1439 Como Dr Manteca, CA 95337

Estimated Value: $983,568 - $1,146,000

3

Beds

4

Baths

3,960

Sq Ft

$268/Sq Ft

Est. Value

About This Home

This home is located at 1439 Como Dr, Manteca, CA 95337 and is currently estimated at $1,060,642, approximately $267 per square foot. 1439 Como Dr is a home located in San Joaquin County with nearby schools including Nile Garden Elementary School and Sierra High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2020

Sold by

Alavalapati Niranjan Vennapusala and Nallani Vijaya B

Bought by

Vennapusala Niranjan and Nallani Vijaya B

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2010

Sold by

Oakwood Lt Ventures I Llc

Bought by

Alavalapati Niranjan Vennapusala and Nallani Vijaya B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

4.27%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vennapusala Niranjan | -- | None Available | |

| Alavalapati Niranjan Vennapusala | $575,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Alavalapati Niranjan Vennapusala | $417,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,155 | $736,660 | $257,510 | $479,150 |

| 2024 | $8,921 | $722,216 | $252,461 | $469,755 |

| 2023 | $8,676 | $708,056 | $247,511 | $460,545 |

| 2022 | $7,978 | $694,173 | $242,658 | $451,515 |

| 2021 | $7,893 | $680,562 | $237,900 | $442,662 |

| 2020 | $7,582 | $673,585 | $235,461 | $438,124 |

| 2019 | $7,486 | $660,379 | $230,845 | $429,534 |

| 2018 | $7,390 | $647,431 | $226,319 | $421,112 |

| 2017 | $7,286 | $634,737 | $221,882 | $412,855 |

| 2016 | $7,116 | $622,294 | $217,532 | $404,762 |

| 2014 | $6,628 | $600,944 | $210,069 | $390,875 |

Source: Public Records

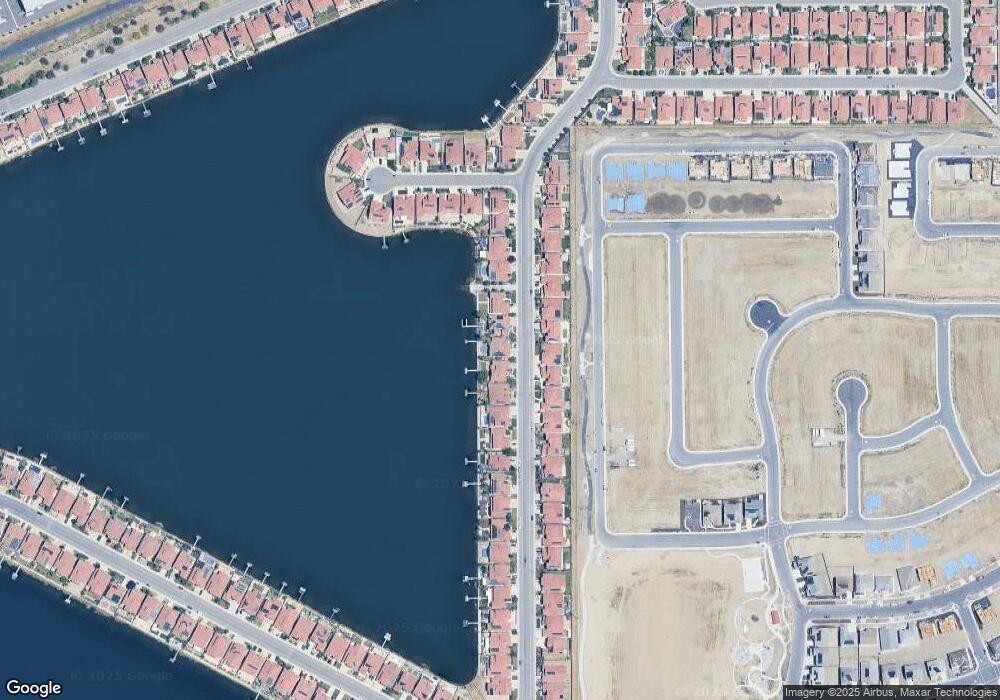

Map

Nearby Homes

- 3602 Levanto Way

- 3548 Rapallo Way

- 1717 Tornillo Ave

- 1739 Tornillo Ave

- 1718 Tornillo Ave

- 1732 Tornillo Ave

- 1727 Shingle Ave

- 4129 Castellina Way

- 1738 Shingle Ave

- 3270 Oak Trail Dr

- 3277 Nightfall Dr

- 3271 Nightfall Dr

- 3261 Oak Trail Dr

- 3259 Nightfall Dr

- 1533 Finestra Dr

- 3259 Jubilee Dr

- Magnolia Plan at Poppy at Oakwood Trails

- Marigold Plan at Poppy at Oakwood Trails

- Maple Plan at Poppy at Oakwood Trails

- Mulberry Plan at Poppy at Oakwood Trails