge Dr

- 1136 W Rowland St

- 1037 E Hill Rd

- 00 Mckinley Blvd

- 000 Mckinley Blvd

- 1096 Harding Dr

- 1044 W Rowland St

- 4505 Old Carriage Rd

- 0 Taylor Dr Unit 50159493

- 1075 E Hill Rd

- 0 Harding Dr Unit 20251056693

- 4480 Cherrytree Ln

- 1423 Sunset Blvd Unit 48

- 1423 Sunset Blvd Unit 1423

- 1421 Sunset Blvd

- 1421 Sunset Blvd Unit 47

- 1417 Sunset Blvd Unit Bldg-Unit

- 1417 Sunset Blvd Unit 34

- 1422 Sunset Blvd

- 1422 Sunset Blvd Unit 46

- 1413 Sunset Blvd

- 1420 Sunset Blvd

- 1420 Sunset Blvd Unit 45

- 1415 Sunset Blvd

- 1415 Sunset Blvd Unit 33

- 1418 Sunset Blvd

- 1418 Sunset Blvd Unit 44

- 1416 Sunset Blvd Unit 42

- 1416 Sunset Blvd

- 1410 Sunset Blvd

- 1428 Sunset Blvd

- 1414 Sunset Blvd