1424 Ranch Rd Encinitas, CA 92024

Central Encinitas NeighborhoodEstimated Value: $1,811,061 - $2,386,000

3

Beds

3

Baths

2,700

Sq Ft

$798/Sq Ft

Est. Value

About This Home

This home is located at 1424 Ranch Rd, Encinitas, CA 92024 and is currently estimated at $2,154,515, approximately $797 per square foot. 1424 Ranch Rd is a home located in San Diego County with nearby schools including Capri Elementary School, Diegueno Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2015

Sold by

Saik Richard P and Saik Linda F

Bought by

The Saik Family Trust

Current Estimated Value

Purchase Details

Closed on

Feb 3, 2004

Sold by

Sharkey Linda Louise

Bought by

Saik Richard P and Saik Linda F

Purchase Details

Closed on

Aug 10, 2001

Sold by

D R Horton San Diego Holding Company Inc

Bought by

Sharkey Linda Louise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$528,887

Interest Rate

7.05%

Purchase Details

Closed on

Jun 1, 2001

Sold by

Price Evan H

Bought by

Sharkey Linda

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Saik Family Trust | -- | None Available | |

| Saik Richard P | $860,000 | First American Title | |

| Sharkey Linda Louise | $705,500 | Chicago Title Co | |

| Sharkey Linda | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sharkey Linda Louise | $528,887 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,382 | $422,778 | $203,834 | $218,944 |

| 2024 | $7,382 | $414,489 | $199,838 | $214,651 |

| 2023 | $7,262 | $406,363 | $195,920 | $210,443 |

| 2022 | $6,758 | $398,396 | $192,079 | $206,317 |

| 2021 | $7,123 | $390,585 | $188,313 | $202,272 |

| 2020 | $7,445 | $386,581 | $186,383 | $200,198 |

| 2019 | $7,287 | $379,002 | $182,729 | $196,273 |

| 2018 | $7,294 | $371,572 | $179,147 | $192,425 |

| 2017 | $191 | $364,287 | $175,635 | $188,652 |

| 2016 | $7,134 | $357,145 | $172,192 | $184,953 |

| 2015 | $7,110 | $351,781 | $169,606 | $182,175 |

| 2014 | $7,018 | $344,891 | $166,284 | $178,607 |

Source: Public Records

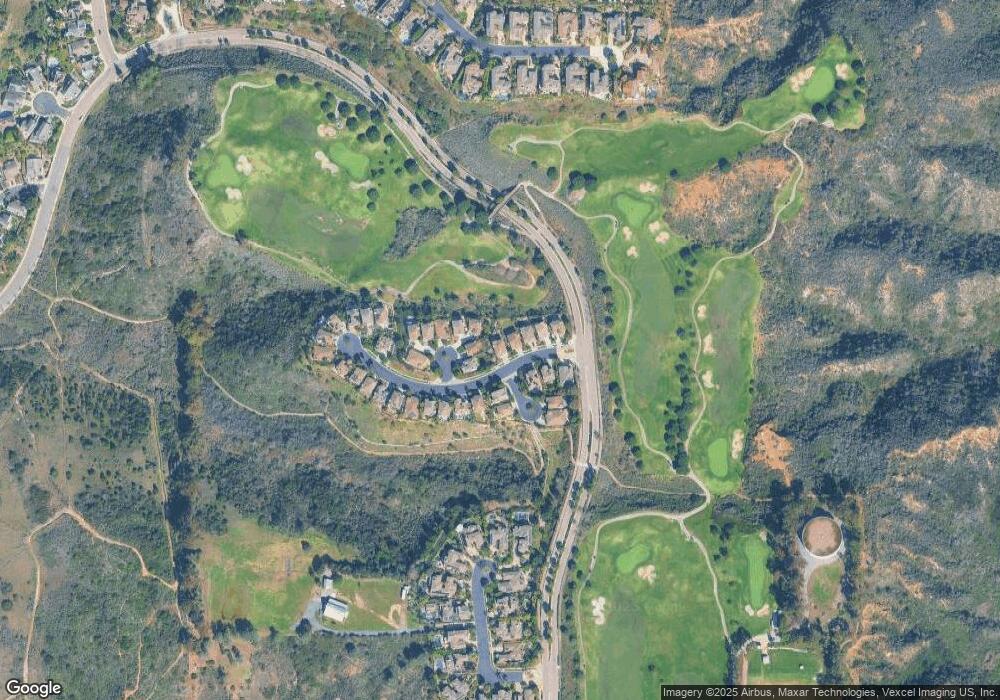

Map

Nearby Homes

- 1375 Ravean Ct

- 1518 Bella Vista Dr

- 1603 San Remo Place Unit 105

- 1601 San Remo Place Unit 101

- 1650 Bella Laguna Ct

- 1107 Catania Ct Unit 203

- 1403 Anacona Place Unit 103

- 1400 Anacona Place Unit 105

- 1129 31 Saxony Rd

- 1139 41 Saxony Rd

- 1090 Alexandra Ln

- 1605 Burgundy Rd

- 1570 Burgundy Rd

- 1690 Gascony Rd

- 7767 Caminito Monarca Unit 100

- 7758 Caminito Monarca Unit 101

- 7747 Caminito Monarca Unit 100

- 836 Jensen Ct

- 844 Saxony Rd

- 2002 Ladera Ct

- 1432 Ranch Rd

- 1545 Fairway Vista

- 1549 Fairway Vista

- 1440 Ranch Rd

- 1541 Fairway Vista

- 1446 Ranch Rd

- 1551 Fairway Vista

- 1437 Ranch Rd

- 1532 Rainey Ct

- 1445 Ranch Rd

- 1452 Ranch Rd

- 1554 Fairway Vista

- 1413 Ranch Rd

- 1524 Rainey Ct

- 1453 Ranch Rd

- 1405 Ranch Rd

- 1548 Fairway Vista

- 1523 Rainey Ct

- 1544 Fairway Vista

- 1399 Ranch Rd