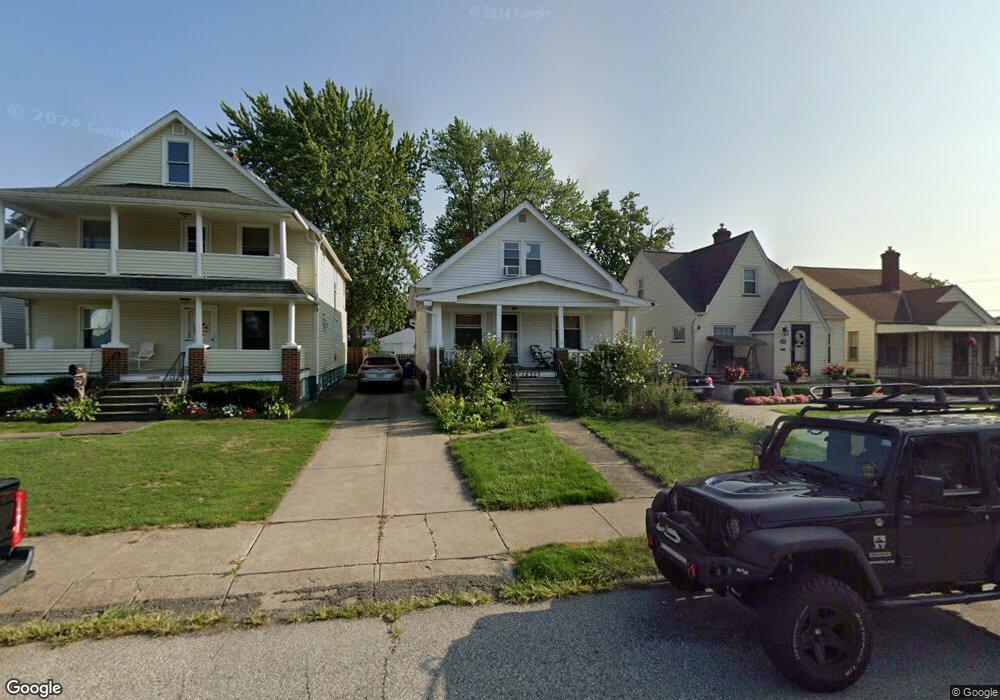

14327 Montrose Ave Cleveland, OH 44111

Kamm's Corners NeighborhoodEstimated Value: $194,431 - $238,000

2

Beds

1

Bath

1,259

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 14327 Montrose Ave, Cleveland, OH 44111 and is currently estimated at $209,108, approximately $166 per square foot. 14327 Montrose Ave is a home located in Cuyahoga County with nearby schools including Artemus Ward School, Almira Academy, and Anton Grdina School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2005

Sold by

Jasko Paul and Pitre Jasko Nancy E

Bought by

Pate Stacie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,300

Outstanding Balance

$61,828

Interest Rate

6.17%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$147,280

Purchase Details

Closed on

Nov 29, 2005

Sold by

Jasko Paul S and Jasko Paul S

Bought by

Jasko Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,300

Outstanding Balance

$61,828

Interest Rate

6.17%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$147,280

Purchase Details

Closed on

Nov 22, 2005

Sold by

Estate Of Dorothy V Kendall

Bought by

Jasko Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,300

Outstanding Balance

$61,828

Interest Rate

6.17%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$147,280

Purchase Details

Closed on

Apr 23, 2002

Sold by

Estate Of Paul S Jasko Sr

Bought by

Jasko Paul S

Purchase Details

Closed on

Jan 1, 1975

Bought by

Jasko Paul and Jasko Dorothy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pate Stacie | $111,300 | Wexford Title | |

| Jasko Paul | -- | -- | |

| Jasko Paul | -- | -- | |

| Jasko Paul S | -- | -- | |

| Jasko Paul | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pate Stacie | $111,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,697 | $56,385 | $10,850 | $45,535 |

| 2023 | $2,782 | $36,680 | $8,750 | $27,930 |

| 2022 | $2,766 | $36,680 | $8,750 | $27,930 |

| 2021 | $2,738 | $36,680 | $8,750 | $27,930 |

| 2020 | $2,436 | $28,210 | $6,720 | $21,490 |

| 2019 | $2,253 | $80,600 | $19,200 | $61,400 |

| 2018 | $2,245 | $28,210 | $6,720 | $21,490 |

| 2017 | $1,981 | $24,020 | $5,920 | $18,100 |

| 2016 | $1,965 | $24,020 | $5,920 | $18,100 |

| 2015 | $1,794 | $24,020 | $5,920 | $18,100 |

| 2014 | $1,794 | $21,840 | $5,390 | $16,450 |

Source: Public Records

Map

Nearby Homes

- 14328 Adrian Ave

- 14426 Alger Rd

- 14104 Hazelmere Ave

- 14625 Grapeland Ave

- 14608 Triskett Rd

- 3201 W 139th St

- 14315 Rainbow Ave

- 32743 Warren Rd Unit 19

- 32742 Warren Rd Unit 18

- 14303 Tuckahoe Ave

- 3475 W 145th St

- 14031 Lakewood Heights Blvd

- 2263 Warren Rd

- 14428 Delaware Ave

- 3395 W 136th St

- 3334 W 155th St

- 2230 Alger Rd

- 2209 Alger Rd

- 3445 W 152nd St

- 14924 Delaware Ave

- 14325 Montrose Ave

- 14329 Montrose Ave

- 14333 Montrose Ave

- 14317 Montrose Ave

- 14313 Montrose Ave

- 14324 Adrian Ave

- 14320 Adrian Ave

- 14332 Adrian Ave

- 14316 Adrian Ave

- 14309 Montrose Ave

- 14324 Montrose Ave

- 14403 Montrose Ave

- 14320 Montrose Ave

- 14328 Montrose Ave

- 14312 Adrian Ave

- 14332 Montrose Ave

- 14316 Montrose Ave

- 14305 Montrose Ave

- 14308 Adrian Ave

- 14312 Montrose Ave